Ah, the world of Bitcoin, where dreams are made and shattered with the flick of a digital coin! Top analysts, those modern-day prophets, are waving their hands in alarm, pointing to a weakening momentum and a rising tide of short pressure, all while the macro backdrop resembles a soap opera—full of twists and turns.

Van de Poppe: A Correction on the Horizon? 🌅

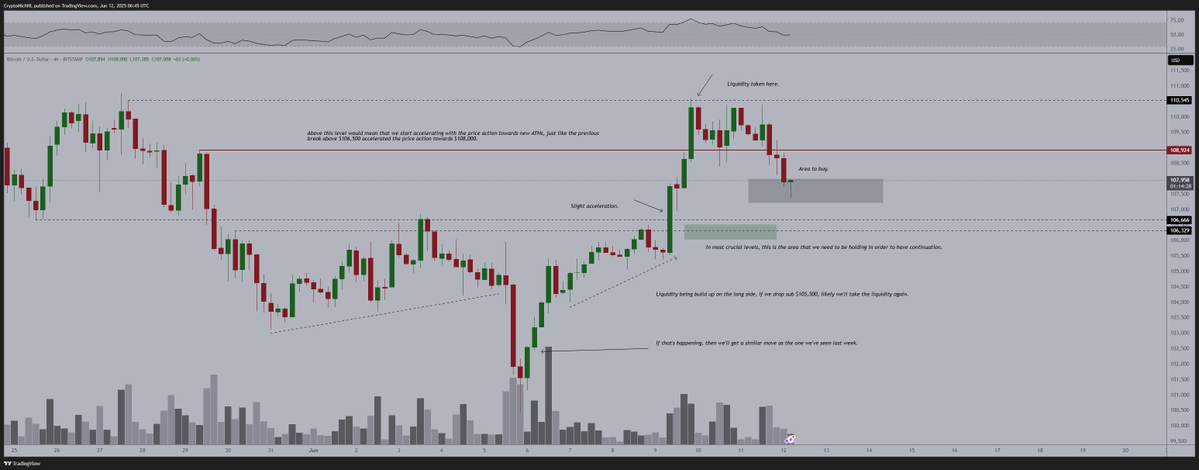

According to the ever-astute Michaël van de Poppe, Bitcoin has failed to break free from the clutches of the critical $110,000 zone, much like a bird trying to escape a cage. In a tweet that could rival the best of Shakespeare, he suggested that a correction is now likely, especially with the geopolitical drama involving U.S.-Iran tensions—because who doesn’t love a little global chaos to spice things up? Meanwhile, gold is having its own little rally party.

Yet, our dear van de Poppe remains cautiously optimistic, like a cat on a hot tin roof: “As long as BTC stays above $106,000, then there’s nothing to worry about.” His chart, a veritable work of art, indicates that BTC is entering a key demand zone, with the $106K level acting as a critical short-term support. Fingers crossed! 🤞

Axel Adler Jr.: The Futures Whisperer 🐉

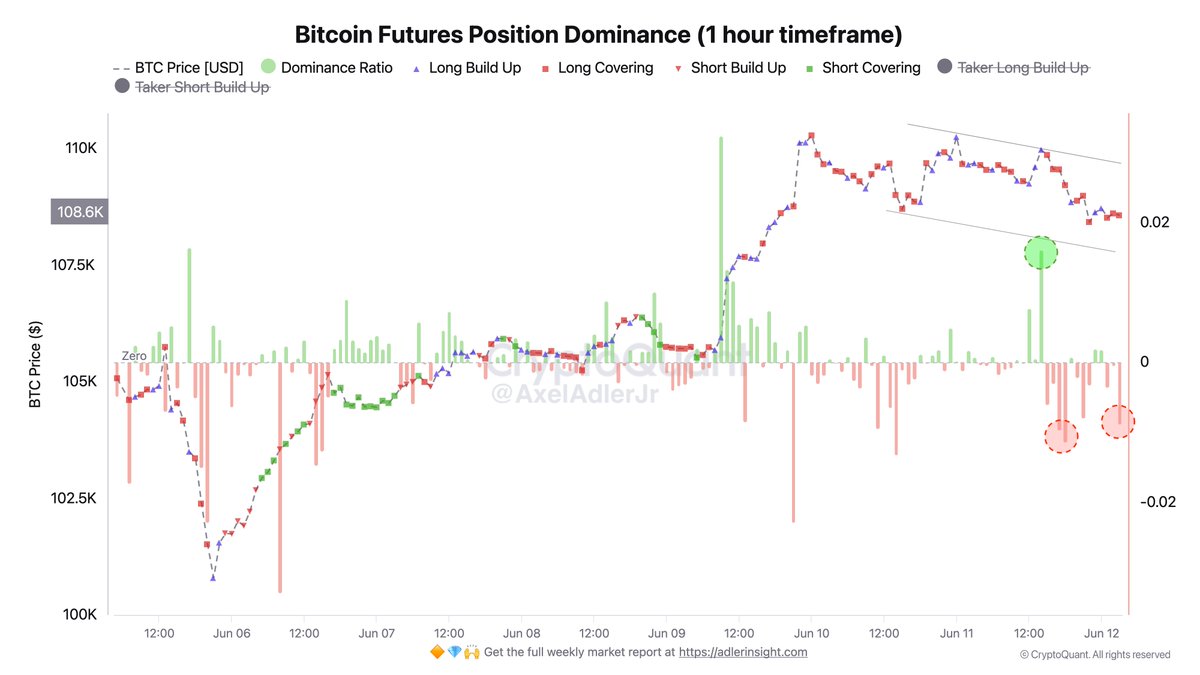

On the derivatives side, Axel Adler Jr. has donned his detective hat, pointing to declining open interest and aggressive short volume as signs of a potential “soft reversal point.” It’s like watching a game of chess, where the bulls are slowly losing their conviction, and the bears are sharpening their claws.

“In the current hour, there is a clear closing of long positions supported by aggressive short volume,” Adler explained, as if narrating a thrilling novel. His futures chart shows a clear dominance of short builds and long liquidation events, suggesting that Bitcoin may face a cozy little consolidation below $108,000 in the near term. How delightful! 🎢

Market Outlook: The Crystal Ball 🔮

- Immediate Resistance: $110,000 remains the ceiling to break for bullish continuation. Will it ever happen? Stay tuned!

- Key Support: $106,000 is the level analysts agree must hold to avoid a deeper correction. No pressure, right?

- Futures Sentiment: A drop in open interest alongside rising short positions typically precedes either a cooldown phase or broader repositioning. It’s like waiting for the other shoe to drop.

While the longer-term sentiment remains as constructive as a well-built house, analysts are urging traders to stay cautious in the short term as volatility ticks up and BTC consolidates within a tightening range. Because who doesn’t love a little suspense in their financial lives? 🎭

Read More

2025-06-12 11:53