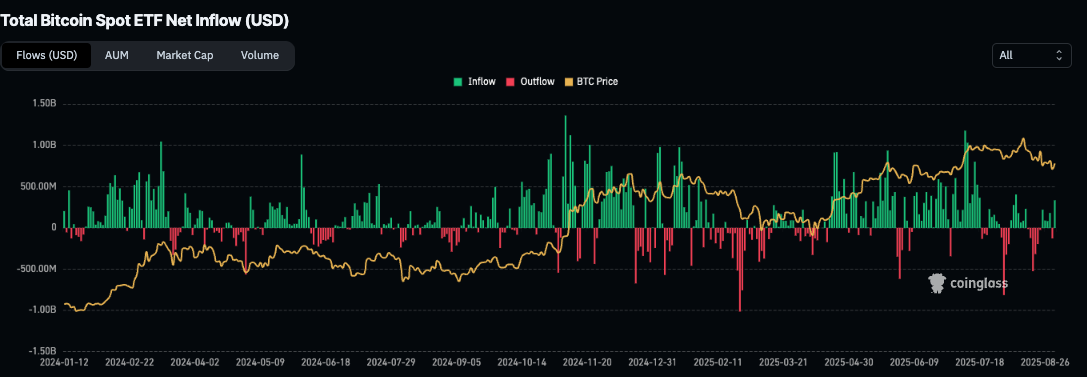

It appears that Spot Bitcoin ETFs have once more captured the public’s fickle fancy, attracting a handsome sum of $332.7 million in daily net inflows-the most vigorous demonstration of enthusiasm since a fortnight ago. One might say the market is simply recovering from a brief fainting spell. 🙃

- Spot Bitcoin ETFs attract $332.7 million in daily net inflows-the finest showing since the middle of August

- The market capitalisation for Spot Bitcoin ETFs currently stands at a staggering $109 billion, brushing closely against historic pinnacles

- The appetite for Bitcoin, that most capricious of assets, is revived by favourable macroeconomic zephyrs

Institutional parties of no small consequence have reopened their wallets towards Bitcoin (BTC) with renewed vigour. On Tuesday, the 2nd of September, Spot Bitcoin ETFs recorded an impressive $332.7 million in net inflows, as reported by the reputable CoinGlass. Such a figure constitutes the most substantial single-day increase since mid-August, putting previous doubt to shame.

This spirited advance follows last week’s notable triumph of $440 million in total ETF inflows. It seems investors have concluded that the current volatility is naught but a charming opportunity rather than a fearsome portent. Presently, Spot Bitcoin ETFs preside over a vast treasure trove valued at $109 billion, perilously close to historic summits. The iShares Bitcoin Trust ETF, in particular, reigns supreme, holding dominion over $82.8 billion in Bitcoin assets-a sum that might set even the most stoic minds to dreaming.

Meanwhile, as if to assert their stubbornness, Bitcoin treasury firms continue to prop up prices with institutional interest, making them rather adhesive, even when ETF inflows happen to stumble.

Macro Tailwinds: More Than Just a Breezy Excuse

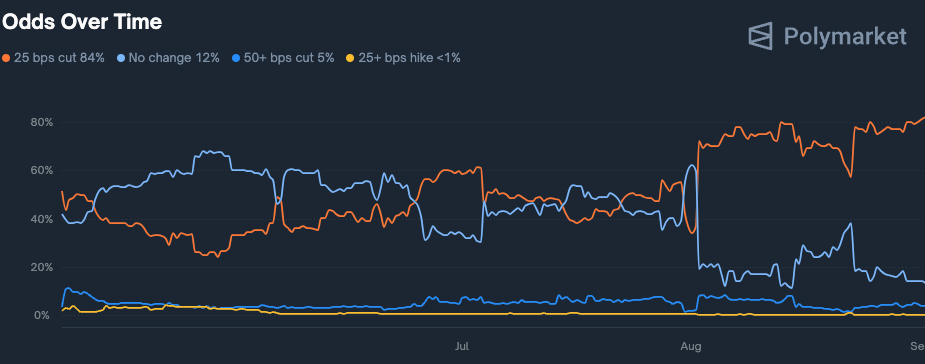

The renewed fervour for Bitcoin ETFs may well be attributed to a rising tide of “risk-on” sentiment; no doubt encouraged by the intrigues of the grand stage known as the macroeconomic environment, and, dare we say, the subtle art of monetary policy. Investors, those eternal fortune-tellers, are increasingly persuaded that the Federal Reserve might cut rates as early as mid-September-an event eagerly anticipated like the next chapter in a scandalous novel. 📉✨

Curiously, Polymarket traders assign an 84% probability to a rate cut at the Federal Open Market Committee meeting on September 17th, whereas the chances of no cuts linger at a paltry 12%. This development is far from trivial, for a reduction in rates would ease borrowing, depress Treasury yields, and might, to the chagrin of the cautious, nudge investors toward the exhilarating precipice of riskier ventures.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-03 18:32