On the most recent Monday, the esteemed Bitcoin found itself in a most unfortunate predicament, descending below the hallowed threshold of $80,000, and reaching a lamentable low of $77,393. Such a precipitous decline has incited a veritable exodus among miners, who, in their distress, have chosen to relinquish their precious holdings.

Indeed, the on-chain data has unveiled a rather alarming increase in miner sell-offs—a trend that, I daresay, has fostered a most bearish sentiment within the market, thereby exerting further downward pressure upon the price of BTC.

Bitcoin’s Price Plummets to a Multi-Month Low as Miners Rush to Exchanges

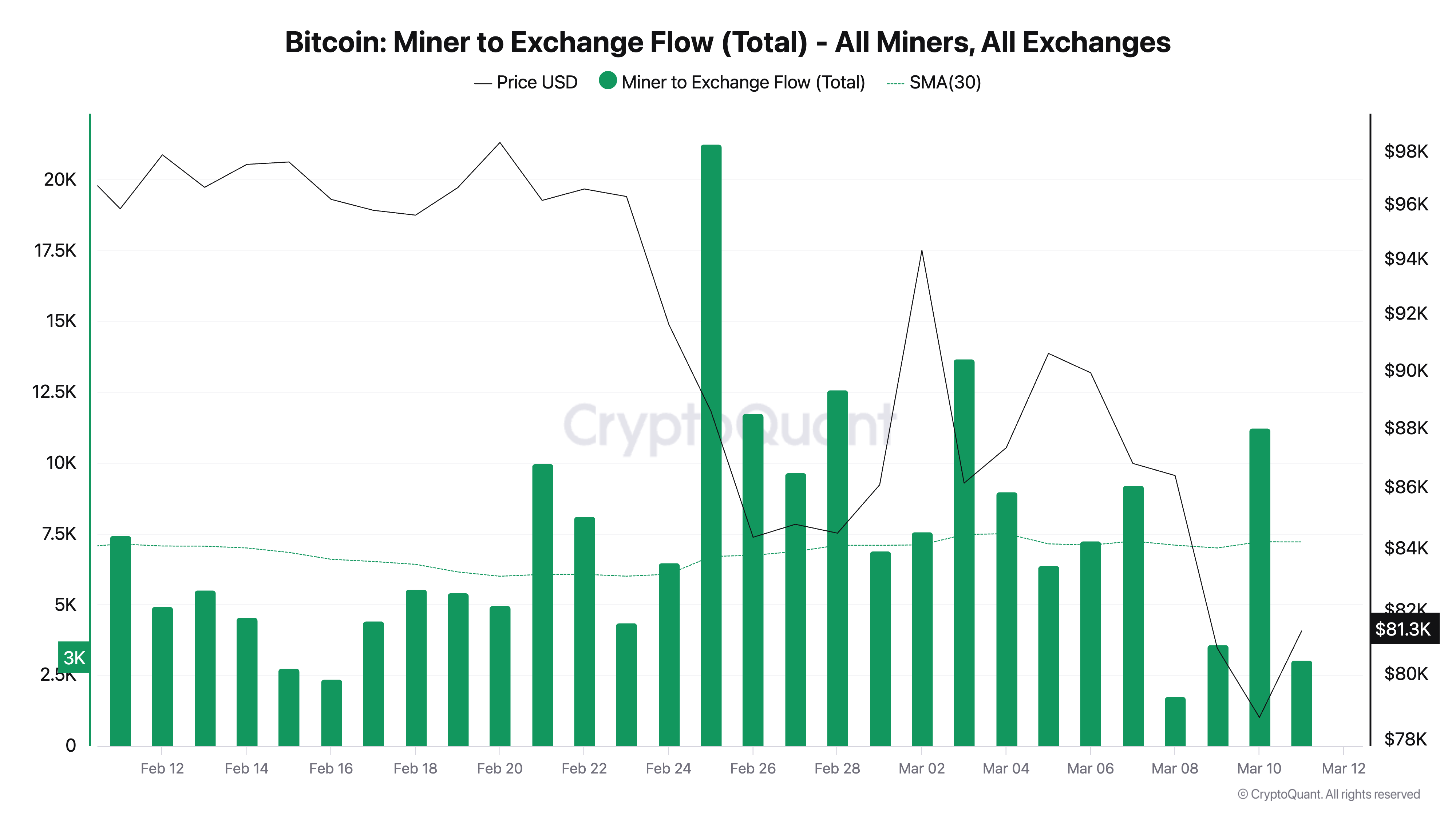

As our dear Bitcoin plummeted to this multi-month low, the transfers from miners to exchanges surged with remarkable fervor. According to the esteemed CryptoQuant, the BTC’s Miner-to-Exchange Flow—which, if I may say, measures the total amount of coins dispatched from miner wallets to exchanges—spiked to a staggering 11,250 BTC during this tumultuous period.

When the Miner-to-Exchange Flow ascends in such a manner, it is a clear indication that miners are offloading their holdings, often to cover their operational expenses or to mitigate their losses. This increased selling pressure, I fear, may further weaken BTC’s price and hasten the market’s descent into despair.

Moreover, the current decline in BTC miner netflow serves to confirm the ongoing trend of coin sell-offs among miners on the Bitcoin network. At this very moment, the metric’s value stands regrettably negative at -620.01.

Miner netflow, for those unacquainted, tracks the net amount of coins that miners are either acquiring or relinquishing. It is calculated by subtracting the amount of BTC miners are selling from the amount they are purchasing.

When this figure is negative, as it currently is, it indicates that miners are parting with more coins than they are acquiring. This, dear reader, is a bearish signal and often heralds an extended downward trend in the coin’s price.

BTC Grapples with $80K Amidst Heavy Selling

Historically, miners have exhibited a tendency to sell more fervently during price declines to cover their operational expenses, which only serves to amplify the selling pressure and can accelerate the market’s downturn. Presently, BTC trades at $81,686, having shed a modest 1% of its value over the past 24 hours.

During this same period, its trading volume has skyrocketed by over 50%, reflecting the high selling activity that has gripped the market. Should this trend persist, it may very well impede BTC’s near-term recovery, as the coin could plummet below $80,000 once more, potentially trading at a disheartening $73,631.

However, should a robust demand arise to absorb this additional supply, it could indeed propel BTC’s value to a more respectable $86,601. One can only hope! 😅

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-11 14:11