As an analyst with a background in financial markets and experience in following the crypto space, I find it intriguing to observe the growing correlation between Bitcoin and traditional indices like the Nasdaq 100 and S&P 500. The increasing synchronicity between these assets challenges the long-held perception of Bitcoin as a store of value or an inflation hedge.

Based on Bloomberg’s report, the connection between Bitcoin and the Nasdaq 100 index has reached a 90-day correlation coefficient of 0.46 – the strongest link since late August. A correlation coefficient of 1 implies that assets move in perfect harmony, while a score of -1 indicates they move in opposite directions. According to the article, the correlation between the two spiked above 0.8 when the Fed initiated rate hikes in early 2022 – the strongest link since Bitcoin became widely recognized.

As a researcher, I’ve come across an intriguing observation from Joshua Lim, the co-founder of Arbelos Markets, shared with Bloomberg. He noted that investors are starting to regard crypto as a growing asset class. They appreciate the technological prowess and the fundamental role crypto plays in facilitating value transfers, which makes it more akin to growth assets such as tech equities.

As an analyst, I’ve noticed that Bitcoin has been referred to as digital gold, an inflation hedge, and a store of value due to its scarcity and decentralized nature. However, its price volatility has raised questions about these characterizations. The U.S. Securities and Exchange Commission (SEC) approving spot Bitcoin ETFs in January marked a significant milestone. This approval opened up new avenues for investment in Bitcoin, making it more accessible to a larger pool of investors.

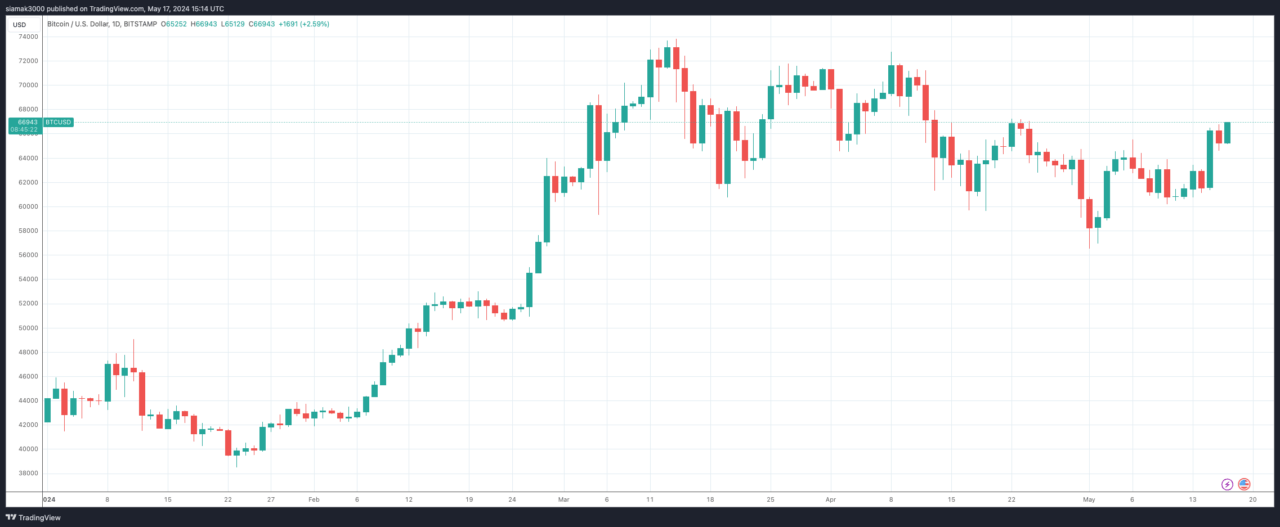

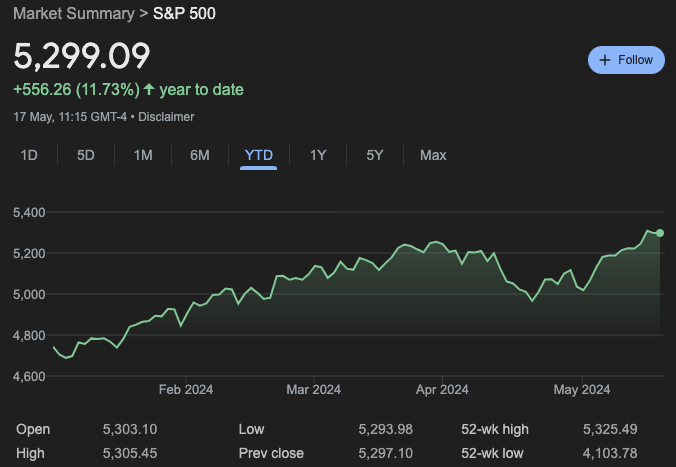

Toby Winterflood, CCData’s Chief Product Officer, spoke with Bloomberg about how Bitcoin’s connection to the S&P 500 has strengthened since early 2024. This development contradicts Bitcoin’s longstanding role as a safe-haven asset or store of value. According to Winterflood, the surge in Bitcoin’s price can be linked to the rapid growth of Bitcoin ETFs, which have broken records for speedy expansion. The cryptocurrency experienced significant gains following their launch on January 11, peaking at nearly $74,000 in March before settling as demand waned. On a recent Friday, Bitcoin saw a 2.3% increase to approximately $67,064, representing a near 10% rise that week. Year-to-date, Bitcoin has seen an approximate 60% growth compared to the S&P 500’s 11.73% increase and the Nasdaq-100’s 12.19% gain.

Recently, Lim noted that conventional investors have begun taking a closer look at Bitcoin following significant catalysts such as the US ETF approval, its unprecedented peak in March, and the April halving event. Now, it seems that attention has moved towards evaluating Bitcoin’s role within the larger economic context.

Yesterday, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index for Urban Consumers (CPI-U) grew by 0.3 percent on a seasonally adjusted basis in April, following a 0.4 percent rise in March. Over the past year, this index has ascended 3.4 percent before adjusting for seasonal fluctuations. However, Bloomberg noted that some Federal Reserve officials have proposed keeping interest rates elevated to further curb inflation, suggesting they are in no rush to reduce them.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- Everything We Know About DOCTOR WHO Season 2

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- All 6 ‘Final Destination’ Movies in Order

2024-05-17 18:45