Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Pour yourself a cup of that overpriced coffee, dear reader, as we delve into the audacious predictions of Standard Chartered regarding Bitcoin (BTC). The esteemed bank suggests that Bitcoin could soar to a staggering $500,000, all thanks to global institutions scrambling to acquire Strategy’s MSTR stock for a rather indirect dalliance with Bitcoin.

Crypto News of the Day: Standard Chartered’s Bold Bitcoin Prediction

As of now, Bitcoin is trading at a modest $105,178, having risen a paltry 2.27% in the last 24 hours. In a delightful twist, the market capitalization of this pioneering cryptocurrency has reached an all-time high of $2.09 trillion. Who knew digital coins could be so… valuable?

Of course, we mustn’t overlook the macroeconomic factors at play, such as the PBOC’s rate cuts and Moody’s rather dramatic US credit downgrade, which are providing a rather breezy tailwind for Bitcoin’s ascent.

Yet, analysts are convinced that the real reason behind Bitcoin’s meteoric rise is institutional interest. Yes, those traditional finance types are finally waking up to the allure of Bitcoin ETFs (exchange-traded funds), which offer them a rather indirect way to dip their toes into the BTC waters.

In a similar vein, institutions are gaining their indirect exposure to Bitcoin through Strategy’s MSTR stock. A recent publication from US Crypto News revealed that Strategy (formerly known as MicroStrategy) held a staggering 576,230 BTC as of May 19. Quite the hoard, wouldn’t you say?

With such a hefty amount of Bitcoin on its balance sheet, the price of Strategy’s MSTR stock dances closely to the whims of Bitcoin’s price movements.

Analysts attribute this correlation to a rather curious dynamic where Bitcoin serves as the base layer, while MSTR operates as a vehicle with its own set of risks, mechanics, and rewards. A delightful little game of financial hopscotch!

In light of this, BeInCrypto reached out to Geoff Kendrick, the Head of Digital Assets Research at Standard Chartered. According to Kendrick, Bitcoin is still on track to hit that lofty $500,000 mark before the end of Trump’s second administration. Because why not aim high?

Kendrick attributes this optimistic outlook to the deepening institutional adoption, particularly through those oh-so-indirect channels via MicroStrategy’s MSTR shares.

Standard Chartered Says Increasing Allocations to MSTR Is Bullish for Bitcoin

Newly released Q1 2025 13F filings from the US SEC (Securities and Exchange Commission) bolster the bank’s bullish thesis. Specifically, Strategy has seen increasing allocations to MSTR from a variety of global sovereign and quasi-sovereign entities. Quite the international affair!

“As more investors gain access to the asset and as volatility falls, we believe portfolios will migrate towards their optimal level from an underweight starting position in Bitcoin,” Kendrick mused in an email to BeInCrypto.

While direct holdings of Bitcoin ETFs have dipped slightly—largely due to the State of Wisconsin Investment Board selling its entire 3,400 BTC-equivalent position in BlackRock’s IBIT ETF—other entities have quietly increased their exposure via MSTR, which Kendrick charmingly refers to as a “Bitcoin proxy.”

“Government entities increased their holdings of Strategy Incorporated (MSTR), which typically trades like a Bitcoin proxy. Entities in Norway, Switzerland, and South Korea reported significant MSTR increases, and Saudi Arabia added a very small position for the first time,” Kendrick informed BeInCrypto.

The Standard Chartered executive emphasized that while Bitcoin ETF flows were “unexciting,” the MSTR accumulation trend was the real story this quarter. Who knew excitement could be so… dull?

“The MSTR ownership detail was where the excitement was,” he added, with a hint of sarcasm.

Geoff Kendrick elaborated further, detailing Standard Chartered’s analysis of the filings. According to their findings:

- Norway added 700 BTC-equivalent via MSTR, now holding 6,300 BTC-equivalent.

- Switzerland also added 700 BTC-equivalent, reaching 2,300 BTC-equivalent.

- South Korea added 700 BTC-equivalent, bringing its total to 1,300 BTC-equivalent.

- US state funds (California, New York, North Carolina, Kentucky) added 1,000 BTC-equivalent collectively, now at 3,300 BTC-equivalent.

- Saudi Arabia’s Central Bank opened a small MSTR position—its first. How quaint!

Meanwhile, Abu Dhabi’s quasi-sovereign wealth fund Mubadala added 300 BTC equivalent via ETF holdings, increasing its position to 5,000 BTC equivalent. A veritable treasure trove!

“SEC 13F data for Q1 supports our thesis that Bitcoin is attracting a wider range of buyers. While data on Bitcoin ETF holdings was disappointing, MSTR – a Bitcoin proxy – saw increased buying. Overall sovereign positions were unchanged due to the Wisconsin pension fund selling its ETF holdings,” Kendrick concluded.

BeInCrypto reported on the delightful spread of the MicroStrategy effect worldwide, with TradFi companies building their Bitcoin war chests. Quite the spectacle!

The data reinforce Standard Chartered’s outlook that institutional and sovereign flows—both direct and indirect—will be a key driver of Bitcoin’s ascent to $500,000 in the coming years. Because who doesn’t love a good financial fairy tale?

Chart of the Day

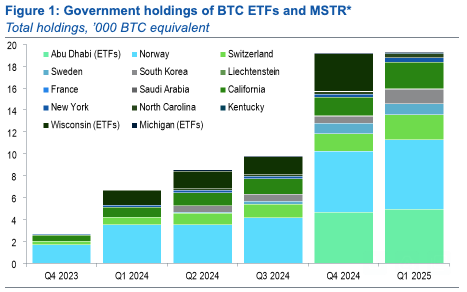

This chart illustrates the total government holdings of Bitcoin ETFs and MicroStrategy’s MSTR stock from Q4 2023 to Q1 2025, measured in ‘000 (thousands) BTC equivalents. The chart reveals that holdings have grown steadily, peaking in Q1 2025 at around 18,000 BTC. Quite the upward trajectory!

The chart shows that key contributors include Abu Dhabi (ETFs), Norway, Sweden, South Korea, France, New York, Wisconsin (ETFs), Michigan (ETFs), Switzerland, Liechtenstein, California, North Carolina, Saudi Arabia, and Kentucky, with varying contributions across quarters. A veritable United Nations of Bitcoin!

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Company | At the Close of May 19 | Pre-Market Overview |

| Strategy (MSTR) | $413.42 | $412.95 (-0.11%) |

| Coinbase Global (COIN) | $263.99 | $267.22 (+1.22%) |

| Galaxy Digital Holdings (GLXY.TO) | $31.49 | $32.44 (+3.01%) |

| MARA Holdings (MARA) | $16.32 | $16.37 (+0.31%) |

| Riot Platforms (RIOT) | $8.97 | $9.02 (+0.56%) |

| Core Scientific (CORZ) | $10.85 | $11.06 (+1.94%) |

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- ANDOR Recasts a Major STAR WARS Character for Season 2

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2025-05-20 17:28