- In a world where liquidity dances with Bitcoin, a rare green signal has flickered to life, like a lighthouse in a stormy sea.

- Binance and Metaplanet are hoarding BTC like squirrels before winter, as the selling pressure takes a much-needed vacation.

Now, if you squint just right, you might see the logarithmic measurement of Bitcoin’s price and global liquidity doing a little jig together. It’s a sight to behold, folks!

Historically, when the Z-Score dips below -3, it’s like a green light at a traffic stop, and when it climbs above +3, well, that’s when you might want to hit the brakes and reconsider your life choices.

Take a stroll down memory lane to early 2016, when Bitcoin leaped from below $500 to over $1,000, all thanks to a little transaction signal that could. It was like watching a toddler take their first steps—adorable and a bit wobbly.

But then came late 2017, when the red warning sign flashed like a neon “Caution: Proceed at Your Own Risk” before Bitcoin hit its peak at $20,000, only to tumble down faster than a cat off a hot tin roof.

Fast forward to early 2020, when Bitcoin decided to break the $10,000 barrier, leading to a price explosion that had everyone shouting, “To the moon!”

And now, here we are, with a fresh green signal suggesting that Bitcoin might just be ready to rise again, like a phoenix from the ashes—or maybe just a really determined bread dough.

Binance and Metaplanet Buy BTC

Institutional investors, those big fish in the crypto pond, are diving in headfirst. Binance and Metaplanet are snapping up BTC like it’s the last slice of pizza at a party, following a buy indicator that’s got everyone buzzing.

In the last 24 hours, Binance has gobbled up $250 million worth of Bitcoin, sending it off to the market maker, Wintermute, as if it were a hot potato that nobody wanted to hold onto.

And let’s not forget Metaplanet, who decided to add 150 Bitcoin to their collection, posting about it on X (formerly Twitter) like it was the latest fashion trend.

These institutional purchases could send BTC prices soaring, creating a buying frenzy that would make even the most seasoned investors giddy with excitement.

With other heavyweights like BlackRock and MicroStrategy also piling on BTC during the recent dip to $80K, it’s starting to feel like a crypto party, and everyone’s invited!

What’s the Impact of Reducing Selling Pressure?

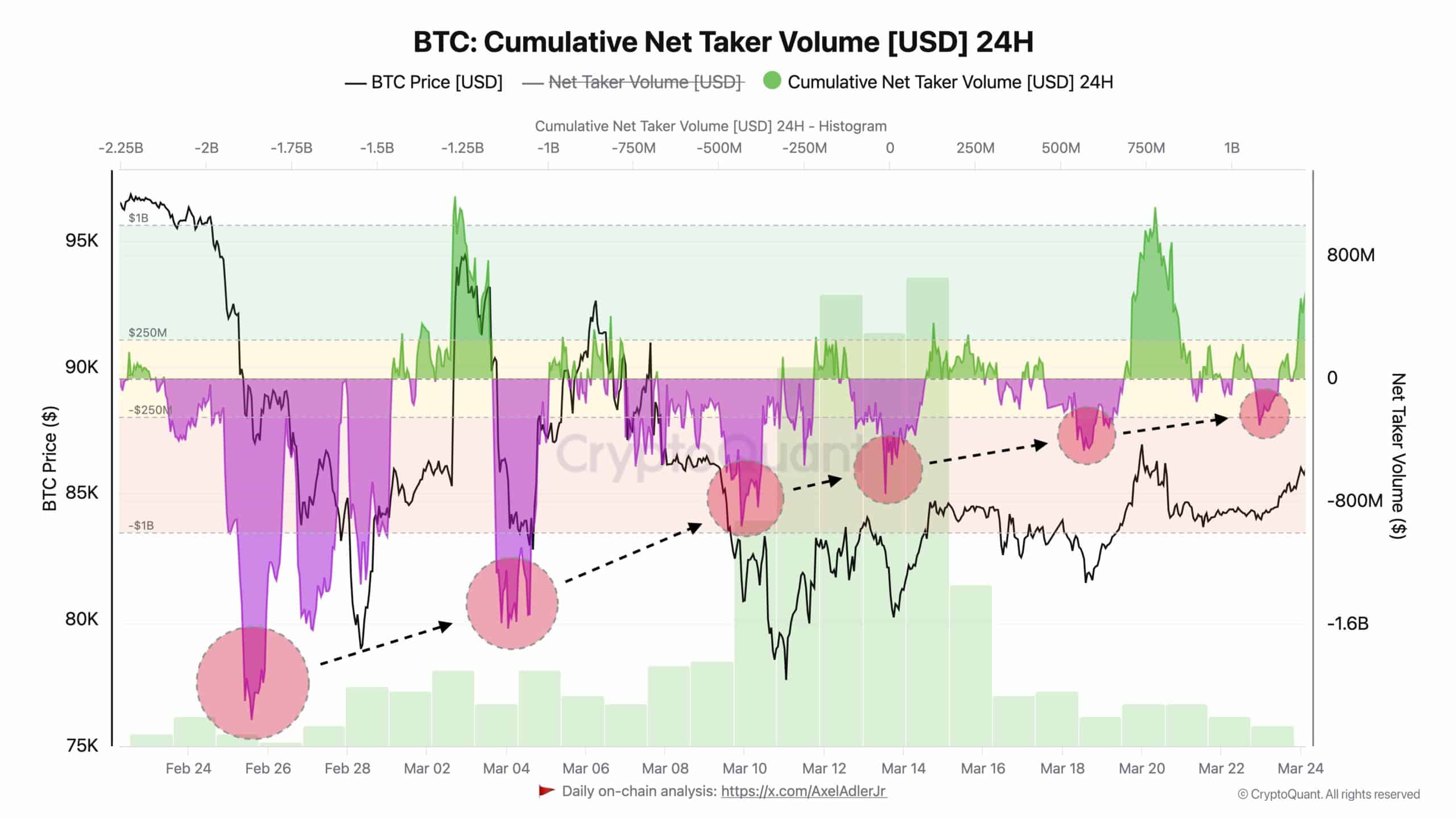

The cumulative net taker volume is showing us that the aggressive selling of BTC has taken a backseat since February, like a tired dog finally settling down for a nap.

From February 24 to mid-March, Bitcoin faced a selling storm that knocked its price down from $95K to nearly $75K. Ouch! But fear not, for BTC has a knack for bouncing back after each major sell-off, like a rubber ball that just won’t quit.

By mid-March, the negative net taker volume started to decline, signaling that the market was finally catching its breath.

As a result, Bitcoin’s price rebounded above $85K, thanks to the green cumulative net taker volume that made its grand entrance on March 20th. It’s like watching a plot twist in a soap opera—just when you think it’s over, it’s not!

With no major economic slowdowns in sight and asset liquidation under control, it seems that Bitcoin is poised for a reasonable price expansion, according to the current market patterns. Buckle up, folks; it’s going to be a wild ride!

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- In Conversation With The Weeknd and Jenna Ortega

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- USD ILS PREDICTION

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2025-03-24 23:07