Ah, Bitcoin! The digital darling that has been languishing in a downtrend since the halcyon days of mid-January, where every valiant attempt to escape this cycle has been met with the cold shoulder of market resistance.

Recent price movements have led many to believe that BTC‘s plight could worsen, yet, lo and behold, the current market conditions whisper sweet nothings of a potential recovery. Who knew? 😏

Bitcoin Has Suffered For Long

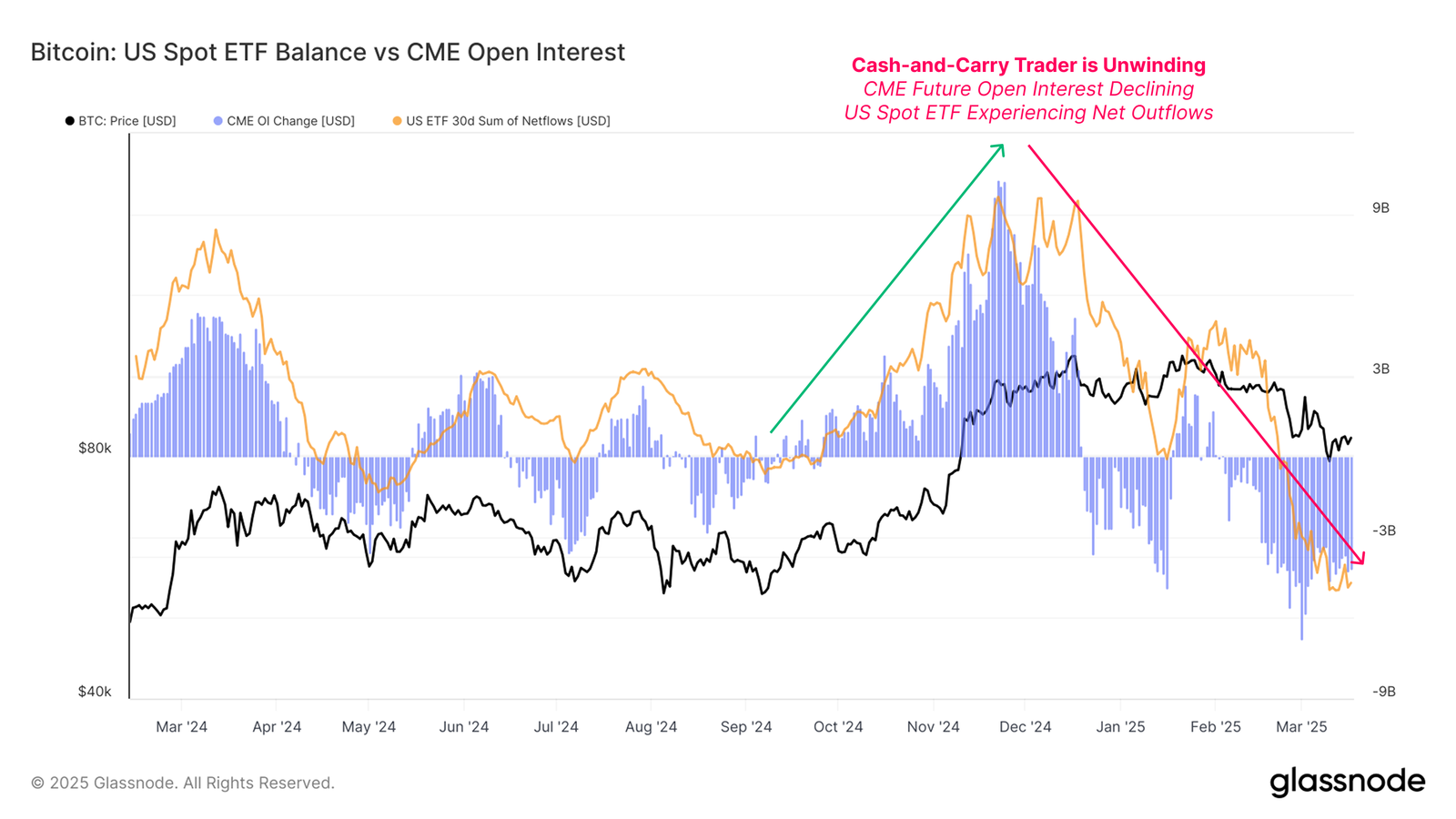

One might find strong evidence of a cash-and-carry trade by comparing the flows into US Spot ETFs and the Open Interest (OI) across CME Futures contracts. As the long-side bias in the market begins to wane, the unwinding of this carry trade becomes as clear as a sunny day in London. In the past month, we have witnessed the highest ETF outflows and a decline in Open Interest, marking a 12-month low. How delightful! 🎉

These developments, while signaling short-term weakness, have historically been the precursors to market recovery phases. The decrease in outflows suggests that liquidity pressure is easing, and investor sentiment may soon shift back toward accumulation. As the market conditions improve, the unwinding of the carry trade could provide Bitcoin with the much-needed support for a longer-term recovery. Fingers crossed! 🤞

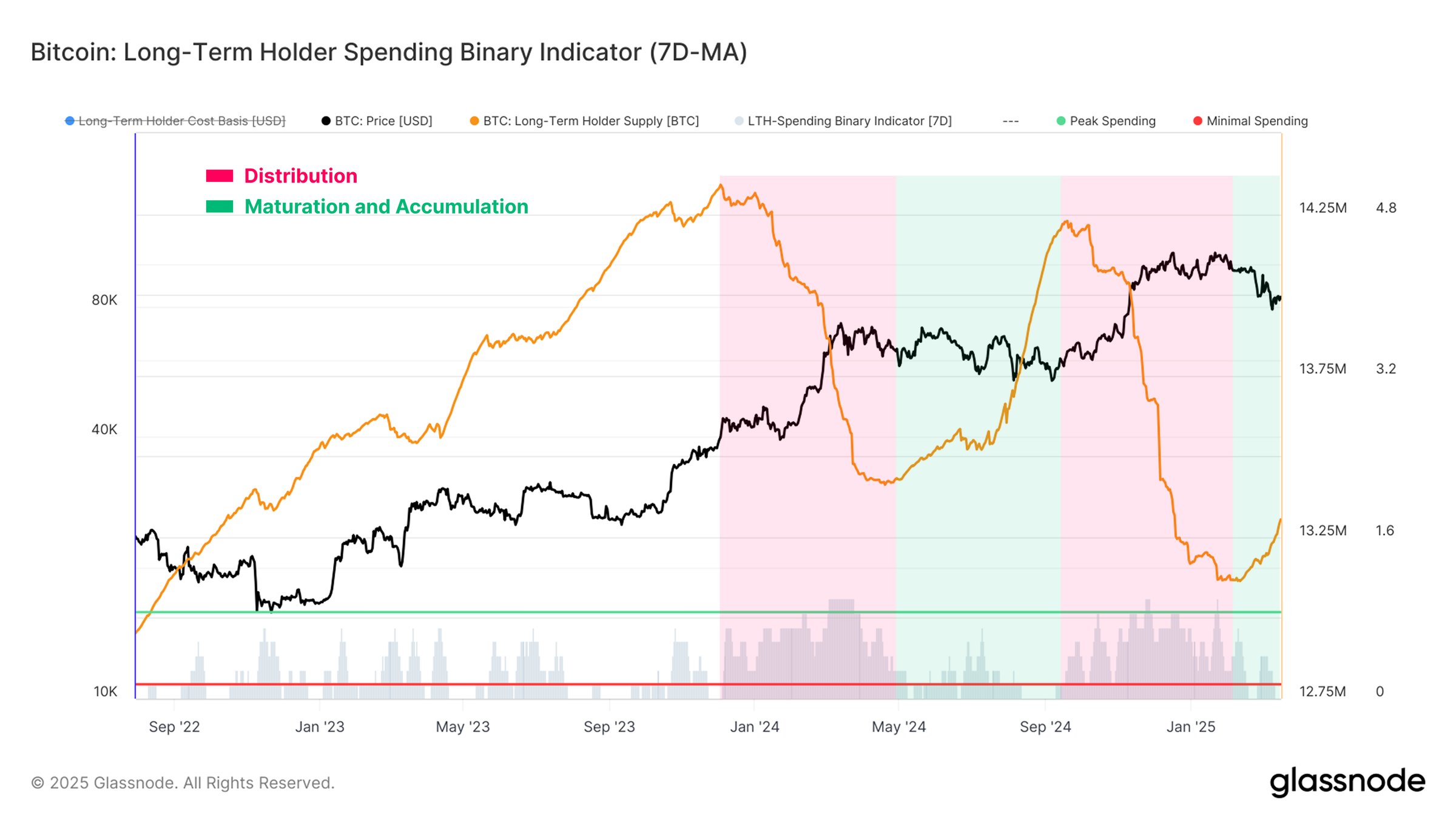

The Long-Term Holder (LTH) Binary Spending Indicator has recently slowed, indicating a shift in sentiment. This indicator tracks when a significant proportion of Bitcoin’s long-term holders decide to spend their assets. Spoiler alert: they’re not spending much! 😅

A slowdown in this spending behavior suggests that LTHs are less inclined to sell, indicating a newfound confidence in holding through this tempestuous period. Historically, when this trend occurs, it leads to an accumulation phase as holders wait for a more favorable market environment. Patience is a virtue, after all!

The reduced spending activity from LTHs could be a sign that these investors are biding their time for a more favorable price action, which could lead to less market selling pressure. As LTHs opt to hold, the likelihood of a sustained rally increases, potentially laying the groundwork for Bitcoin’s recovery. How thrilling! 🎢

BTC Price Needs To Find A Breach

Bitcoin is currently attempting to break out of a two-month-old descending wedge pattern, which presents a bullish opportunity for our crypto king to rise beyond the illustrious $90,000 mark. A successful breach of the $89,800 resistance would confirm this breakout, potentially initiating a new upward trend. How very exciting! 🎈

The aforementioned bullish cues support this optimistic outlook. If Bitcoin successfully surpasses $89,800, it could rise to $95,761, recovering a significant portion of recent losses. This could also trigger more investor confidence, reinforcing the momentum. What a rollercoaster ride! 🎢

However, this bullish thesis is at risk if Bitcoin fails to breach $89,800 or struggles to break beyond $87,041. In such a case, the price could plummet back below $85,000, towards $80,000, invalidating the bullish scenario and delaying any potential recovery. Oh, the drama! 🎭

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Oblivion Remastered: How to get and cure Vampirism

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Does Oblivion Remastered have mod support?

- DODO PREDICTION. DODO cryptocurrency

- The Elder Scrolls: Oblivion Remastered Review – Rebirth of a Masterpiece

- Clair Obscur: Expedition 33 – If I were two years old, at what age would I Gommage?

2025-03-20 12:35