Veteran analyst and trader Peter Brandt has shared his concerns about the declining magnitude of Bitcoin’s price advances in a blog post published on April 26. In the post, Brandt points out that each successive bull cycle for Bitcoin has seen a decrease in price advance, with the current cycle potentially reaching a high around $73,000 based on past patterns.

As a researcher studying the cryptocurrency market, I’ve come across an intriguing analysis by veteran trader and analyst Peter Brandt. In a blog post published on April 26, he expressed concerns about the declining magnitude of Bitcoin‘s price advances during bull markets based on historical data.

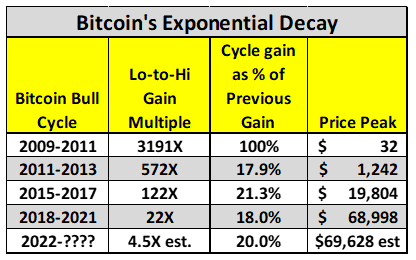

As a seasoned crypto investor following Brandt’s analysis, I can tell you that according to his assessment, we’ve experienced four significant Bitcoin bull markets up until now. Here’s how they played out in terms of price progression:

- Dec 21, 2009 to Jun 6, 2011 [3,191X advance]

- Nov 14, 2011 to Nov 25, 2013 [572X advance]

- Aug 17, 2015 to Dec 18, 2017 [122X advance]

- Dec 10, 2018 to Nov 8, 2021 [22X advance]

- Nov 21, 2022 to xxx x,, yyyy [high so far is $73,835 registered on Mar 14, 2024]

According to Brandt’s analysis, each new bull market cycle builds upon the previous one with approximately 20% greater magnitude. This implies that about 80% of the prior cycle’s exponential energy gets consumed in the process. Based on this trend, if we apply it to the current bull market cycle, Brandt forecasts a potential peak price around $72,723 – a level that has already been attained.

Recognizing the possible price surge after the latest Bitcoin halving, an event known for driving significant price gains in the past, Brandt cautions against overlooking the exponential decay trend. He assigns a 25% probability that the current Bitcoin peak has already occurred within this market cycle.

If Bitcoin has reached its peak, Brandt proposes a possible drop to the mid-$30s or last year’s lows. Yet, he emphasizes that such a decline might be the most optimistic outcome for Bitcoin’s future growth based on traditional chart analysis. He uses the Gold price trend from August 2020 to March 2024 as an illustration of a comparable chart pattern.

Brandt acknowledges that he finds the analysis hard to accept, yet insists that the data is unbiased and clear-cut. He emphasizes the necessity of confronting the concept of exponential decay, despite its unwelcome implications for Bitcoin investors, including himself, since Bitcoin represents a significant portion of his personal investments.

Read More

2024-04-28 19:43