Bitcoin, that elusive specter of wealth, slipped beneath the $90,000 threshold this week, as if the cosmos itself conspired against its ascent. 🌌💸

The fall, a cruel mistress, erased all gains from previous attempts to reclaim the lofty $94,000-$95,000 zone, marking the second such calamity this month, as if the market itself were weeping for the lost gold. 📉😭

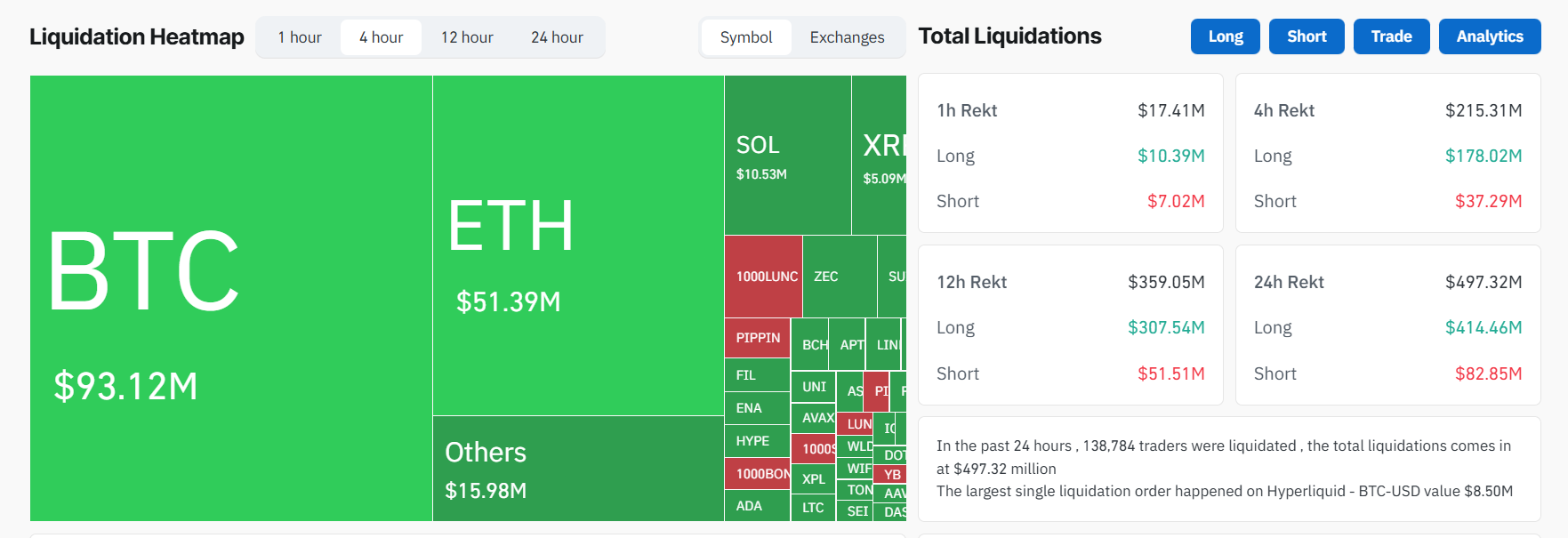

Forced Liquidations Across the Market

The catalyst was a cascade of forced long liquidations, a financial earthquake that wiped out nearly $500 million across exchanges, leaving 140,000 traders in a state of financial ruin, as if the market had turned into a merciless judge. ⚖️🧨

The ETF flows, those supposed lifelines, failed to absorb the deluge of selling, as BlackRock’s iShares Bitcoin Trust, that stalwart of investment, recorded six consecutive weeks of outflows, a total of $2.8 billion, a testament to the waning faith of institutions. 🧾📉

US ETF inflows fell to just $59 million on December 3, a stark reminder that even the most fervent investors can grow weary. 🧘♂️📉

Macro Pressure Added Fuel to the Drop

The macroeconomic backdrop, once a harbinger of hope, turned hostile, as the Bank of Japan, that cautious guardian of stability, signaled a possible rate hike, threatening the very liquidity that had sustained global risk assets like a fragile dream. 🌏📈

Traders, ever the cautious souls, derisked ahead of the US PCE inflation release, forcing Bitcoin into a cautious $91,000-$95,000 holding pattern, as if it were a nervous child hiding behind a curtain. 🧸📉

BREAKING: Bitcoin pumped $1500 on the lower than expected PCE data. But then it crashed -$3500 in 60 minutes.

This wiped out $155 million worth of long positions in last 1 hour.

There is no negative news or sudden FUD which could cause this type of sudden dump.

It appears that…

– Bull Theory (@BullTheoryio) December 5, 2025

The latest US PCE data, arriving with the precision of a clock, showed cooling core inflation, yet still lingered above the Federal Reserve’s target, a reminder that even in the realm of economics, perfection remains an unattainable ideal. ⏰📉

Markets reacted cautiously, interpreting the print as evidence that inflation continues to ease, but not fast enough to guarantee rapid rate cuts, a dance of patience and uncertainty. 🕺🌀

Corporate signals amplified the fear. MicroStrategy warned it may sell Bitcoin if its treasury-valuation ratio weakens, triggering a 10% decline in its stock, a tale of corporate paranoia. 🧠📉

Miner stress increased as energy costs rose, hashrate fell, and high-cost operators began liquidating BTC to remain solvent, a grim reminder of the harsh realities of the crypto frontier. 🔥📉

On-chain flows reflected split sentiment. Matrixport moved more than 3,800 BTC off Binance into cold storage, suggesting accumulation among long-term holders, a quiet act of faith. 🧾📊

However, analysts estimate that a quarter of all circulating supply remains underwater at current prices, a sobering truth for the hopeful. 🧊📉

Matrixport has withdrawn 3,805 $BTC($352.5M) from #Binance over the past 24 hours.

– Lookonchain (@lookonchain) December 5, 2025

Community Sentiment Shows Fear – With Pockets of Optimism

Traders, those ever-vigilant observers of the market’s whims, debated whether the move was a natural occurrence or the work of unseen hands. Analysts, ever the pragmatists, blamed excess leverage, thin liquidity, and macro-hedging, rather than any grand conspiracy. 🧠🔍

Others pointed to long-term optimism, citing JPMorgan’s fresh $170,000 price model for 2026, a beacon of hope in the storm. 🌈📈

Bitcoin now trades near a critical pivot, with liquidation clusters between $90K and $86K leaving the market as fragile as a moth’s wing. A reclamation of the $96K-$106K range is necessary to confirm a recovery, but who can say what the future holds? 🕊️📉

For now, volatility rules the tape. Bitcoin has fallen, rebounded, and broken again – and traders are watching for the next decisive move, a game of chess played with digital coins. 🎲📉

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Best Actors Who Have Played Hamlet, Ranked

- 9 Video Games That Reshaped Our Moral Lens

2025-12-05 22:42