Ah, Bitcoin (BTC), that capricious darling of the digital realm, finds itself ensnared in a most unfortunate predicament, having failed to ascend beyond the exalted $105,000 threshold. This price, dear reader, has become a veritable glass ceiling, thwarting any aspirations of further elevation.

As if the universe conspired against it, our long-term holders (LTHs) have chosen to part ways with their beloved coins, unleashing a torrent of selling pressure that has sent the price tumbling downwards. One can only imagine the drama unfolding in the crypto salons! 🎭

Bitcoin Investors: A Comedy of Errors

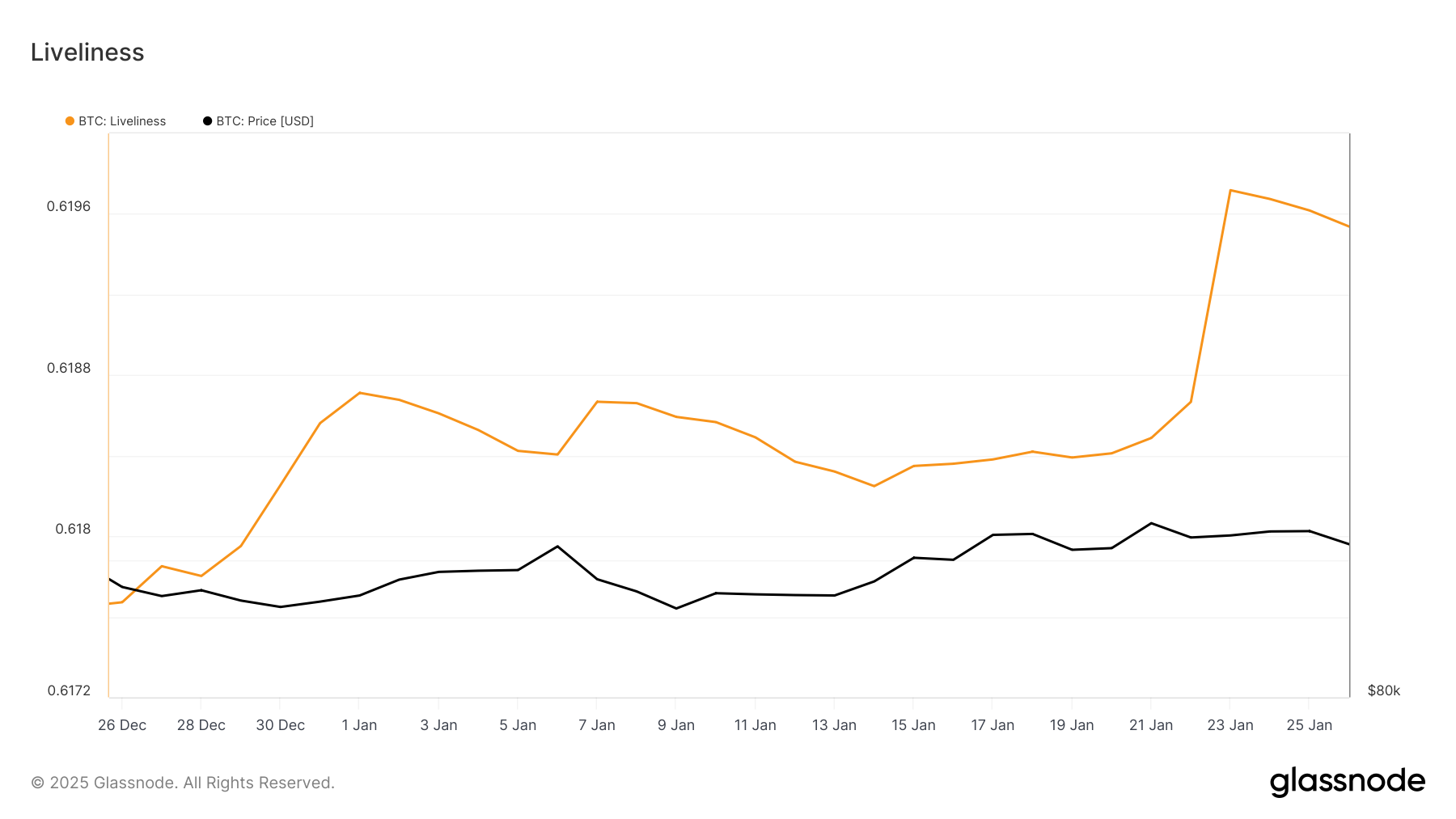

Recent revelations reveal a rather alarming surge in Bitcoin’s Liveliness—a metric that tracks the activity of our long-term holders. This spike, akin to a sudden burst of enthusiasm at a dull party, suggests that many LTHs have decided to liquidate their holdings in a fit of impatience. The evidence is irrefutable, as we witness a shift in LTH balances and a rise in Coin Days Destroyed, signaling a most significant exodus of previously slumbering BTC.

Historically, these LTHs have been regarded as the stalwart guardians of Bitcoin’s stability. Yet, their recent sell-off has cast a long shadow, leading to bearish outcomes that have unfolded over the weekend and into this very day. One might say it’s a tragicomedy of sorts! 🎭

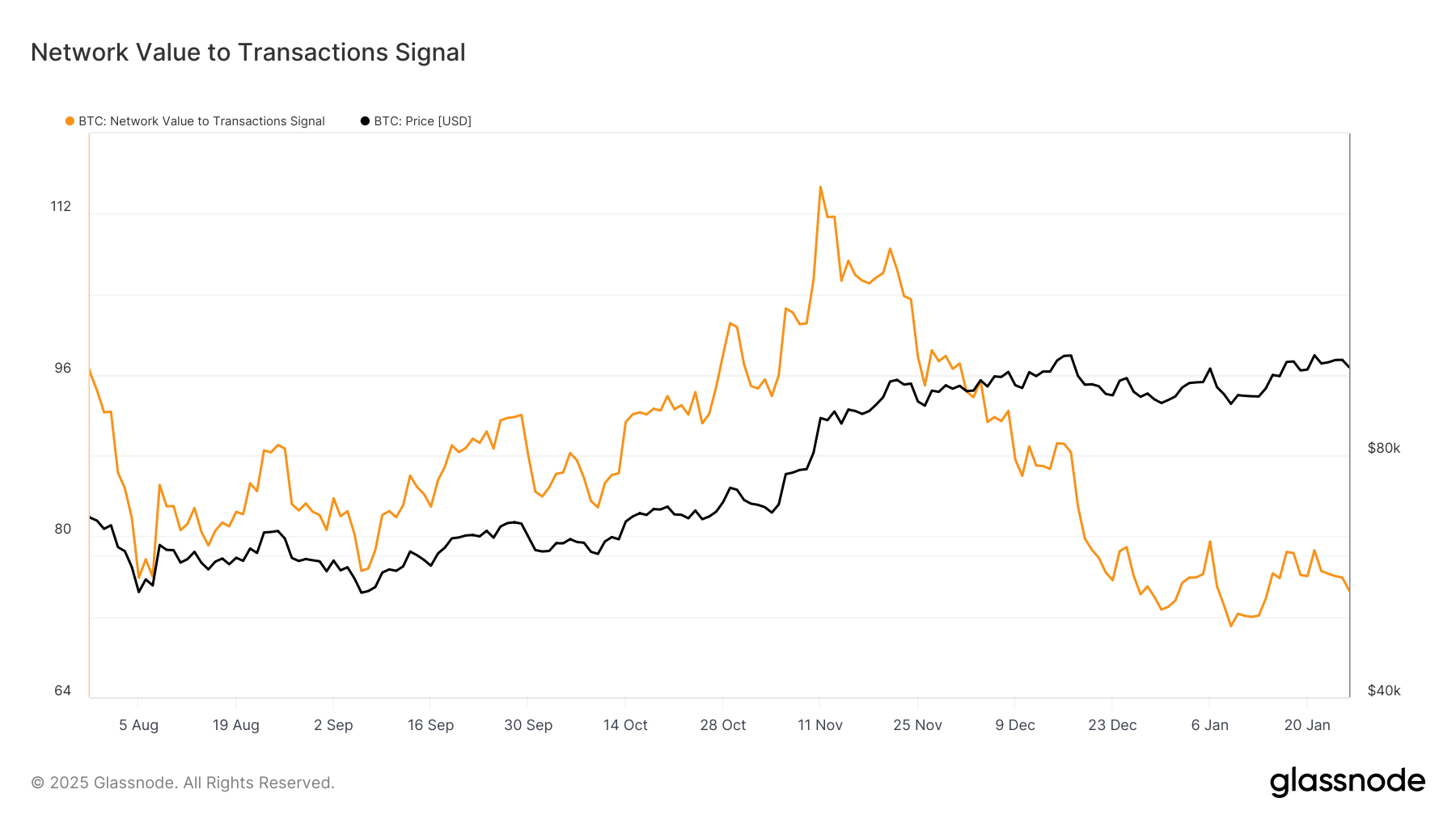

Despite this disheartening downturn, the macro momentum of Bitcoin hints at a potential renaissance. The Network Value to Transaction (NVT) Signal, that ever-reliable barometer of valuation, currently languishes at a lowly state. This suggests that Bitcoin may be undervalued, much like a fine wine left to gather dust in a cellar, hinting at the possibility of future growth. 🍷

While the NVT signal offers a glimmer of hope, one must remember that the broader market cues must align harmoniously for BTC to regain its former glory. Investors, it seems, are not overtly bearish at this juncture, suggesting that sentiment could shift with the slightest breeze of favorable conditions—perhaps a sudden surge in buying activity or a stroke of economic fortune! 🌬️

BTC Price Prediction: The Art of Avoiding Catastrophe

In a rather dramatic twist, Bitcoin’s price has plummeted by 3.88% in the last 24 hours, landing at a rather precarious $100,682. This decline, dear friends, is primarily attributed to the liquidations of our long-term holders and BTC’s inability to breach the $105,000 resistance level, thus reinforcing a rather gloomy sentiment in the short term.

The next crucial support lies at the psychological and technical level of $100,000. Will BTC bounce back from this support, or will it settle here like a weary traveler? Should it falter and lose this level, we may witness a descent to $95,668, amplifying losses and deepening the bearish malaise. Oh, the drama! 🎢

Conversely, should the winds of fortune shift and Bitcoin reclaim the $105,000 as its steadfast support, the bearish outlook shall be cast aside like an old coat. In such a splendid scenario, BTC could very well march towards its all-time high (ATH) of $109,699, rekindling investor confidence and paving the way for a new rally. What a delightful prospect! 🌟

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

2025-01-27 11:04