As a seasoned crypto investor with a decade of experience under my belt, I find the recent dip in Bitcoin‘s price intriguing yet reassuring. Having weathered numerous market fluctuations, I’ve learned to interpret these dips not as signs of impending doom but as opportunities for strategic buying. The resilience shown by the market participants, who are holding onto their coins rather than selling off, is a testament to the growing bullish sentiment.

Over the last seven days, Bitcoin (BTC) has seen a 5% decline in value. Currently, it’s trading at approximately $96,905, which is just under the significant threshold of $100,000.

It’s notable that despite the recent drop, there hasn’t been a rush of sell-offs. This indicates that optimism among investors is still high, and many believe the coin’s value will soon surpass $100,000 in the short term.

Bitcoin Sees Decline in Selloffs

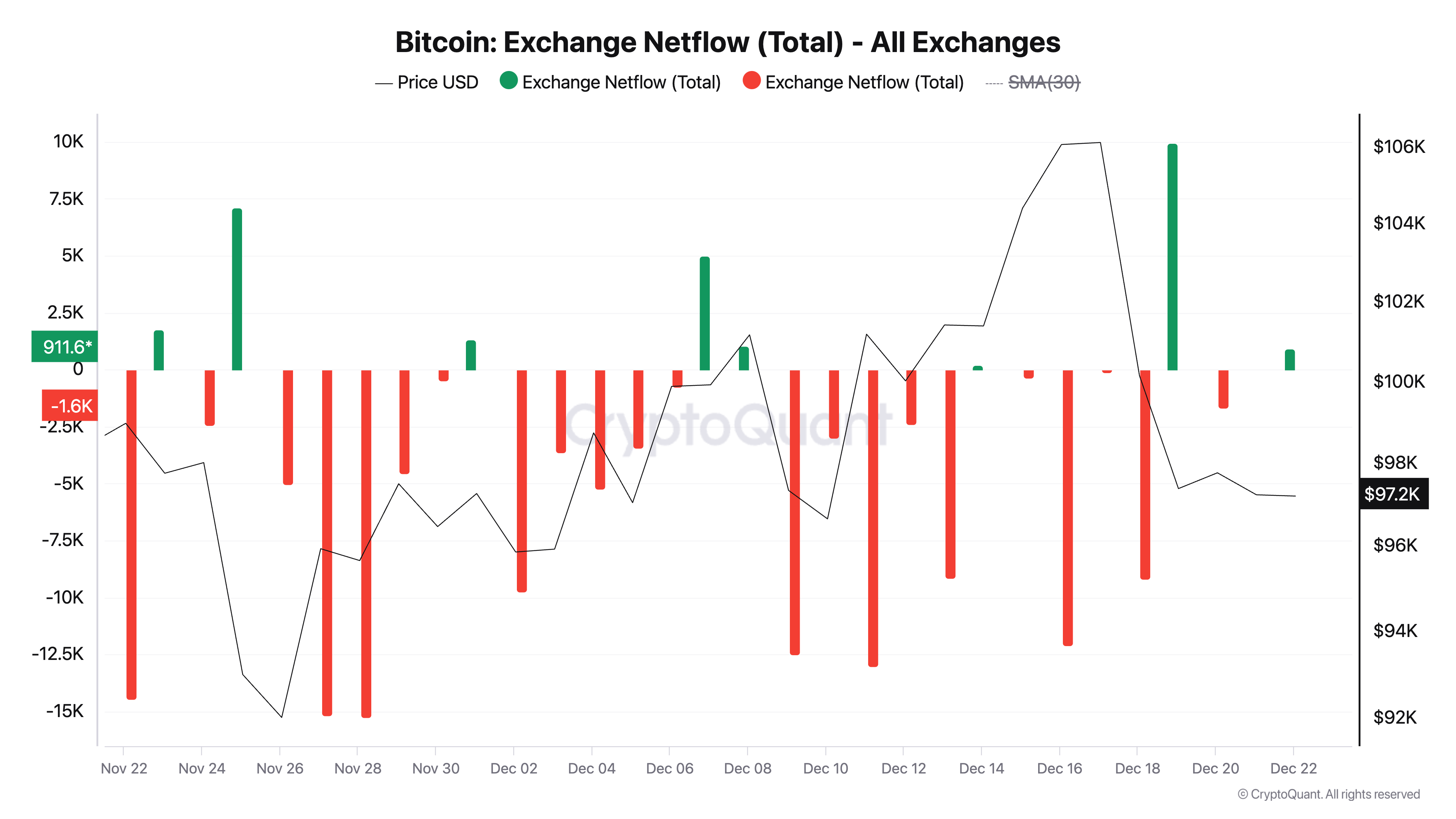

Based on information from CryptoQuant, more than $2.5 billion in Bitcoin has been withdrawn from digital currency exchanges during the last seven days, indicating a net withdrawal. The term “net outflows from exchanges” refers to the total amount of coins or tokens that have been taken out of exchange wallets.

As I analyze the data, a significant increase in an asset’s outflows from exchanges suggests that more and more investors are choosing to hold their assets in personal wallets instead of actively trading or selling. This trend is typically interpreted as a bullish signal, indicating that investors anticipate the asset’s price to rise.

As an analyst, I recently observed some interesting insights regarding Bitcoin, shared by the pseudonymous expert KriptoBaykusV2 in a recent report. In essence, these observations could have significant implications for the future of Bitcoin.

If the ongoing pattern of Bitcoin being withdrawn from exchanges persists, it might lessen the market’s selling pressure. With less Bitcoin circulating on exchanges (where trades occur) and demand potentially remaining steady or growing, there could be a surge in Bitcoin prices due to increased buying interest.

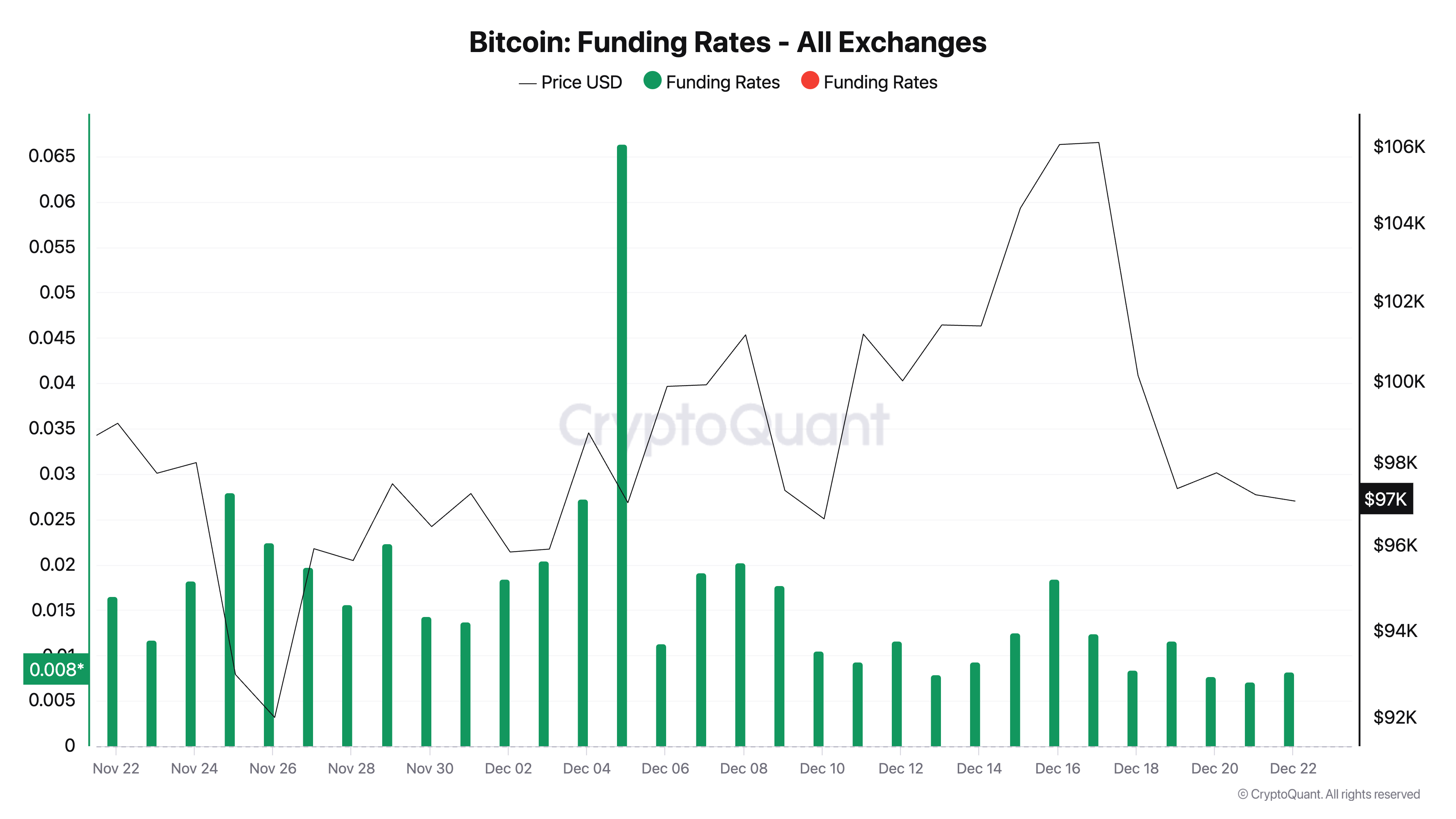

Moreover, the favorable funding cost for the coin increases its chances of a price rise in the short term. At present, the funding rate for perpetual futures is set at 0.0081.

When a financial asset’s return on investment (funding rate) is more than zero, it signifies that those holding long positions are compensating or paying those in short positions. This situation suggests a positive outlook among traders, as they anticipate the price of the asset to increase, thereby displaying a bullish market sentiment.

Bitcoin Price Prediction: Coin Battles Dynamic Resistance at $100,000

Due to a wider decline in the overall market, Bitcoin’s price has dipped below its Ichimoku Cloud’s Leading Span A line, which currently stands at $100,160. This line serves as a dynamic level of resistance. The Ichimoku Cloud is an indicator that follows the momentum of an asset’s market trends and helps determine potential support or resistance points.

If an asset’s cost falls beneath its Leading Span A within the Ichimoku Cloud, this typically suggests a downward trend since selling pressure dominates and buyers find it tough to raise the price. This situation frequently hints at possible additional price drops unless the value rebounds over the cloud.

If Bitcoin manages to surge past the current level, it could potentially reach its record peak of $108,388. Conversely, if Bitcoin fails to breach this resistance point, there’s a possibility that its value might drop to around $95,690 instead.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-12-22 20:19