Bitcoin, our digital darling, has been dancing below $100,000 since February 5, stubbornly resisting all our hopeful advances. The market’s mood swingers have apparently sided with the sellers, as BTC’s Directional Movement Index (DMI) paints a picture of increasing bearish pressure. 🐻

Yet, in the whimsical world of cryptocurrency, the Ichimoku Cloud whispers of a potential rebellion if Bitcoin can muster the courage to surge above the key resistance zones. Should bullish spirits reawaken, BTC might just flirt with the $97,756 resistance and dare to retake the $100,000 throne, with $102,668 in its sights.

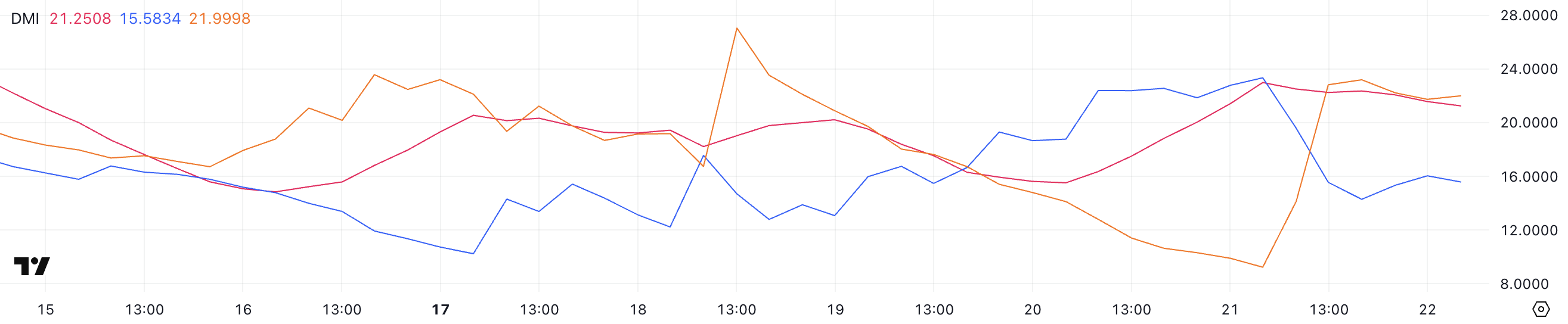

BTC DMI: Sellers Celebrate a Temporary Victory

Bitcoin’s Directional Movement Index (DMI) reveals an Average Directional Index (ADX) at a modest 21.2, after a brief flirtation with 22.9, rising from 15.5 just days ago.

ADX, the trend’s strength meter, ranges from 0 to 100. Generally, anything above 25 screams a strong trend, while below 20 suggests a market as weak as a kitten. 🐾

With ADX lingering around 21.2, Bitcoin’s trend is as weak as a cup of tea, hinting at a potential period of transition.

This could mean the previous uptrend is running out of steam, possibly leading to a reversal or the start of a downtrend. Time to hold onto your hats! 🎩

Meanwhile, Bitcoin’s +DI has slipped to 15.5 from 23.3 in just a day, indicating a waning bullish momentum, while -DI has climbed to 21.9 from 9.2, reflecting a growing bearish party. 🎉

This crossover, where -DI triumphs over +DI, suggests sellers are taking the reins, possibly signaling a shift from an uptrend to a downtrend. Buckle up! 🚀

If -DI continues its ascent and +DI remains weak, Bitcoin might face increased selling pressure and a potential price decline. But if +DI stabilizes and rebounds, Bitcoin might just consolidate before making a more decisive move.

Bitcoin Ichimoku Cloud: A Bearish Tale with a Twist

The Ichimoku Cloud chart for Bitcoin tells a mixed story with hints of a potential comeback. The blue Tenkan-sen line is currently standing tall above the red Kijun-sen line.

This crossover suggests that buying pressure is trying to stage a comeback, which could support a potential upward journey. 🚀

However, Bitcoin’s price is still lurking below the Kumo cloud, indicating that the overall trend remains bearish and resistance is strong. 🛡️

The Kumo cloud ahead is thin and slightly rising, suggesting that the bearish momentum might be losing steam. If Bitcoin can break above the cloud, it would signal a potential trend reversal, especially if the Tenkan-sen continues to lead. 🌟

Conversely, if Bitcoin fails to break above the cloud and the Tenkan-sen drops below the Kijun-sen again, it would confirm the bearish trend’s persistence. 🐻

For now, Bitcoin faces a crucial resistance zone, and its next move will depend on whether it can break through the cloud or get pushed back down.

Bitcoin’s $100,000 Dream: Closer or Further Away?

Bitcoin was on the brink of forming a new golden cross yesterday before the Bybit hack sent it tumbling from $98,000 to roughly $95,000 in just four hours. 🌩️

Its Exponential Moving Average (EMA) lines are still bearish, with short-term EMAs positioned below long-term ones, indicating ongoing downward momentum. 📉

This bearish setup

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- DODO PREDICTION. DODO cryptocurrency

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Everything We Know About DOCTOR WHO Season 2

2025-02-22 17:49