Ah, Bitcoin! The digital sovereign of the blockchain stage, dressed in its finest cryptographic robes, has once again stumbled upon the treacherous $113,000 mark. Alas, it now languishes at $111,139-a 1.6% decline over the past 24 hours. Truly, a spectacle for the ages! 😅

Whispers abound that this leading luminary may have reached its cycle top, as capital pirouettes out of BTC and into Ethereum 💃. Behold the evidence:

- BTC Price: $109,866

- 24h Volatility: 2.8%

- Market Cap: $2.19 T

- 24h Volume: $40.05 B

Meanwhile, Ethereum prances about with renewed vigor:

- ETH Price: $4,339

- 24h Volatility: 5.8%

- Market Cap: $524.69 B

- 24h Volume: $31.89 B

Divergence Signals Echo the 2021 Cycle Top 📉🎭

Enter Ali Martinez, the sage of charts, who points to a most ominous sign: a bearish divergence between Bitcoin’s price and its Relative Strength Index (RSI). While Bitcoin ascends to loftier heights, its RSI descends like a jester fleeing the king’s court. “Ah, mes amis,” cries Martinez, “this is the very same divergence we saw before the 2021 crash!” 😱

Bitcoin $BTC is making higher highs while RSI makes lower lows. This is the same divergence seen before the 2021 cycle top!

– Ali (@ali_charts) August 29, 2025

Indeed, history repeats itself, though perhaps not in the manner we’d prefer. Shall we call it tragic? Or merely farcical? 🤔

Short-Term Optimism, Long-Term Caution 🎢🎭

Swissblock’s Altcoin Vector offers us a glimpse into the players’ roles:

- Long-Term Holders (LTHs): Distributing their riches like misers at a feast.

- Short-Term Holders (STHs): Accumulating with the fervor of lovers chasing lost dreams.

- Whales: Indecisive as ever, refusing to commit to this grand masquerade.

- Exchanges: Mild outflows suggest no great panic-yet.

It’s no secret that profit-taking is happening in $BTC, with much of that capital rotating into $ETH.

– Bitcoin Vector (@bitcoinvector) August 28, 2025

Until the whales decide to join the dance, dear readers, BTC’s ascent shall remain capped, and ETH shall lead the waltz. A comedy of errors, n’est-ce pas? 😌

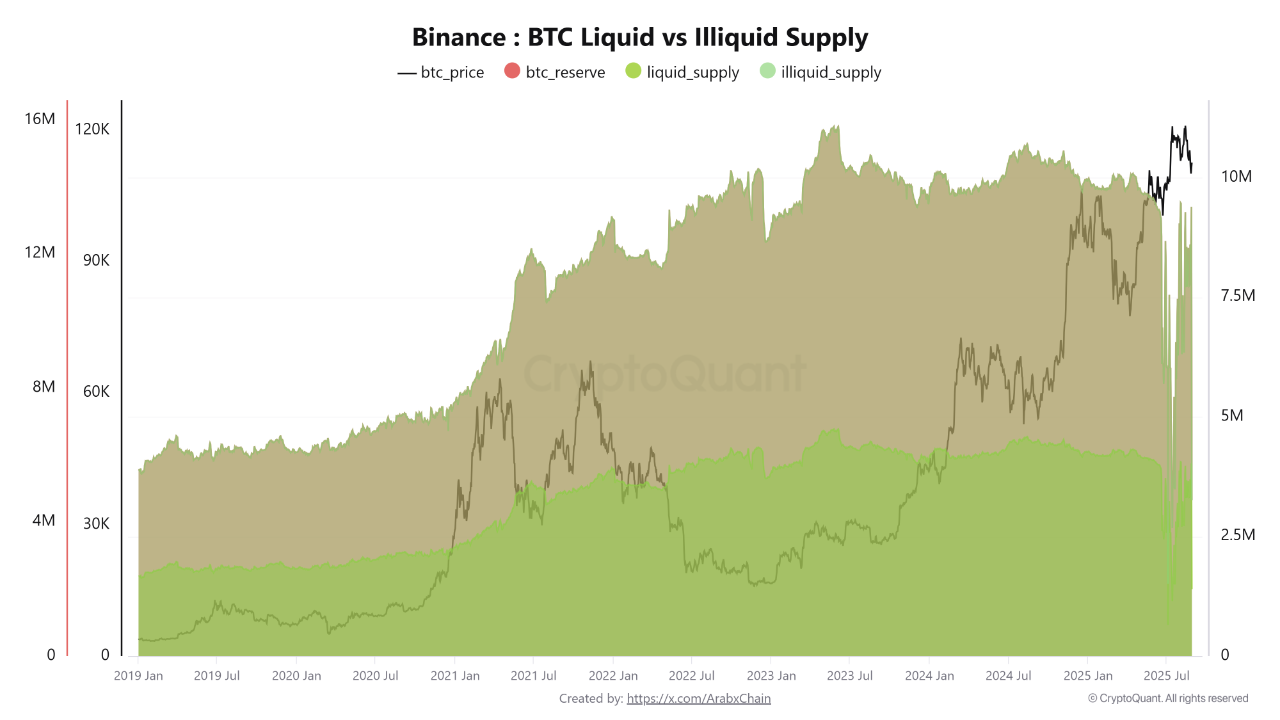

Liquidity Scarcity: A Fragile Bull Run 🐂💔

CryptoQuant reveals that Bitcoin’s illiquid supply grows ever larger, while liquid supply dwindles like wine at a banquet. This scarcity props up prices, but beware! For if the whales awaken from their slumber and sell en masse, the market could collapse faster than a house of cards in a hurricane. 🌪️

CryptoQuant analysts foresee two paths ahead:

- If illiquid supply continues rising, Bitcoin may soar toward $150,000 in 2025. A triumph worthy of applause! 👏

- But should liquid supply return due to large-scale sell-offs, BTC could tumble to the $90,000-$100,000 range. A tragedy fit for Shakespeare himself. 🎭

And so, dear audience, we leave you with this question: Will Bitcoin rise like a phoenix or fall like Icarus? Only time-and perhaps a few more memes-will tell. 😉

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Gold Rate Forecast

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- The Weight of First Steps

2025-08-29 15:33