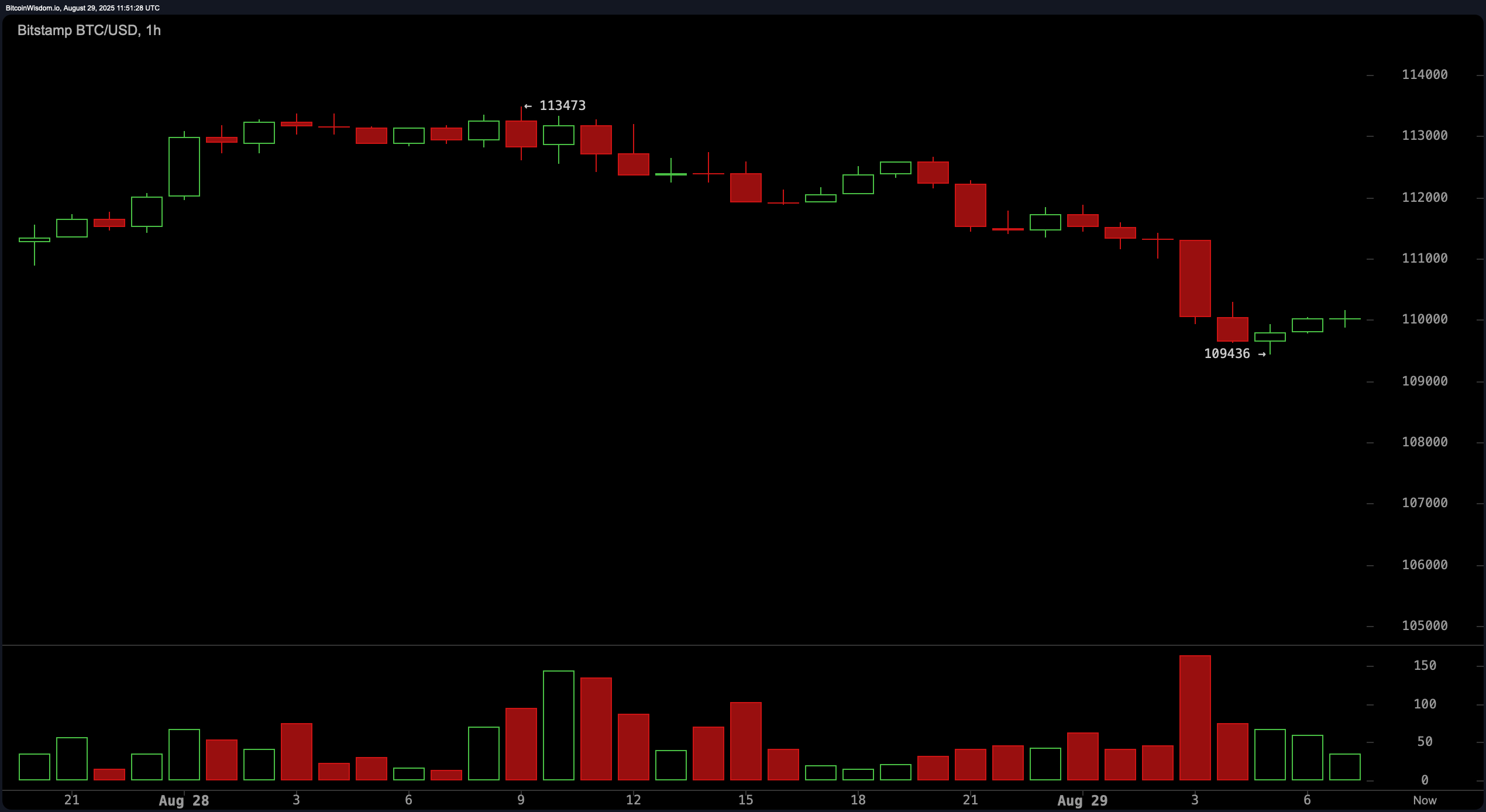

Behold! The price of this esteemed cryptocurrency, Bitcoin, remained in a most circumspect state, hovering between the modest figures of $110,919 and $111,100 on the 29th of August, a testament to the market’s unyielding bearish disposition. With a market capitalization of $2.19 trillion, it commands a grandeur befitting a noble estate, yet its 24-hour trading volume of $40.13 billion speaks of a rather subdued gathering. 🏰📉

Bitcoin

Alas, the broader trend, as observed through the daily chart, remains decisively bearish. This elusive creature, Bitcoin, has yet to conquer the lofty heights of $116,000, its repeated attempts met with scorn, reinforcing a pattern of declining peaks and troughs. The waning trading volume, akin to a dwindling supply of tea at a society event, suggests a dearth of fervor among buyers and an air of indecision among traders. The support at $108,717, a recent low, now stands as a critical threshold. Should Bitcoin breach this with vigor, it may herald a continuation of its melancholic descent. 🕯️

On the 4-hour chart, Bitcoin experienced a minor rebound from the $108,717 support level, yet its attempts to surpass resistance near $113,000 were met with resolute defiance. This movement, reminiscent of a poorly executed waltz, forms a bear flag, a classic pattern that bodes ill for the downtrend. Moreover, the paucity of buying volume during upward moves, contrasted with robust volume on red candles, signals a most unwelcome divergence. Sellers, ever the dominant force, ensure that any rally is swiftly quashed. 🕺

From the 1-hour perspective, Bitcoin appears to be engaged in a most unremarkable consolidation, attempting to establish a base around $109,436. However, the lack of volume and the diminutive candles suggest a stalemate between bulls and bears. While downward pressure has eased, the absence of bullish conviction is palpable. Until a breakout above $113,500 with corresponding volume occurs, short-term traders would do well to approach this period with the caution of a debutante navigating a ballroom. 🕺

The technical indicators, though varied, offer a rather inconclusive outlook. The relative strength index (RSI), at 40, exhibits a neutral demeanor, while the Stochastic oscillator, at 22, mirrors this ambivalence. The commodity channel index (CCI), at -110, hints at potential oversold conditions, yet no reversal signals have emerged. The average directional index (ADX) at 17 suggests a weak trend, and the Awesome oscillator’s value of -4,390 reinforces the lack of bullish momentum. Momentum at -2,964, while technically bullish, is as subtle as a whisper in a tempest. The moving average convergence divergence (MACD) level at -1,417 remains firmly bearish. 🧠

Examining the moving averages, Bitcoin trades below nearly all key short- and medium-term levels. The exponential moving averages (EMA) and simple moving averages (SMA) for the 10, 20, 30, 50, and 100-periods all issue sell signals. Only the long-term 200-period EMA and SMA offer a glimmer of hope, maintaining a positive rating at $103,995 and $101,155, respectively. These suggest that while the long-term structure remains intact, the short- to mid-term bias is as bleak as a winter’s dawn. 🧊

Bull Verdict:

If Bitcoin can sustain a move above $113,500 with robust buying volume confirmed on the 1-hour and 4-hour charts, a short-term reversal may yet be in the offing. This would position the bulls to target the $116,000 and $118,500 resistance zones, though success hinges on decisive momentum and market participation. 🏆

Bear Verdict:

The dominant trend remains bearish across all timeframes, with consistent rejections at key resistance and lower highs forming on each bounce. A confirmed break below $108,700 would reinforce the downtrend and open the door for declines toward $105,000 or even $102,000, especially if volume continues to spike on red candles. 🐍

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

2025-08-29 16:08