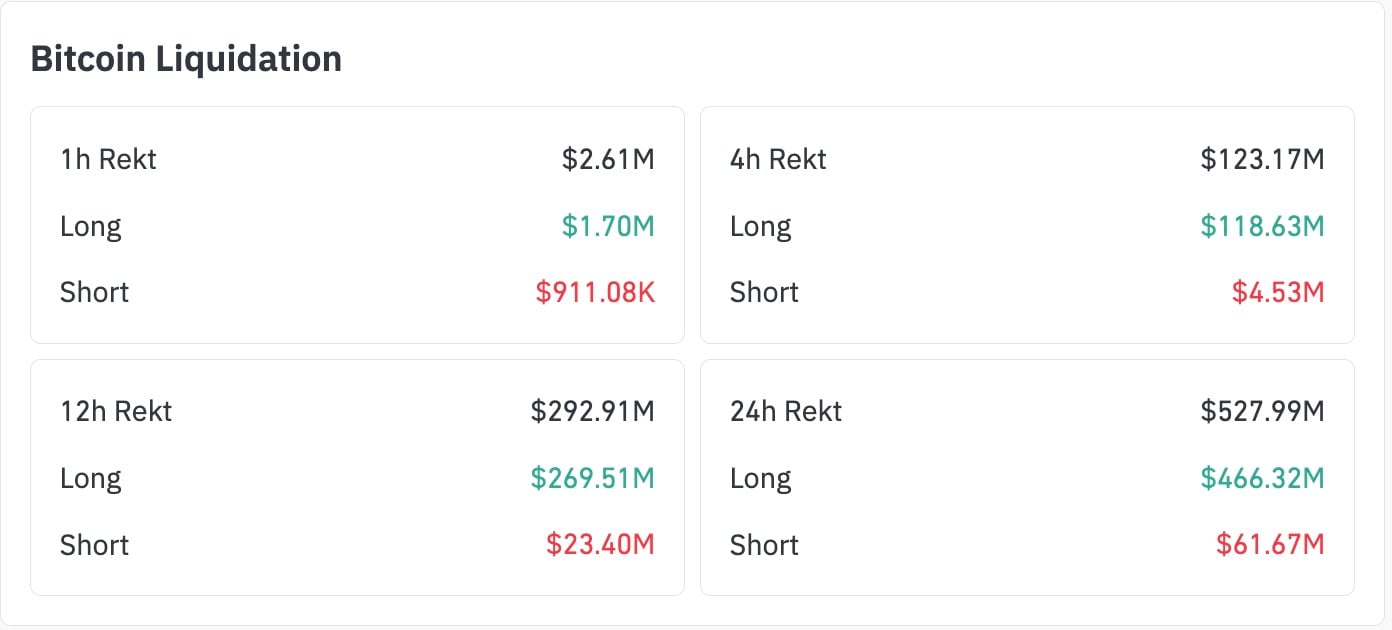

Well, butter my blockchain, the Bitcoin bulls have had a right old spanking today, haven’t they? According to the wizards at CoinGlass, a whopping $118.63 million in long positions got force-liquidated in a mere four hours. Shorts? A paltry $4.53 million. That’s a 2,618% imbalance, or as I like to call it, a “financial banana peel” of epic proportions.

One of the most one-sided liquidation events since 2026, they say. And here I thought 2026 was just going to be about flying cars and robot butlers. Silly me.

The total “rekt” count hit $123.17 million, which is enough to make even the most hardened crypto trader weep into their cold wallet. This wasn’t just a liquidation wick-it was a full-on liquidation tsunami, flushing out long-heavy leverage like a Discworld troll flushing out unwanted guests from the Mended Drum.

Mark Dow: I Want Bitcoin to Go to Zero

And the funniest part? Funding rates stayed sky-high on platforms like Binance and Bybit. Bulls, it seems, were so busy HODLing they forgot to de-risk. Classic.

What does this liquidation imbalance mean for Bitcoin (BTC)?

Ah, the $69,000 question (quite literally, as BTC hit that psychological level). The Feb. 5 imbalance is a neon sign flashing “Leveraged Market in Denial.” Bulls were clinging to their optimism like a wizard to his staff, even as the macro, ETF flows, and derivatives markets were whispering, “Doom, doom, doom.”

The 24-hour figures? $466.32 million in long liquidations out of $527.99 million total. That’s 88%-or as I like to put it, “almost as lopsided as a one-legged troll.” But it’s the four-hour chart that’s the real fire-breathing dragon here.

Bitcoin’s market structure has been cracked like a nut at a dwarf’s tea party. And that 2,618% imbalance? It’s a forensic marker of how far bullish conviction detached from reality. Or, as Granny Weatherwax would say, “You can’t ride a unicorn if it’s just a goat with a glitter problem.”

If this environment persists, Bitcoin could be in for a deeper de-risking cycle, with the $40,000 to $50,000 range acting as a magnet. Or, in simpler terms, it’s time to either buckle up or start hoarding tinned beans.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- The Best Actors Who Have Played Hamlet, Ranked

2026-02-05 19:36