Bitcoin: The Cryptocurrency That Refuses to Let Go! 💎💰

Ah, February! A month known for love, chocolate, and Bitcoin’s ongoing struggle to stay above the $100,000 mark. It’s like trying to balance a teetering stack of pancakes while riding a unicycle—Donald Trump’s tariff wars have turned the market into a veritable circus, with traders juggling their nerves like seasoned performers.

Yet, amidst this chaotic carnival, a peculiar breed of coin holders—those with the remarkable ability to resist the siren call of selling—have decided to double down. It’s as if they’ve taken a solemn oath to hoard their coins like a dragon with a particularly shiny hoard. This, dear reader, is a sign of unwavering faith in the long-term prospects of this digital treasure.

Bitcoin Long-Term Holders: The Unyielding Knights of the Blockchain

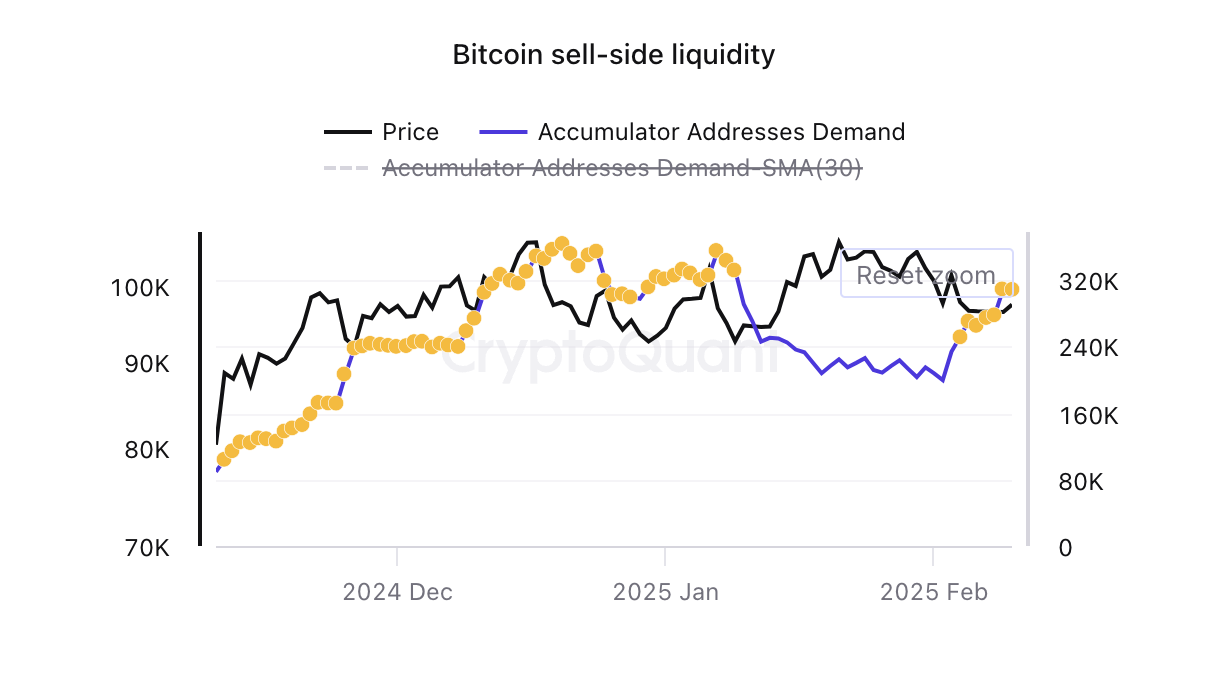

According to the wise sages at CryptoQuant, there’s been a noticeable uptick in what they call Bitcoin’s Permanent Holder Demand. These are the stalwart souls who accumulate Bitcoin over time, never daring to dip into their stash for a quick snack or a new pair of socks. They’re in it for the long haul, and they’re not afraid to show it!

BeInCrypto, in its infinite wisdom, has observed that since Bitcoin hit a year-to-date low on February 2 (a date that will live in infamy), the demand for these accumulator addresses has skyrocketed. It’s like watching a bunch of squirrels stockpiling acorns before winter—only these acorns are digital and worth a small fortune.

Even as Bitcoin experienced a bit of a hiccup in early February, the long-term holders remained steadfast, like a ship’s captain refusing to abandon ship during a storm. Fewer of them are selling compared to previous cycles, which only reinforces their bullish conviction. It’s almost as if they’ve taken a vow of silence regarding their coins.

Moreover, Bitcoin’s valiant attempt to breach its 20-day exponential moving average (EMA) is a clear indication that demand for the king coin is on the rise. As of now, BTC is trading at $98,022, just a smidge below the magical resistance level of $98,995. It’s like trying to reach the top shelf in a kitchen—so close, yet so far!

The 20-day EMA is a clever little contraption that tracks an asset’s average price over the past 20 trading days, giving more weight to recent data. When an asset is poised to break above this moving average, it’s like a rocket preparing for launch—growing bullish momentum suggests a potential shift toward an uptrend, provided it doesn’t get distracted by shiny objects along the way.

BTC Price Prediction: Will the Diamond Hands Prevail? 💎

If the demand from our steadfast permanent holders continues, we might just see BTC rally above the resistance formed by its 20-day EMA. A successful break above this level could provide the momentum needed for the coin to reclaim its all-time high of $109,356. It’s like watching a phoenix rise from the ashes, only with more digital glitter.

However, should the accumulation among BTC investors come to a screeching halt, we might find ourselves plummeting to $92,325. And nobody wants that, unless you’re a fan of roller coasters, in which case, hold on tight!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-02-11 16:09