As a seasoned Bitcoin investor with a decade-long journey through the cryptocurrency wilderness, I can’t help but feel a sense of déjà vu as I watch the current price action unfold. The market’s ebb and flow have become familiar friends, and while the dance between bulls and bears never ceases to surprise me, it’s always a bit disheartening when we reach this point in the cycle.

The upward push of Bitcoin’s value has weakened, finding difficulty maintaining the bullish excitement that built up in recent times. At present, it’s valued at approximately $98,166, and it’s hovering slightly below the significant $100,000 barrier, which many traders consider psychologically influential.

As someone who has closely followed and invested in Bitcoin for several years, I have experienced its dramatic highs and lows. The current stagnation in Bitcoin’s value, coupled with the ongoing wave of investor liquidations, raises a significant concern within me. Based on my past observations, when such conditions arise, there is often a sharp decline in BTC‘s value. This pattern has been evident throughout its history, and I fear that we might be witnessing a repeat of it now. Therefore, I would advise caution to fellow investors, as the potential for a steep drop in Bitcoin’s value seems quite high at this moment.

Bitcoin Investors Are Uncertain

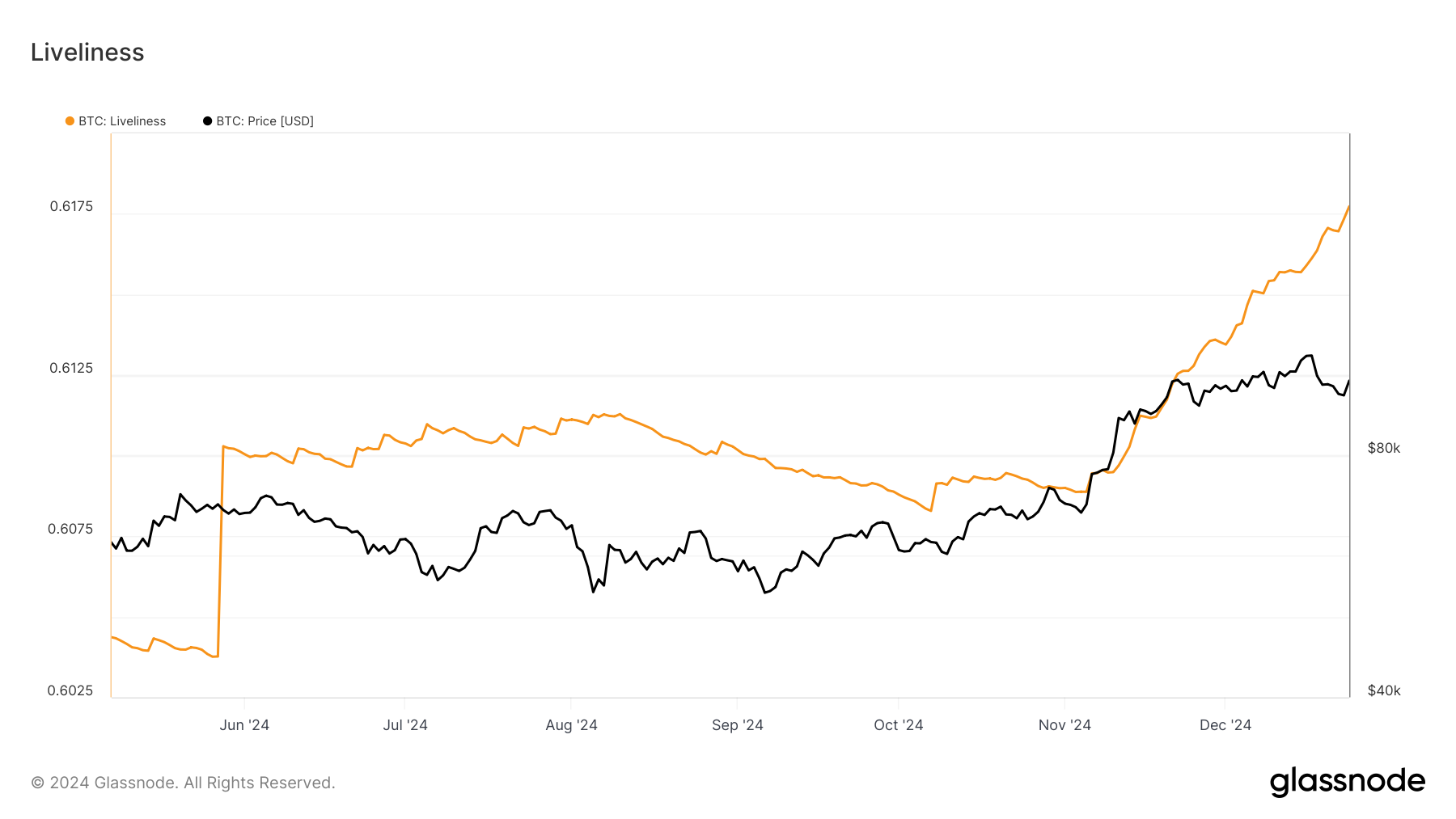

Bitcoin’s Liveliness metric continues to rise despite the recent price plateau. This indicates that long-term holders (LTHs) are increasingly liquidating their positions. LTHs, often considered the backbone of Bitcoin’s stability, are offloading their assets to mitigate potential losses from a looming price drop.

If long-term holders continue to sell, it might intensify the bearish forces acting on Bitcoin. Since long-term holders play a significant role in upholding Bitcoin’s value, their decision to leave the market implies doubt about a lasting bullish comeback. This change in perception could speed up Bitcoin’s fall.

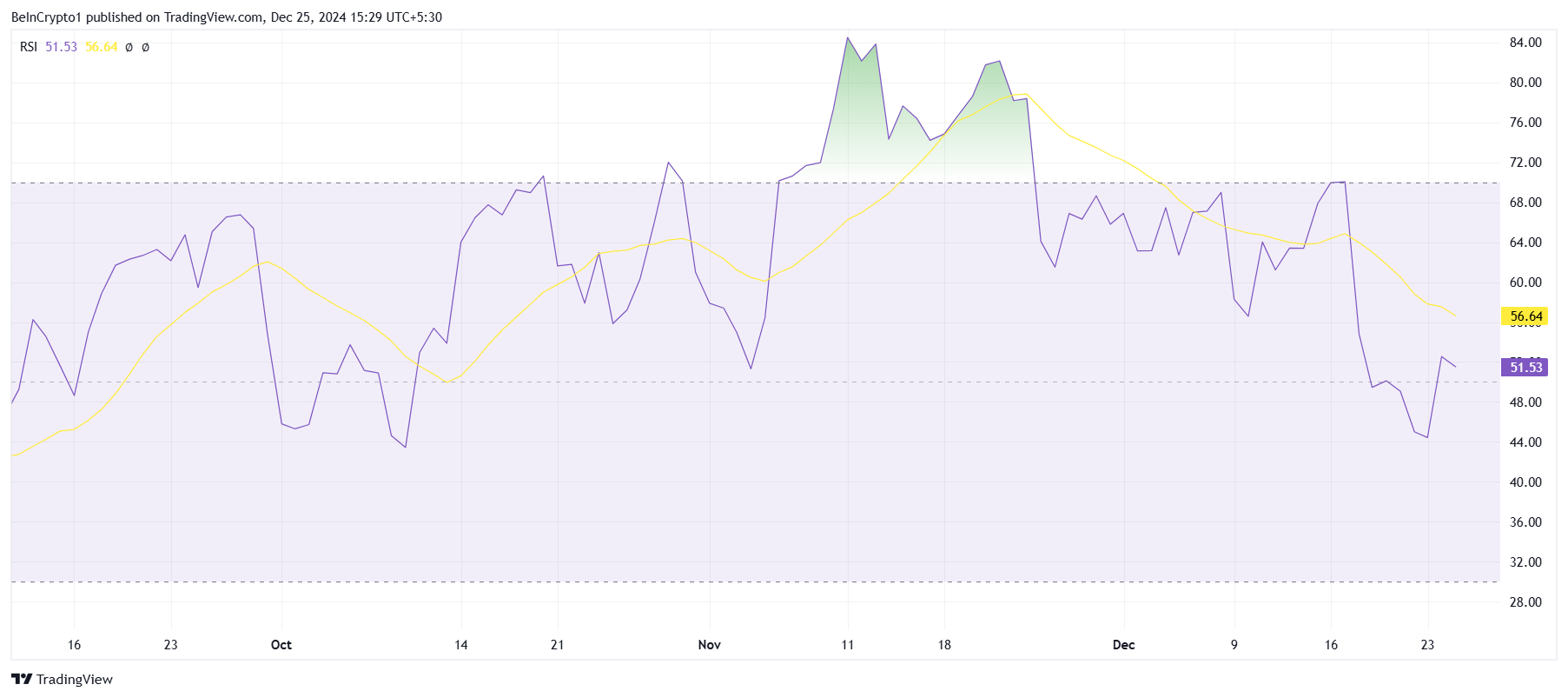

Bitcoin’s overall trend shows signs of bearishness as well. The Relative Strength Index (RSI) has dropped, finding it hard to remain above the neutral 50.0 level, suggesting that its power to indicate bullishness is waning during recent trades.

A decreasing Relative Strength Index (RSI) indicates that Bitcoin’s bullish trend might weaken. If this pattern persists, it could add to the existing pessimism in the market and potentially drive prices downward. Traders and investors are attentively observing the RSI for indications of a possible change in direction or further decline.

BTC Price Prediction: Breaching Key Resistance

Currently, Bitcoin’s value stands at approximately $98,166, nearing the significant barrier of $100,000 for further expansion. Overcoming this barrier and converting it into a support level is crucial for Bitcoin to continue its upward trend and reach unprecedented highs. At present, Bitcoin hasn’t shown sufficient demand to force this transition.

On the downside, the aforementioned bearish factors suggest Bitcoin could drop to $95,668. Losing this key support level might open the doors to a deeper decline, with $89,800 emerging as a potential target. This scenario would mark a significant setback for BTC investors.

If Bitcoin manages to hold $100,000 as a support level, it could potentially climb up to around $105,000. Hitting this mark would boost BTC’s standing and pave the way for a possible revisit of its record high ($108,384). This recovery would depend on restored market trust and robust buying actions.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-25 16:47