Markets

What to know:

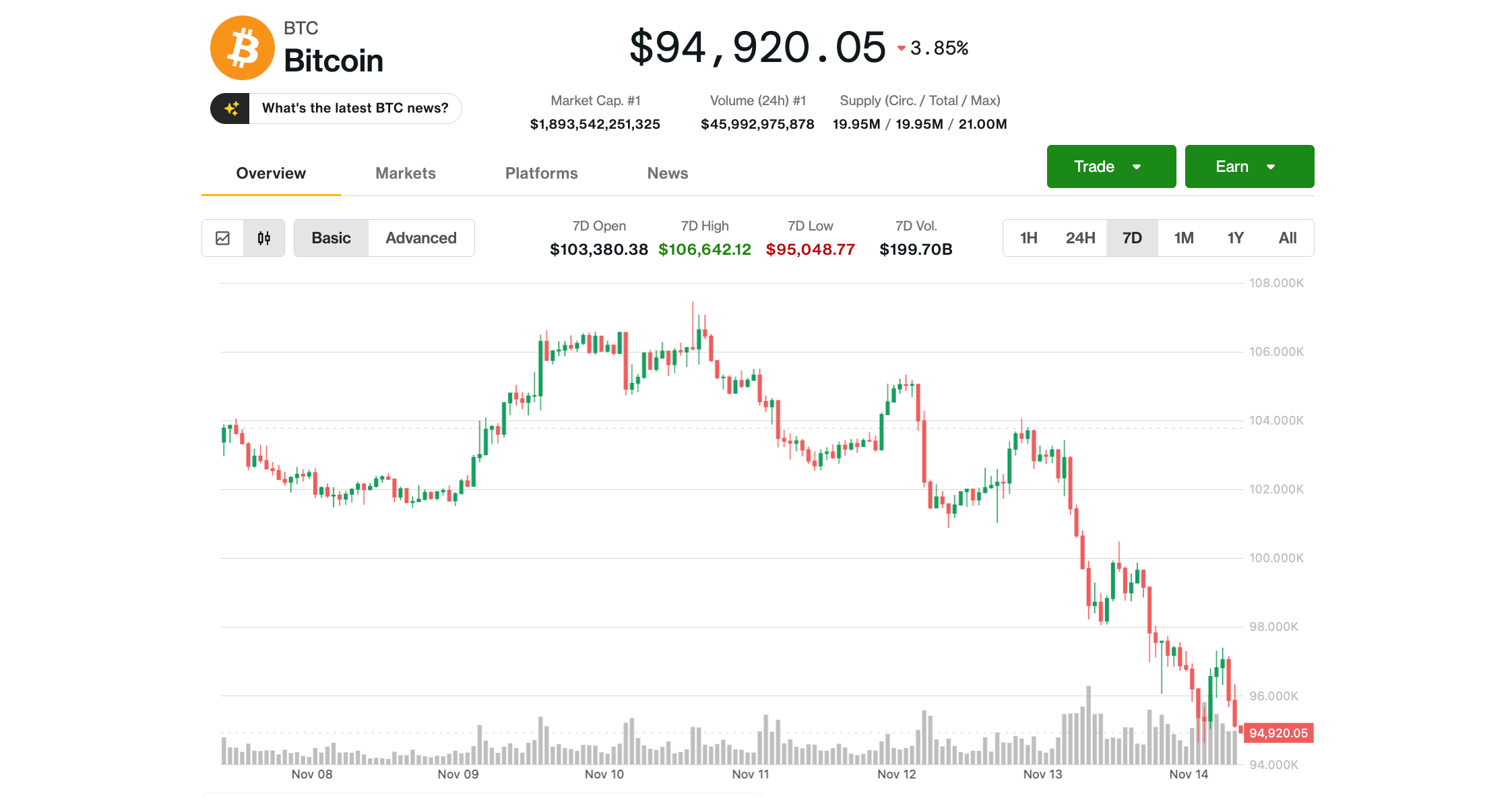

- Bitcoin was at session lows late in the U.S. trading day Friday, sliding below $95,000. Oh, how the mighty fall! 🐭📉

- The market downturn attributed to “information vacuum” and diminishing expectations of Fed rate cut, analysts said. A fancy way of saying no one knows what’s going on. 🧠❓

- The breakdown puts $84,000 level as next downside target, Ledn’s CIO said. Because nothing says “optimism” like a 10% drop. 💸📉

Bitcoin saw no bounce Friday, holding at session lows below $95,000 late in the U.S. day after a bruising week that dragged prices to their lowest since May. A week so bad, even a goldfish would’ve thrown in the towel. 🐟📉

The largest cryptocurrency is again underperforming U.S. stocks, with major U.S. indices holding onto minor gains a few minutes prior to the end of trading. BTC was on track to log a 9% loss for the week, its worst performance in eight months. Because nothing says “resilience” like a 9% weekly loss. 📉

Ethereum, trading below $3,200, fared worse, tumbling more than 11% since Monday, while Solana’s SOL lost 15% over the same period. Meanwhile, Bitcoin’s cousin, Ethereum, is having a crisis of confidence. 🧘♂️💸

held up better, dipping just 1%, perhaps buoyed by this week’s debut of its first spot ETF in the U.S., issued by Canary Capital. A spot ETF? More like a spot of tea to calm the chaos. 🫖🍵

Crypto-related equities performed mixed after Thursday’s steep losses. MicroStrategy (MSTR), the largest public holder of bitcoin, slid another 4% to below $200 for the first time since October 2024. A price last seen in the days of the last Ice Age. 🧊📉

Exchange Bullish (BLSH), Ethereum treasury BitMine (BMNR), miners CleanSpark (CLSK), MARA Holdings (MARA) and Hive Digital (HIVE) slid 4%-7%. Because nothing says “excitement” like a 7% plunge. 📈📉

On the positive side, miner Hut 8 bounced 6% following earnings results from American Bitcoin, a joint venture with the Trump family, while digital brokerage Robinhood (HOOD) and BTC miner Riot Platforms (RIOT) advanced around 3%. A 6% bounce? That’s the crypto equivalent of a sigh of relief. 🤷♂️

‘Information vacuum’ clouds investor confidence

The current market downturn is largely driven by a lack of clarity on key U.S. economic conditions and subsequent monetary policy direction, Bitfinex analysts said. A lack of clarity? How original! 🎩🐇

“The market retracement is the result of an information vacuum and political uncertainty,” they wrote in a Friday note shared with CoinDesk. “Key economic data is still missing to guide the market and the Federal Reserve, putting investors on standby.” Because nothing says “confidence” like a government shutdown and a Fed that’s more mysterious than a magician’s rabbit. 🎩🐇

However, the shutdown-ending spending bill that lawmakers passed only provides funding to keep the government open until 30 January, weighing on investor sentiment. The temporary funding bill is like a Band-Aid on a broken leg-just enough to keep the government from collapsing, but not enough to cure the underlying malaise. 🩹📉

Noelle Acheson, author of Crypto Is Macro Now, said the recent drawdown was a necessary correction after months of range-bound consolidation that failed to sustain a breakout above $120,000. “We need to get through this flush before we can breathe more easily,” she wrote. “Once that happens, the longer-term case for BTC strengthens – but we’re not there yet.” A necessary correction? More like a necessary cry. 🥺

The main driver for BTC remains macro liquidity, Acheson added. While another Fed rate cut might not arrive until later in the first quarter of 2026, expectations for balance sheet adjustments or other easing measures and “liquidity injections” could help rebuild optimism around risk assets including BTC, she said. Because nothing says “optimism” like a 2026 rate cut. 📅📉

BTC headed to $84K, Ledn CIO says

Meanwhile, technical indicators suggest bitcoin may still have plenty of room to fall, said John Glover, chief investment officer at crypto lending firm Ledn.

He noted that to a breakdown below the 23.6% Fibonacci retracement level at just below $100,000 opened the path to the next key support level, sitting at around $84,000. Because nothing says “hope” like a 16% drop. 📉

Glover believes the current pullback is part of bitcoin’s bear market, forecasting volatile action for the upcoming months. “We’ll likely see prices back above $100,000 before any sustained break below $90,000,” he said, noting that the full correction could play out through the summer of 2026. Because nothing says “volatility” like a 2026 summer. 🌞📉

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-11-14 23:46