Oh dear, it seems Bitcoin demand is having a bit of a mid-life crisis after its wild ride to $112,000! According to the latest gossip from Cryptoquant, the party might be winding down. 🎉

Profit-Taking: The New Trend in the Futures Market! 💰

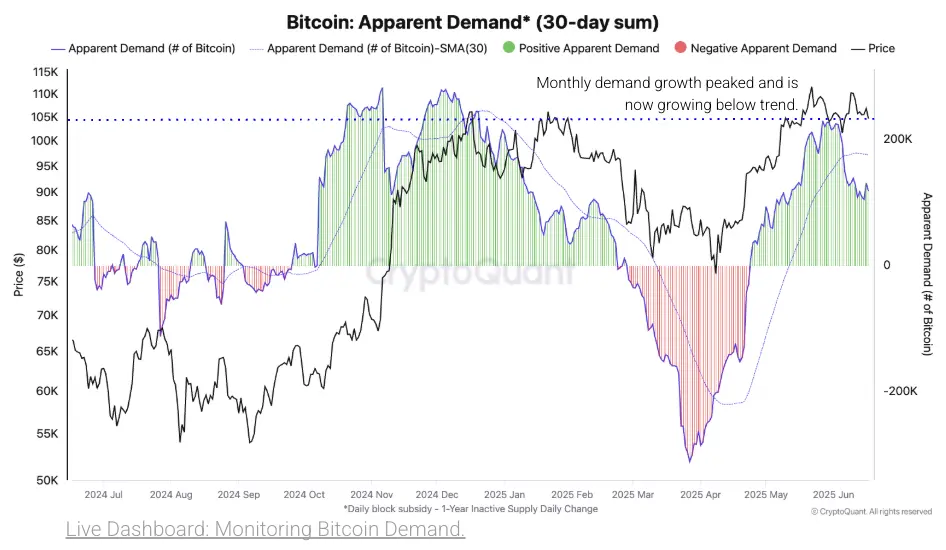

So, Cryptoquant has spilled the tea, revealing that while Bitcoin spot demand is still growing, it’s doing so at a pace that would make a sloth look speedy. Demand growth has plummeted to 118,000 BTC over the last 30 days—down a staggering 48% from its May 27 peak of 228,000 BTC. And guess what? It’s now lagging behind its 30-day moving average (MA). Talk about a dramatic fall from grace! 😱

And the whales? Well, they’re not exactly making waves anymore. Their balances are only expanding by a measly 1.7% month-over-month—less than half of the 3.9% they were flaunting on May 27. Meanwhile, daily purchases by U.S. spot bitcoin exchange-traded funds (ETFs) have nosedived to 3,300 BTC—a jaw-dropping 66% drop from their April 23 peak of 9,700 BTC. Ouch! 😬

Cryptoquant is waving a red flag, saying that for a sustained rally, we need these big players to step up. But alas, new investors are ghosting us, and the negative vibes are only getting stronger. Short-term holder (STH) supply has dropped by 800,000 BTC since May 27, leaving us with just 4.5 million BTC. Cryptoquant’s demand-momentum metric has hit a record low of -2 million BTC. Yikes! 😳

Historically, bull markets thrive on new investors gobbling up supply from long-term holders. But right now, the futures markets are looking a bit cautious. Cryptoquant’s Trader Behavior Dominance metric shows traders cashing out after Bitcoin prices flirted with $110,000 last week. As Bitcoin prices dipped to $105,000, they opened new short positions, signaling a rather gloomy outlook. 😔

If demand continues to fizzle, Cryptoquant warns that $92,000 is the critical support level—the Traders’ Onchain Realized Price, which is like the safety net for bull markets. If we fall through that, we might be testing the $81,000 lower band. Hold onto your hats, folks! 🎢

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

2025-06-20 17:27