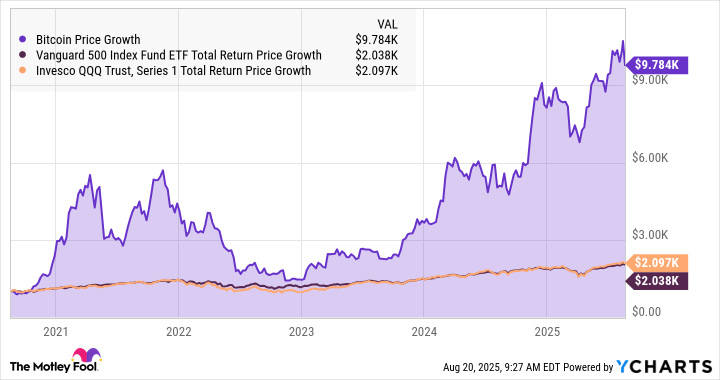

Behold, dear reader, a most diverting tale of folly and fortune, wherein a humble $1,000 is cast into the tempestuous theatre of finance. Should one have invested this sum on the 20th of August, 2020, in the staid Vanguard 500 Index Fund (VOO), with the diligence to reinvest dividends, lo! The sum would have swelled to $2,038 by this present day.

A doubling of one’s purse in five years? A compound annual growth rate of 15.3%! One might call it respectable-though scarcely worthy of the gasps reserved for true financial alchemy.

The Invesco QQQ Trust (QQQ), that Nasdaq-100 scribe, offers a slightly brighter ledger: $2,097. Yet both these prudent investments pale beside the antics of our protagonist, Bitcoin (BTC). A $1,000 wager in that digital curiosity during the summer of lockdowns would now gleam as $9,784:

Act II: The Bitcoin Masquerade

Bitcoin’s performance reads like a farce in three acts. In the first, it ascends with the vigor of a court jester’s jest-soaring in 2020 and 2021. In the second, it tumbles with the gravity of a miser’s lament, plummeting 75% by 2022’s end. And in the third, it rises anew, pirouetting toward all-time highs with the nervous gait of a gambler who has forgotten the stakes.

Volatility? Ah, yes. Bitcoin’s beta of 2.8 renders it thrice as tempestuous as the S&P 500. One might call it a dance-though few who witness it retain their wits.

Epilogue: The Eternal Question

Can Bitcoin outwit Wall Street once more? Alas, my time machine lies in disrepair, and I must rely on the frailty of prophecy. Yet consider this: Bitcoin’s anti-inflationary design, coupled with its rising popularity, may yet fuel a supply-demand farce. The next five years may lack the ninefold crescendo of yore, but the plot’s arc shall likely ascend-though always with the potential for a most dramatic collapse.

And so, the curtain falls on this financial comedy. Let us but hope the audience leaves with both laughter and a modicum of wisdom. 🎭

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- USD PHP PREDICTION

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-08-21 16:27