Ah, the illustrious Bitcoin, that shimmering digital mirage, has now slipped beneath the $100,000 threshold, as if it were a clumsy dancer at a grand ball, tripping over its own exuberance.

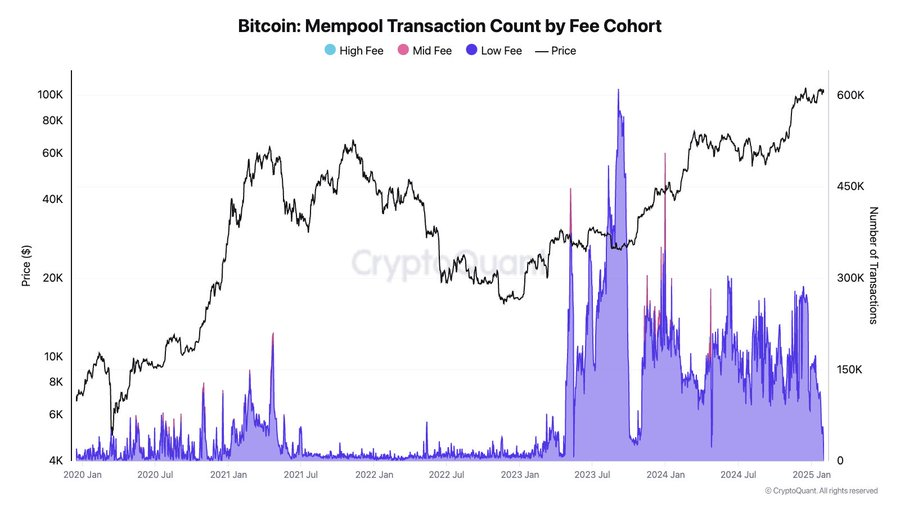

This unfortunate descent coincides with a rather dismal decline in transaction activity on the Bitcoin network, where the memory pool—our dear mempool—has reached a level of emptiness not seen since the bleak days of March 2024.

Market Meltdown: A Whopping $500 Million Vanishes into Thin Air!

In a mere 24 hours, Bitcoin has plummeted below the $100,000 mark, shedding over 4% of its value, like a snake shedding its skin, briefly flirting with the $98,000 figure. According to the ever-watchful BeInCrypto, our beloved Bitcoin had once peaked at a dazzling $102,000 before being unceremoniously tossed into the abyss of selling pressure.

This decline is but a reflection of the broader market’s instability, with the total crypto market cap losing a staggering 5% of its value. Other major cryptocurrencies, like Ethereum, Solana, and BNB, have also joined the pity party, each recording losses exceeding 7%.

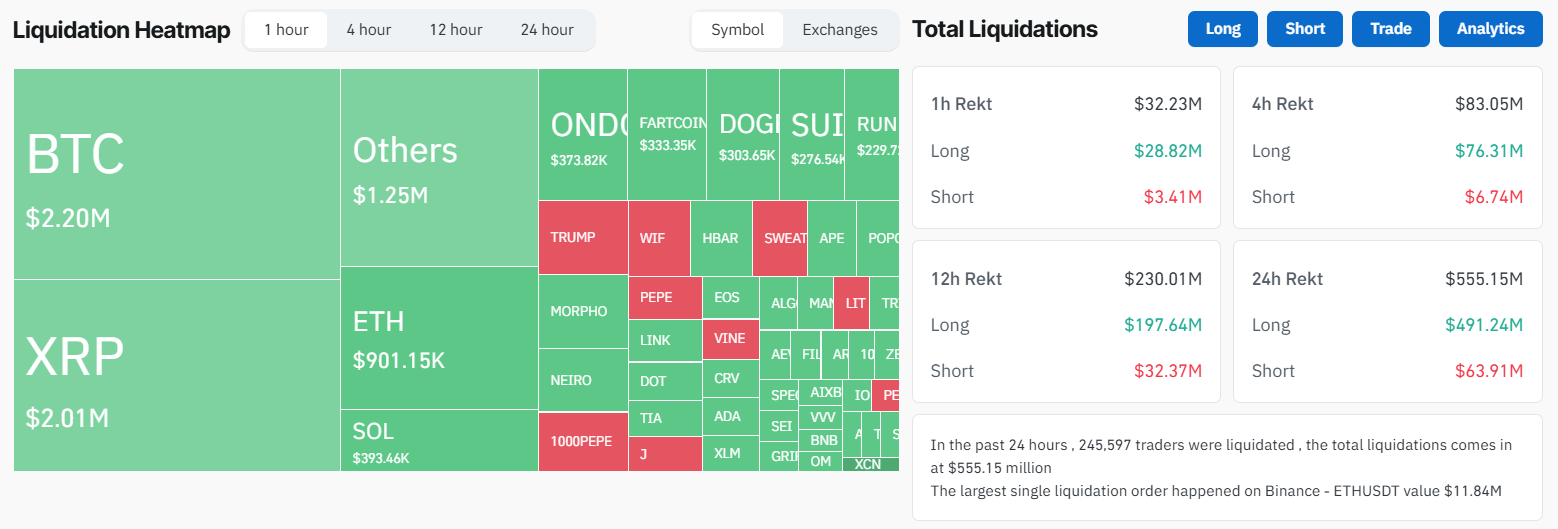

The increased volatility has triggered a liquidation frenzy, wiping out over $555 million in leveraged positions, as reported by CoinGlass. More than 239,000 traders found themselves in the unfortunate position of forced liquidations, with long traders—those optimistic souls betting on price increases—suffering the most, losing a heart-wrenching $491 million. Meanwhile, short traders, those pessimistic prophets, lost a mere $63 million.

This chaos follows the audacious decision by US President Donald Trump to impose stringent tariffs on major trading partners, including our friendly neighbor to the north, Canada.

The administration claims this move is designed to curb the flow of undocumented immigrants and illicit substances into the US. However, the tariffs have ignited concerns about inflationary pressures on American consumers, as if they needed more reasons to fret.

In a delightful twist, Canadian Prime Minister Justin Trudeau announced retaliatory measures, imposing a staggering 25% tariffs on $106 billion worth of American imports.

The first round of levies, targeting $30 billion in goods, will take effect immediately, with an additional $125 billion in tariffs scheduled to follow, like a bad sequel no one asked for.

Bitcoin Network: A Ghost Town of Transactions

Beyond the market’s tempestuous waves, Bitcoin’s network activity has taken a nosedive, with the mempool—our dear waiting area for unconfirmed transactions—showing a notable reduction in volume, akin to a once-bustling café now devoid of patrons.

On February 1, data from CryptoQuant reveals that the mempool is nearly empty, indicating a steep drop in transaction volume. The data further reflects that Bitcoin transaction fees have plummeted to a mere 1 sat/vB, signaling a reduced demand for block space, as if everyone suddenly decided to stay home.

This marks the lowest level of transaction activity since March 2024, a date that will surely live in infamy.

This trend raises eyebrows about Bitcoin’s usage as a medium of exchange, with some analysts suggesting that the growing perception of BTC as digital gold may discourage its transactional use.

Bart Mol, the ever-eloquent host of the Satoshi Radio Podcast, criticized this shift in narrative, stating that celebrating an empty mempool is akin to throwing a party in a deserted wasteland. He likened it to “wood rot” in a house’s foundation, warning that a lack of transaction activity could undermine Bitcoin’s core functionality, like a car without wheels.

“Bitcoiners celebrating that the mempool cleared is one of the most retarded things I’ve seen in a while. The digital gold narrative is slowly destroying the foundation of Bitcoin, like wood rot in the foundation of a house,” Mol wrote, with a flair for the dramatic.

Indeed, Mol’s comment aligns with Bitcoin’s increasing adoption as a reserve asset. Several corporations and governments have begun considering Bitcoin for their treasuries, reinforcing the token’s position as a long-term store of value rather than a transactional currency.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-02-02 17:54