Imagine, if you will, a vast marketplace of shadows and whispers—the realm where Bitcoin, that mercurial spirit, dances. From the cold dawn of November 2024 to the frail light of February 2025, it rose like some strange phoenix, soaring from seventy-four thousand pieces of gold to a dizzying peak beyond one hundred thousand. And yet, beneath this brilliant ascent, the air was thick with unease. The futures market, that oracle of promises and betrayals, spoke not of triumph but of hesitation and dread.

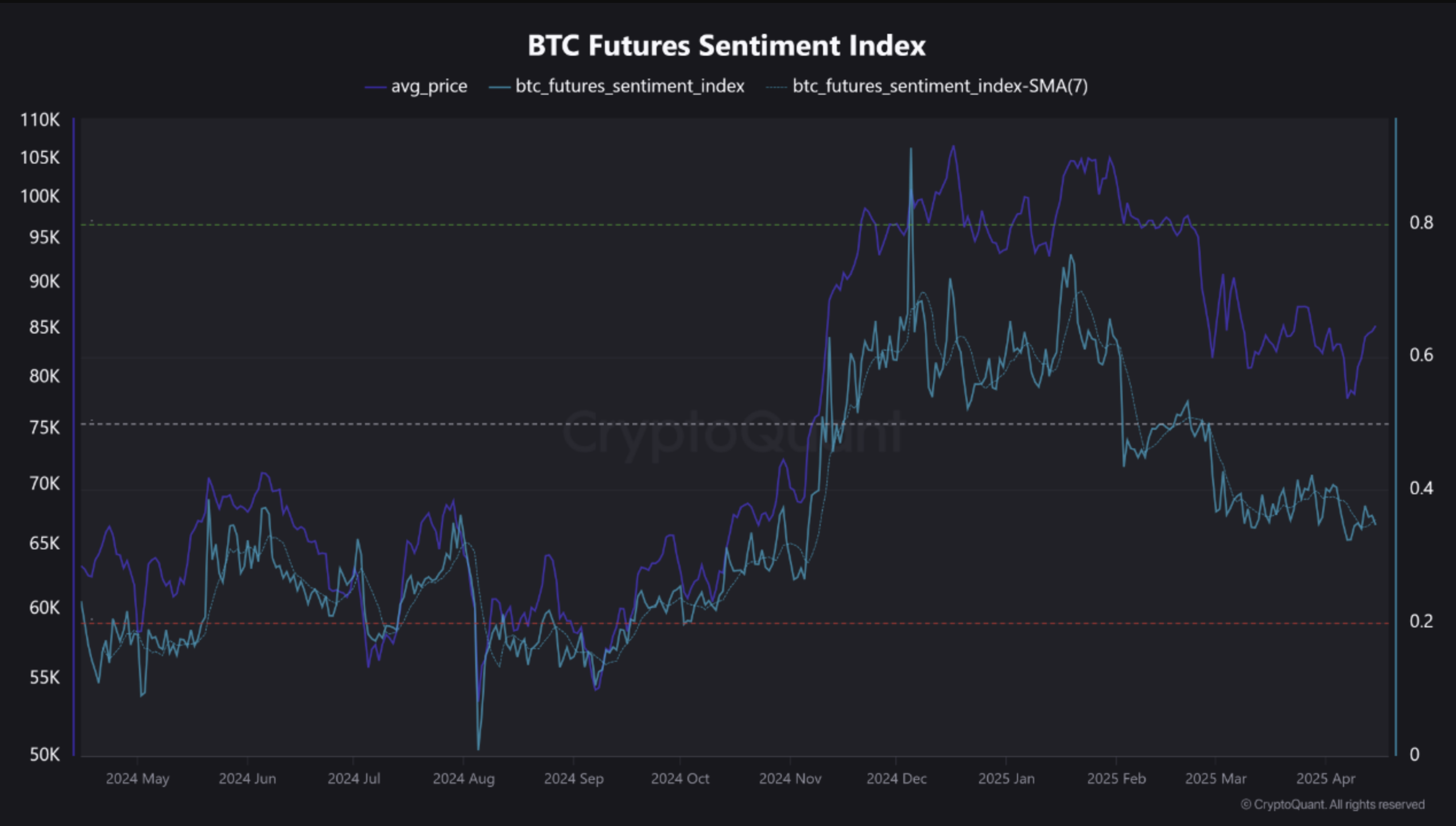

Bitcoin Futures Sentiment Index: The Chill in the Air

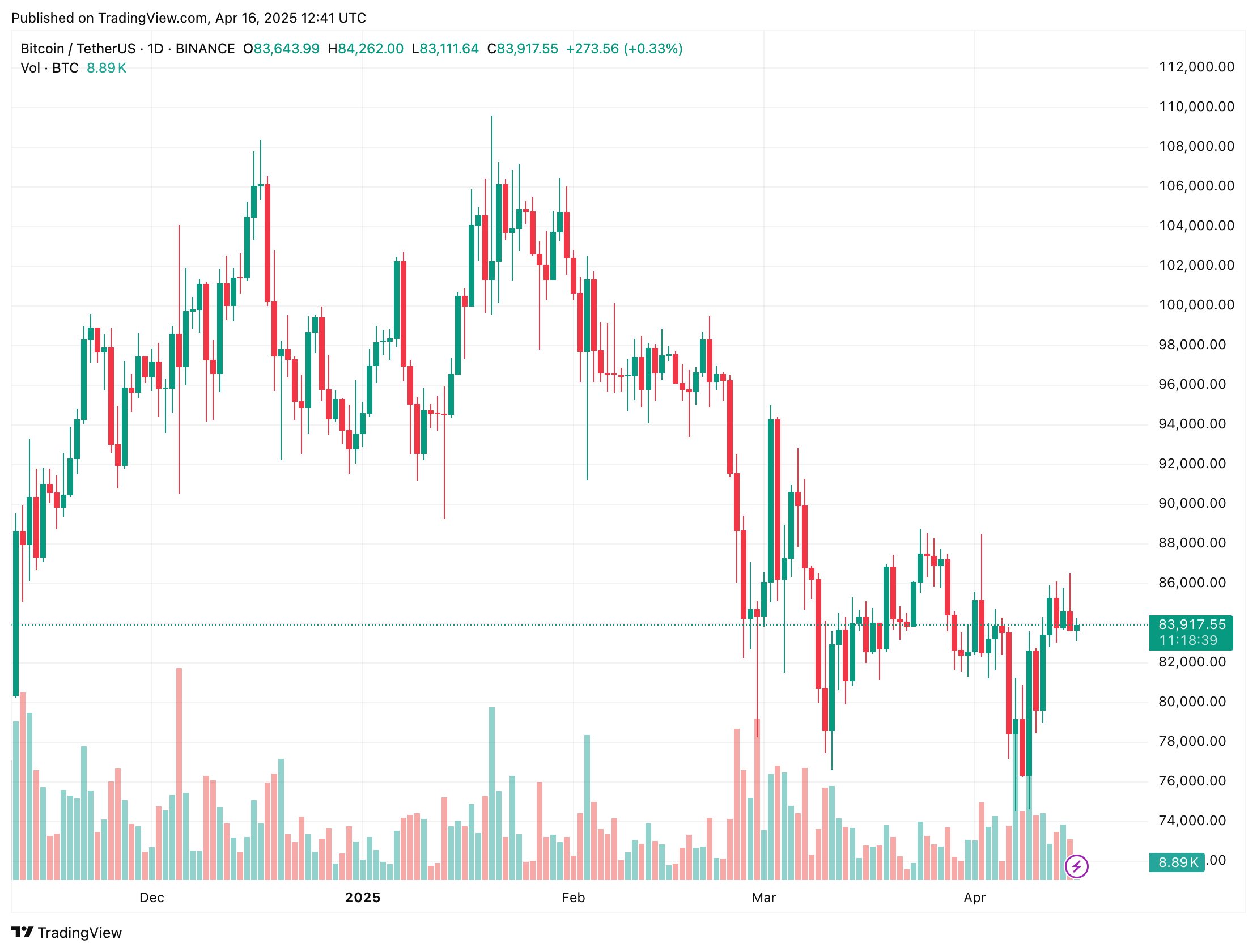

Our volatile hero reached its summit just as the world seemed to tremble under the shadow of tariffs declared by none other than Donald Trump—whose words, sharp as daggers, sent ripples through the sea of risk-loving souls. Bitcoin, among other brave assets, faltered, retreating like a wounded soldier to the mid-eighties thousand mark.

And yet, even as the price regained some ground from its April 6th low—seventy-four thousand five hundred and eight, a number as cold as a Siberian winter—its aura weakened. The futures, those fickle harbingers, showed a growing reluctance, a shiver of fear lurking beneath the surface of bullish pride.

Ah, abramchart, that sage with a wink and a knowing nod, observed this dissonance with a sly grin. “Fear,” he seemed to say, “or perhaps caution, or maybe simply the madness of men fearing a twist in the tale—macroeconomic whispers, the iron grip of regulation, or the inevitable correction that haunts every ascent.”

“This signals a cooling interest or increased fear in the futures market, possibly due to macroeconomic uncertainty, regulatory concerns, or expected corrections.”

Behold the sentiment index—a strange beast oscillating between 0.2 and 0.8—now lurking near 0.4, a liminal realm where bears sharpen their claws while bulls lick their wounds.

Meanwhile, the average price drifts like a melancholic Dostoevskian character, wavering in the range of seventy to eighty thousand, unsure whether to embrace fortune or succumb to fate’s cruel hand amidst the tariffic tempest.

Our observer, abramchart, warns that unless the shadows lift, this lull might stretch on—price consolidation or descent looming like a specter. Yet, the capricious gods of the market could yet smile, and a bullish storm might rise anew.

Is Bitcoin on the Brink of a Grand Awakening?

Some sages whisper that the beast is gathering strength. The mid-eighties thousand plateau is not mere stagnation but a chrysalis, with on-chain omens suggesting undervaluation. The balance of BTC reserves and the stablecoin rites point toward a coming renaissance.

Even the Relative Strength Index, that stubborn herald, cracks its long-held downward spell, hinting at a spirited rally towards the elusive hundred thousand.

Yet, the ominous “death cross” haunts the charts like a Dostoevskian villain, and the ever-present specter of trade wars looms large. As I write these words, the price trembles at $83,917, slipping almost two percent—a modest fall, yet enough to keep the faithful uneasy.

Thus marches the eternal dance of hope and despair, profit and loss, in this modern fable of digital gold. Shall we watch, if not with trembling, then with a sardonic smile and a raised eyebrow? After all, what is life but a series of gambles—some more Bitcoin-y than others? 🤡📉📈

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

2025-04-17 06:43