Ah, Bitcoin! That capricious darling of the digital realm, once again flirting with the stars as it breaches the mundane barriers of resistance. The world, in its infinite folly, watches as institutional inflows, regulatory whims, and macroeconomic theatrics conspire to elevate this cryptographic phoenix. Truly, a spectacle worthy of a Wildean quip: “Bitcoin is the only thing that rises faster than society’s expectations-and crashes with far more panache.” 🌪️✨

The Market’s Grand Ballet: Bitcoin Pirouettes Near Record Heights

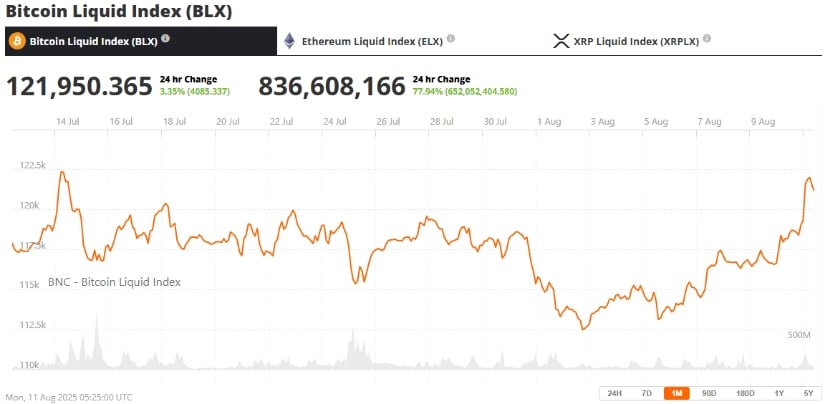

Behold, the latest gossip from the cryptosphere: Bitcoin, that enfant terrible of finance, now trades at a modest $121,950, a 3.3% ascent in the past 24 hours. This audacious leap places it within a whisker of its mid-July zenith of $123,218. On-chain whispers reveal a massacre of short positions-92% liquidated, no less-as the price surged past $120,000, triggering a cascade of stop-loss tears and amplifying the buying frenzy. A drama fit for the West End! 🎭💔

With a market capitalization that dwarfs the GDP of small nations ($2.33 trillion, darling) and daily trading volumes exceeding $14 billion, Bitcoin’s rally is less a retail romp and more a stately waltz of institutional suitors. Spot Bitcoin ETFs, those nouveau riche of the investment world, recorded $246.75 million in net inflows last week, reversing the earlier exodus of funds. How très chic! 🕴️💼

Technical Follies: The Breakout Above $120K Unveils New Fantasies

From the ivory towers of technical analysis, Monday’s rally saw Bitcoin flirt with the 1.618 Fibonacci golden ratio-a level as elusive as a witty retort at a dull dinner party. Should the daily candle close above $120,000, analysts predict a price discovery phase, a journey into the unknown. How delightfully perilous! 🕵️♂️📈

Short-term targets, plucked from the Fibonacci garden, suggest resistance at $127,000, $137,000, and $153,000. If the bulls maintain their bravado, the fabled $140,000 could be within reach before the year’s end. The RSI, a mere 65, hints at robust yet restrained bullishness, while the MACD has flashed a buy signal as bold as a Wildean epigram. Support lingers near $116,000-a critical zone, should the market decide to take a dramatic pause. 🧐📉

Catalysts: ETFs, Policy Capers, and Whale Whims

What fuels this cryptographic crescendo? A mélange of macro and market intrigues, of course:

- ETF Momentum: Inflows into US-listed spot Bitcoin ETFs have rebounded, a testament to investor confidence-or perhaps mere FOMO. Fear, after all, is the only true currency. 💸😱

- Policy Boost: President Trump’s executive order allowing cryptocurrency in 401(k) accounts has broadened the pool of potential speculators. Retirement, it seems, is no longer just for bonds and bingo. 🧓📜

- Whale Accumulation: On-chain data reveals long-term holders amassing positions, while exchange reserves dwindle to multi-year lows. The whales, it appears, are hoarding their digital trinkets. 🐳🛢️

- Global Geopolitics: Optimism over a Trump-Putin détente adds a dash of risk-on sentiment. Diplomacy, like Bitcoin, is a game of high stakes and higher absurdity. 🕊️🤝

Simon Peters, crypto analyst at eToro, opines that “the policy shift marks another step toward mainstream adoption,” though one wonders if ‘mainstream’ is but a euphemism for ‘madness.’ 🗣️🤪

Expert Musings: BTC as the Digital Elixir of Longevity

The post-halving milieu of 2025 continues to underpin bullish forecasts. History, that fickle narrator, suggests Bitcoin rallies in the 12-18 months following a halving, buoyed by reduced supply and insatiable demand. A tale as old as time-or at least as old as blockchain. ⏳🔗

- Cathie Wood (ARK Invest) prophesies Bitcoin reaching $1 million by 2030, citing network effects and institutional adoption. A million, you say? How quaintly ambitious! 💎🚀

- Standard Chartered pegs a medium-term target of $500,000, anointing BTC as “digital gold.” Gold, of course, never crashes-it merely takes a dramatic hiatus. 🏆🪙

- Derivatives data reveals $140,000 as the most popular call option strike on Deribit, with $3 billion in open interest. Traders, it seems, are betting on the stars. 🌟📊

Paul Howard, Director at Wincent, declares the current price action a “golden breakout scenario,” though one suspects all breakouts are golden until they turn to lead. 🏅⚖️

The Grand Finale: BTC Eyes $140K with Wildean Panache

As Bitcoin holds above $120,000, market sentiment remains as bullish as a Wildean wit at a society ball. Technical charts point to $127,000 and $137,000 as interim stops, while macro and institutional winds propel it toward $140,000-$150,000. In the short term, a break above $123,218 would confirm new highs-a triumph or a tragedy, depending on one’s position. Long term, Bitcoin’s role as an inflation hedge and store of value continues to allure both the plebeian and the patrician. 🌍💼

In closing, as Bitcoin ascends, let us remember Wilde’s wisdom: “Everything is dangerous, and nothing is more dangerous than a cryptocurrency rally.” May your portfolios be as resilient as your sense of humor. 🤑😂

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Brent Oil Forecast

2025-08-11 19:26