Ah, Bitcoin. The cryptocurrency that loves to tease its investors by moving up and down like a rollercoaster, but without the safety harness. Lately, it’s been swaying in a range, bouncing between $83,000 and $86,000. But don’t worry! Burak Kesmeci, our beloved crypto analyst, has generously provided us with some crucial price levels that could determine Bitcoin’s next adventure in the short-term.

Support at $82,800, Resistance at $92,000 – And Now, The Big Question: Where Is Bitcoin Actually Going?

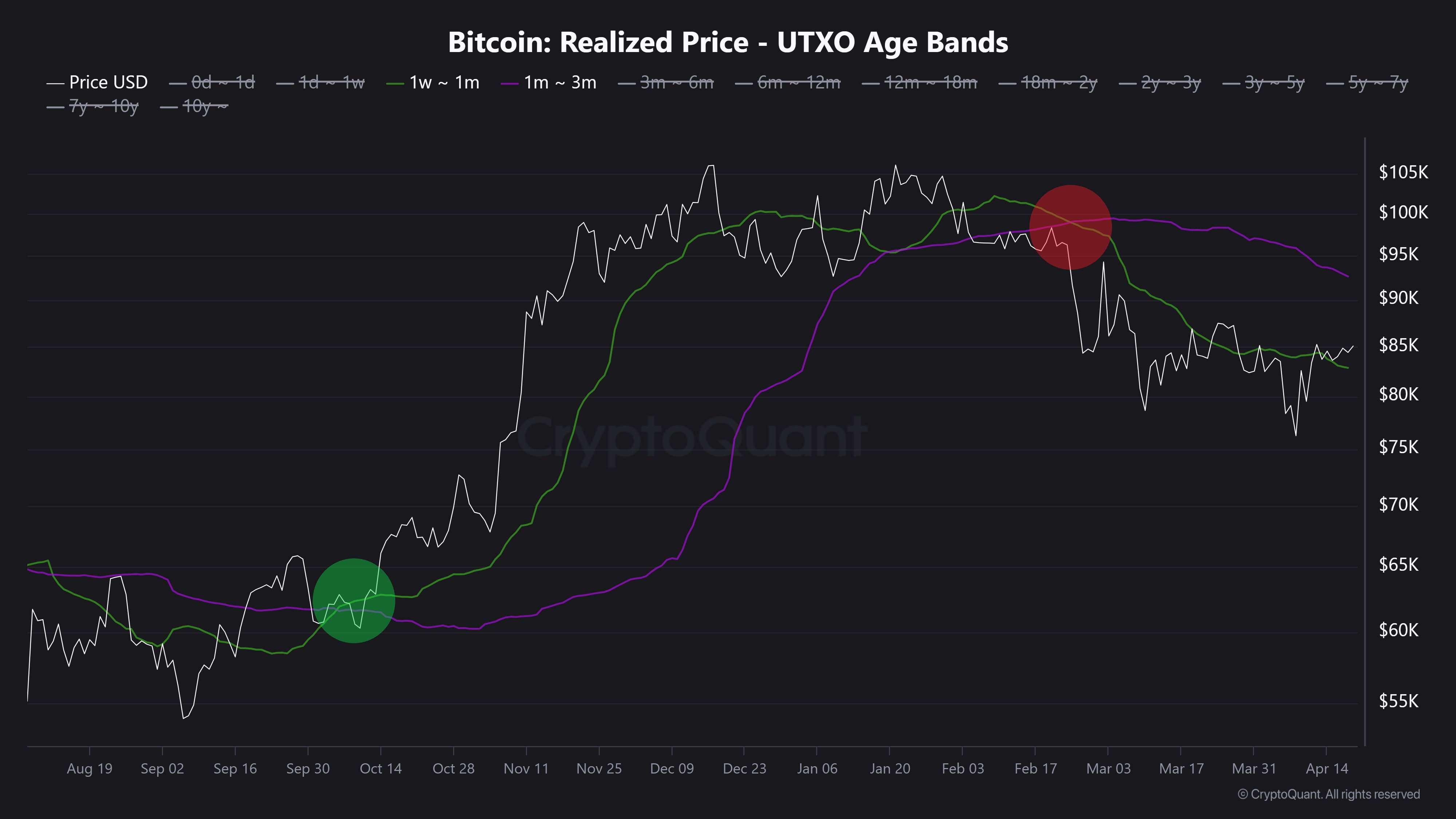

In a recent cryptic post on X (because Twitter isn’t “cool” anymore, apparently), Kesmeci shared his magical on-chain analysis of Bitcoin’s ever-turbulent market. He used the short-term investor cost basis to pinpoint two price levels that are now as important as knowing when to eat your last cookie.

Let’s start with the $82,800 mark. This is the “support level,” and it’s where recent investors are still feeling pretty good about their decisions. They’re sitting on profits and are probably planning a “I told you so” moment if it holds. Apparently, this level has become a psychological floor, which sounds far fancier than it actually is. But hey, who are we to judge?

Meanwhile, there’s the $92,000 price point – the dreaded “resistance” level. This is where Bitcoin’s 1-3 month holders are looking to cash out and leave the market, likely muttering something about “just breaking even.” It’s also where the technical indicators are gathering like a very serious party, all agreeing that $92,000 is a big deal. This price level is so important that if Bitcoin can break through it, the market could go from mild-mannered to full-on superhero in no time.

Now, the drama really starts when these two price levels get into a dance-off. Historically, Bitcoin’s short-term bullish rallies tend to kick off when the cost basis of newer investors (the ones who have been around for just 1-4 weeks) overtakes those of the more seasoned 1-3 month holders. That’s when the confidence shifts and a new wave of buying takes over, setting the stage for a possible rally. But for now, Bitcoin’s still hanging out at around $85,000, caught between support and resistance like an awkward middle child.

What Kesmeci suggests is that for Bitcoin to truly break free and spark a major rally, it needs to surge above $92,000. Easy, right? Just a casual $7,000 jump. Who needs sleep anyway?

Bitcoin ETFs Drop 1,725 BTC: Oops, They Did It Again

And in an unexpected twist, Bitcoin ETFs have decided to let go of 1,725 BTC, worth a staggering $146.92 million. Apparently, institutional investors have had enough of Bitcoin’s emotional rollercoaster, so they’ve withdrawn their shares, leaving the market a little more uncertain than before. Oh, and let’s not forget the 0.89% change in Bitcoin’s price over the past day – because who doesn’t love a bit of fluctuation to keep things interesting?

As of now, Bitcoin is trading at $85,249, with a 0.58% loss on the weekly chart and a tiny 1.06% gain over the past month. It’s like Bitcoin’s taking a breather, trying to figure out if it’s going to run a marathon or just nap for a bit. Whatever happens next, one thing’s for sure: we’re in for one wild ride.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- All 6 ‘Final Destination’ Movies in Order

- Every Minecraft update ranked from worst to best

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

2025-04-21 02:44