Bitcoin, that digital ledger of bad decisions, dipped below $90,000 today, erasing $170 billion like it was Monopoly money and I was your uncle’s second cousin. But fret not! This is just the warm-up act for a main event that smells like burnt toast and regret. Liquidity? Weak as my morning coffee. On-chain signals? Negative enough to make a therapist charge double. And the Fed? Oh, they’re just here for the drama.

Speaking of drama queens, the market’s now playing “Guess Who’s Coming to Dinner?” with a side of panic. Is this a deeper crash? Only time will tell-or maybe a therapist, again.

Fed’s Latest Rate Cut: A Masterclass in Existential Dread

Bitcoin’s latest tantrum was triggered by the Fed slicing rates by 25 bps, which is basically saying, “We’ll give you a discount on your anxiety.” Then, out of nowhere, Jerome Powell dropped a bombshell: “No more rate cuts until 2026.” Because nothing says “confidence” like scheduling a financial heart attack for next year. Suddenly, Bitcoin was down to $89,000, where it joined the rest of us in a support group for things that can’t make up their minds.

And get this-the Fed announced they’re buying $40 billion in Treasury bills, claiming it’s not “money printing.” Sure, Karen. That’s just a fancy way of saying, “We’re panicking, but we’re very professional about it.” Gold prices? Skyrocketing. Crypto investors? Dodging metaphorical arrows like it’s The Hunger Games: Blockchain Edition.

Crypto Market Crashes: $520M Liquidations, All the Fun of a Party Pooper

The crypto market shrunk from $3.24 trillion to $3.07 trillion faster than my willpower at a buffet. The Fear & Greed Index? A hearty 29-because who doesn’t love a good panic attack? Liquidations hit $520 million in 24 hours, with $379 million of that coming from long positions. If you thought betting on Bitcoin was a sure thing, congrats! You’ve just funded my next coffee addiction.

And just when you thought it was safe to breathe, Bitcoin options worth $3.56 billion are expiring tomorrow. The put/call ratio? A chilling 1.09. Translation: Traders are betting on more misery. It’s like a party where everyone brings a casket as a gift.

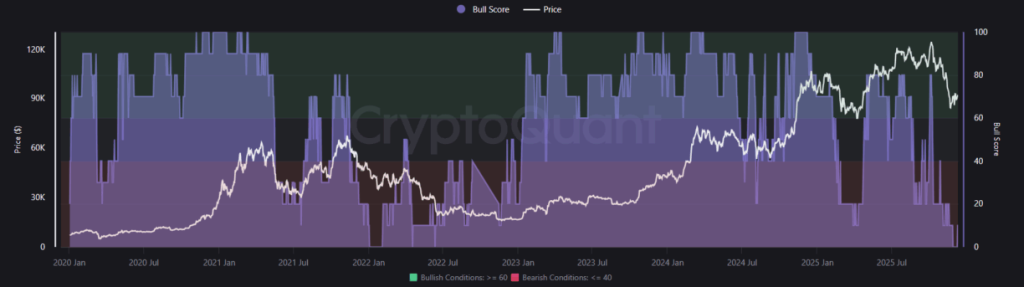

On-Chain Indicators: The Bear’s Got the Spotlight

On-chain data is screaming like a toddler in a candy store. The Bitcoin Bull Score? A sad 0. Realized losses? -18%, which is still 19% shy of the “buy zone” of -37%. But hey, at least we’re getting closer to the “sell everything and cry” zone!

Pro tip: $6 billion in short positions are teetering on a knife’s edge. If Bitcoin spikes to $100,000, those shorts will get liquidated like a game of Jenga gone wrong. Expect a domino effect so epic, it’ll make your Netflix recommendations blush. 🎲💥

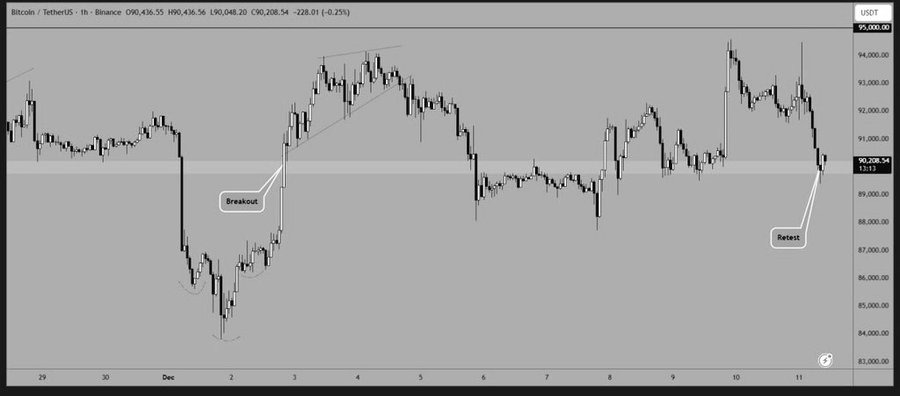

Bitcoin’s $95K Woes: A Tale of Two Support Levels

Crypto Palace, that oracle of chaos, broke down the chart like it was a high school math test. Bitcoin tried to break through $95,000 but flunked, then got whiplash from the Fed’s rate-cut news. Now it’s retesting the $90,000 support zone, where it’s either going to find peace or start a new support group. 🙏

If Bitcoin closes below $90,000, it’ll be a one-way ticket to $87,000 and a lifetime supply of existential dread. But hey, at least the charts are entertaining. 📉☕

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-12-11 14:08