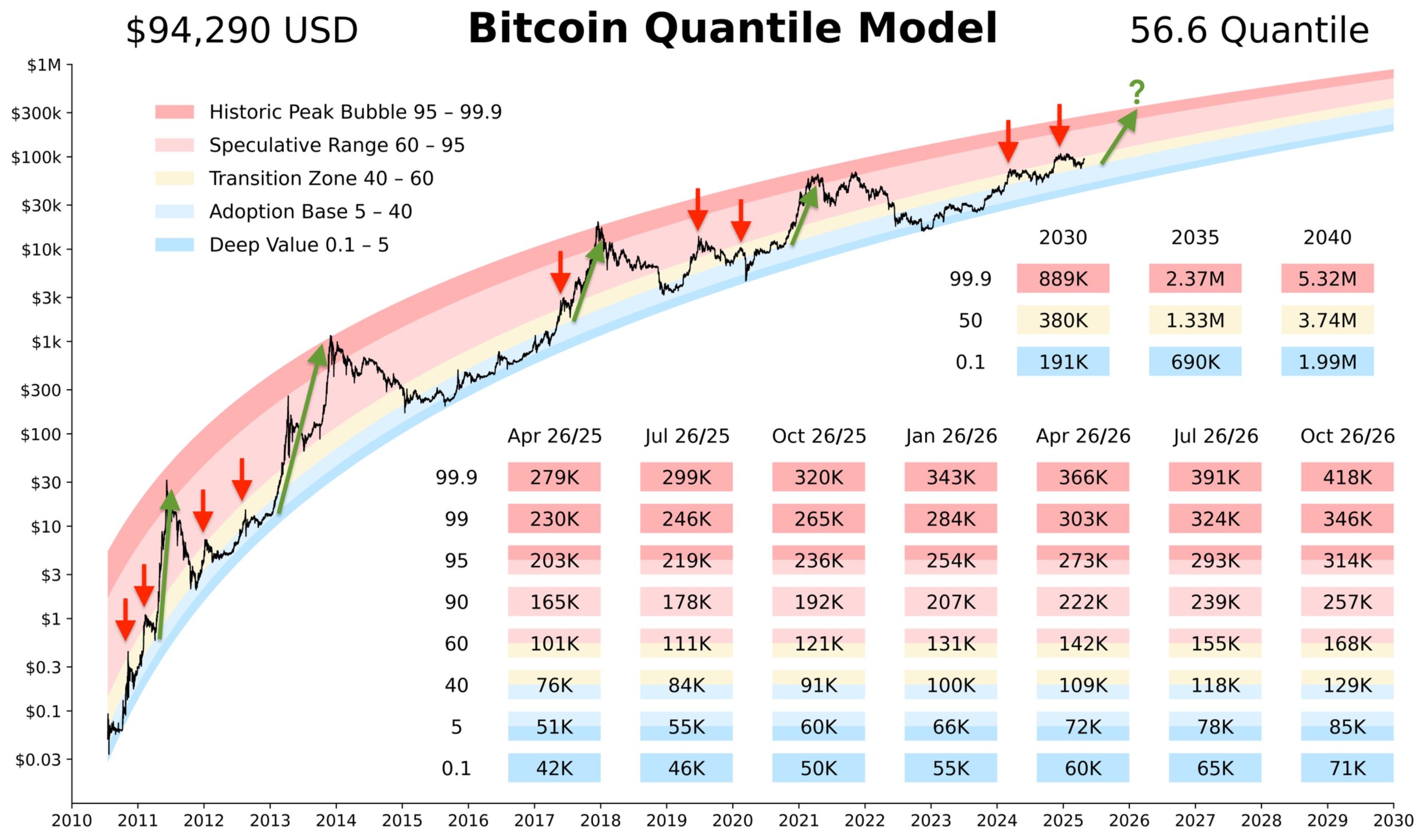

At present, dear reader, BTC sashays around the $94,000 mark, with a Quantile Model Risk Score tumbling at a genteel 56.6%. Not quite the fever pitch of a full-blown mania, but enough to make one sit up and take notice—a mid-stage bullish charade, if you will.

Sina, our ever-persistent raconteur of crypto dramas, points out that Bitcoin’s cycles are like a stubborn ingénue—there’s usually a false start or two before the grand crescendo. History, that old gossip, tells us this latest act is following the script almost too obediently.

Valuation Time-Travel: Back to the Roaring November of 2020

Sina’s analysis brings us a blast from the past—November 2020, when Bitcoin was the modest wallflower at $13,000. From that soirée, it pirouetted with breathtaking flair all the way to $61,000 in mere months. Drama! Suspense! Tears!

One might conjecture that the star of our piece still has a few dazzling numbers left to perform, though the contemporary economic ensemble throws a few more wrenches into the mix.

Macro Headwinds and Tailwinds: The Plot Thickens

Unlike the carefree days of yore, today’s Bitcoin must contend with a duo of uncharming villains: restrictive monetary policy and the ever-looming shadow of recession. These scoundrels are intent on dampening our hero’s ascent.

But, fret not! Sina predicts a plot twist—Fed policies might ease up, uncorking the champagne of liquidity for risk assets like our darling Bitcoin. A renaissance, perhaps, if the economic theatre doesn’t suffer an unexpected blackout.

Should recession volatility refrain from its usual melodramatic outbursts, the medium-term prognosis remains rather propitious.

2025: The Grand Stage for Bitcoin’s Next Applause-Worthy Breakout

By curtain call in 2025, Sina envisions the perfect cocktail of conditions for Bitcoin’s gala performance:

- A monetary policy more laissez-faire than a debutante’s polite curtsy

- Those pesky tariffs finally taking their evening bow and exiting stage left

- A fiscal and administrative encore featuring pro-growth policies—think tax cuts or the deregulation jitterbug

- And if fortune shines just right, we could witness a reprise of Bitcoin’s late-stage rallies, complete with fireworks and maybe a tap dance or two.

Final Act

Though the stage is never without the occasional tempest—short-term volatility’s capricious tantrums—Bitcoin’s long-term libretto grows ever more engaging. As Sina from 21st Capital so eloquently puts it, Bitcoin’s second escape attempt is in motion, and history’s whispers suggest the curtain is poised to rise once again.

Read More

2025-04-27 22:39