- Behold, the ominous dance of market cap versus realized cap, a historical harbinger of bearish woes 🐻💔

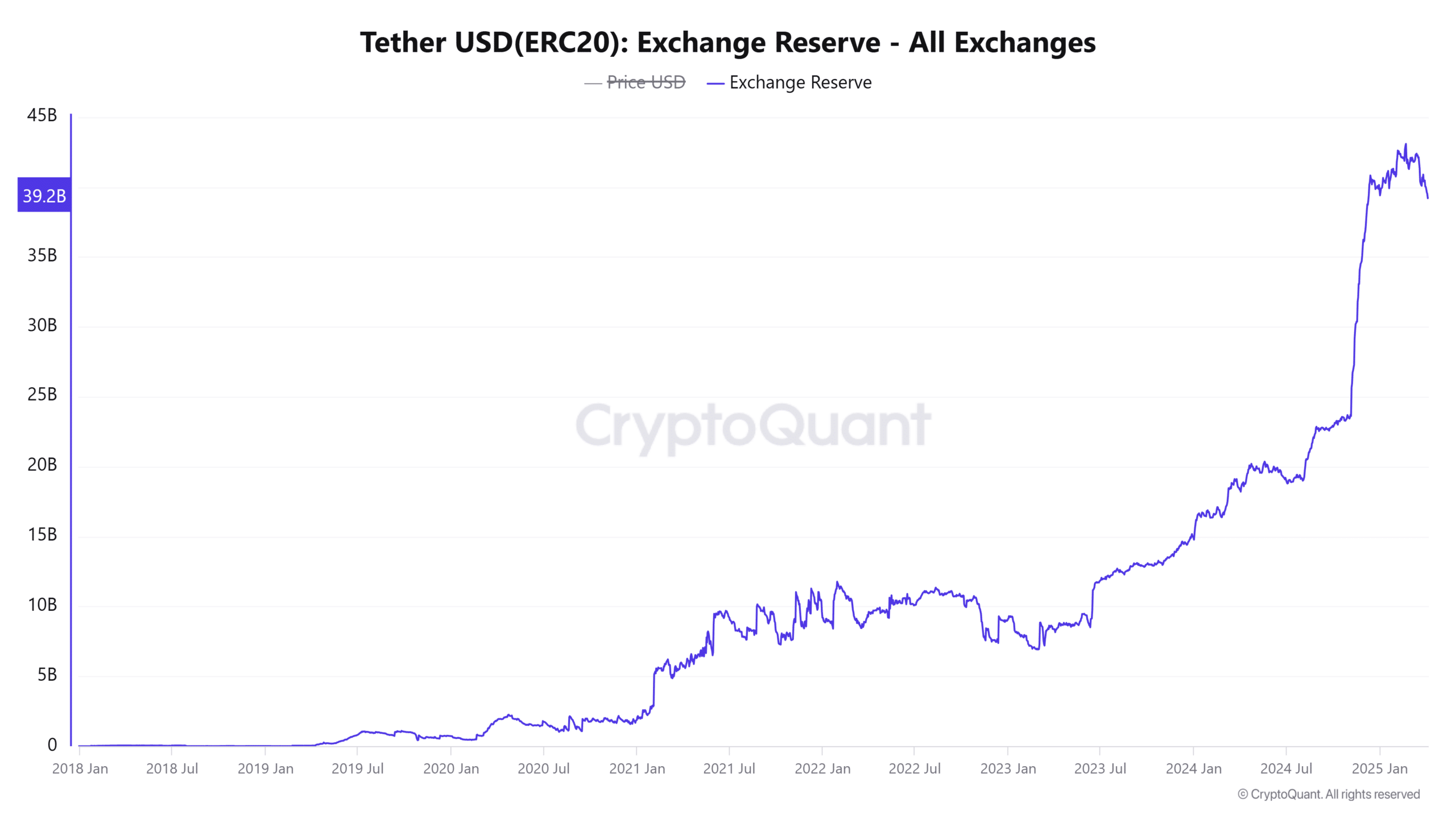

- The once relentless surge of Tether’s reserves now stands still, a sign that the buying power may have found its zenith 🚫💸

In the grand tapestry of global finance, the M2 money supply, embracing all from the mighty dollar to the humble yuan and the sophisticated euro, embarked upon a parabolic ascent in the year of our Lord2025, while Bitcoin, that digital enigma, merely consolidated.

History whispers that such divergences are but fleeting shadows, suggesting Bitcoin might yet soar. 🚀

Yet, lo and behold, the trade war, a spectacle ignited by the United States, has cast a pall over investor spirits. China, not one to shy away from the fray, retaliated with a tariff of34% on the second day of April, deepening the chasm and dragging the crypto market into its tumultuous wake. 🌪️

The Bearish Ballet of Bitcoin

The Bitcoin spot ETFs, once stalwart, now falter under the weight of pessimistic macroeconomic forecasts, victims of the ongoing trade skirmishes.

Blackrock’s IBIT, a beacon amidst the gloom, saw inflows, yet most others faced the relentless tide of selling pressure, painting a portrait of bearish sentiment in the short-term. 🖌️📉

In the midst of this somber scene, the CEO and Co-Founder of the esteemed CryptoQuant dared to proclaim, “The bull cycle is over.” 🗣️🔚

Is the Bitcoin Bull Truly Vanquished?

On the platform known as X, he unfurled the banner of the Realized Cap, a metric more reflective of the capital flowing into Bitcoin, contrasting it with the Market Cap, a mere product of price and supply.

With the365-day Moving Averages as his tools, he revealed a decline in the delta growth, a sign of the realized cap’s ascent amidst the market cap’s descent, a trend noted since the twilight of2024.

Ki Young Ju, with a touch of solemnity, declared that without capital inflows propelling prices, we tread upon bearish ground. The delta’s negative trend echoed the bear market’s call. A déjà vu from December2021, post the $69k zenith, hinted at a prolonged bearish sojourn, with no rally in sight for another half-year. 📉🔮

Realized cap data, a harbinger of bearish tidings, clashed with the rising global M2, a beacon of burgeoning buying power. The Tether reserve’s growth stalling mirrored past market tops, yet no cycle-top metrics have reached the fever pitch of yore.

Thus, the stage is set for a potential bear market encore, yet the final act remains unwritten, shrouded in the mists of uncertainty. 🎭📜

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-04-06 20:12