On Nov. 7, bitcoin, that capricious lover of markets, dipped beneath the $100,000 threshold for the second time in a week, as whispers of OG whales-those ancient leviathans of the crypto sea-offloading their glittering hoards sent ripples of panic through the digital abyss.

Price Plunge and Market Impact

On Nov. 7, bitcoin (BTC) slithered below $100,000, slinking to $99,376 amid rumors that long-term holders-those OG whales, who’ve clung to their BTC since the dawn of blockchain-were cashing in their chips like a pack of sardonic gamblers. The slide dragged bitcoin’s market capitalization further from the $2 trillion mirage, while the crypto economy’s total value wilted to a paltry $3.4 trillion-a sum that would make a billionaire blush.

Though BTC later clambered back above $100,000, its inability to conquer the $105,000 summit-a mere molehill in crypto’s grand landscape-only deepened the growing suspicion that the bull market’s parade had ended, leaving investors stranded in a desert of dwindling hope. Since its October 6 peak of $126,000, bitcoin had clung to $120,000 like a drunkard to a lamppost for four days before the October 10 flash crash-triggered by Donald Trump’s tariff tantrums-sent prices tumbling like a house of cards in a hurricane.

While BTC has staged feeble recoveries, its overall trend resembles a drunken waltz downward, led by Jerome Powell’s cryptic musings on rate cuts and AI bubble fever, which have left investors clutching their wallets like anxious lovers in a thriller. The absence of positive news? A cruel joke, perhaps, orchestrated by the gods of finance.

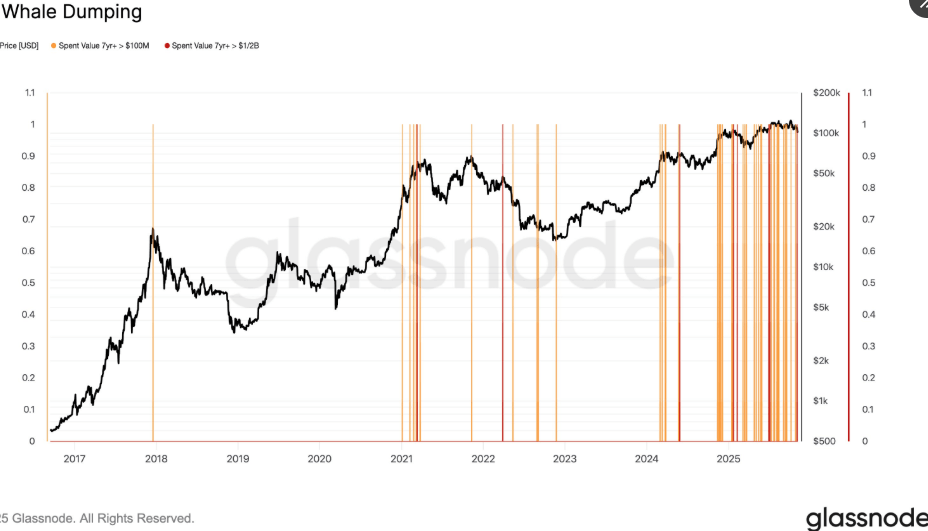

On the social media platform X, “bitcoin short” trended like a bad haircut, as bearish sentiment spread like wildfire. Reports of super whales unloading BTC worth hundreds of millions painted a picture of crypto’s aristocracy cashing out in a panic. Investor Charles Edwards, ever the showman, shared a chart resembling a graph of doom, declaring, “OG Bitcoin whales are dumping. This chart gives a charming visual of how many super whales are cashing out of Bitcoin. All lines here are 7+ year on-chain spends from pre-2018 era OG Bitcoin Hodlers.”

The Nov. 7 volatility, that fateful dance of dollars and despair, triggered a tempest of liquidations in leveraged positions. According to Coinglass data at 10:30 a.m. EST, nearly $100 million in short contracts were obliterated within 24 hours, with ethereum (ETH), Zcash (ZEC), and BTC accounting for the lion’s share-$37.5M, $29.21M, and $15.64M, respectively. A feast for the vultures of volatility.

But long positions, those naive optimists, bore the brunt of the carnage, with over half of the $765 million in total liquidations-$382.5M-wiped out in a single day. A lesson in hubris, perhaps?

FAQ 🧠

- Why did bitcoin fall below $100K on Nov. 7? BTC slinked to $99,376 as OG whales, those crypto dinosaurs, cashed out.

What triggered the broader crypto market decline? Bitcoin’s dip sent the crypto economy’s value plummeting to just above $3.4 trillion, a number so small it could fit in a teacup. 🫖

What factors are driving bitcoin’s downward trend? Rate cut speculation, AI bubble fears, and the general stench of despair are suffocating BTC’s recovery. 🐉

How much was liquidated during the Nov. 7 volatility? Over $765 million in leveraged positions were vaporized, mostly from long contracts. A financial fireworks show, if you will. 🎆

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Gold Rate Forecast

- ‘A Charlie Brown Thanksgiving’ Tops Apple TV+’s Top 10 Most-Watched Movies List This Week

2025-11-07 22:39