Although the cryptocurrency community anticipates a robust 2025 with Donald Trump back in the White House, recent findings indicate that the Trump-driven market surge may encounter obstacles.

Starting from 2025, the cryptocurrency trading landscape exhibits a blend of patterns, influenced by the December FOMC meeting and the winter holiday season’s passing.

Bitcoin Rally Risks Losing Momentum Despite Trump’s Support

10x Research predicts that the first quarter of 2025 may not maintain the same pace as the periods from late January to March 2024, or late September to mid-December last year.

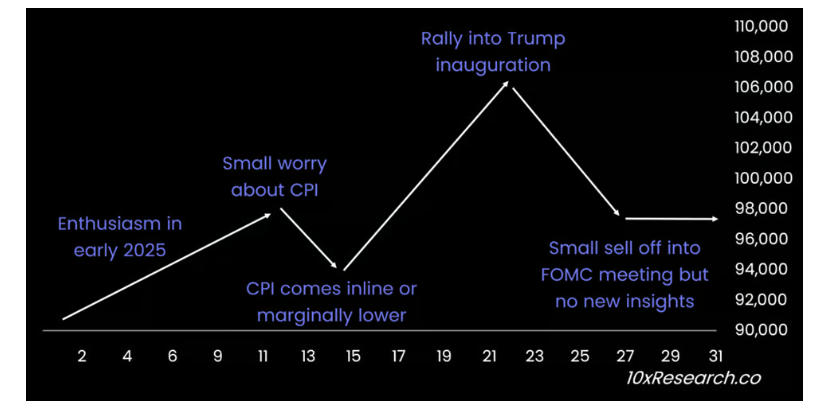

On January 15th, it’s crucial to keep an eye on the publication of the Consumer Price Index (CPI) data. It’s expected that there might be a decrease in activity prior to this release. However, if the results are beneficial, the market could bounce back and potentially rally again.

10x founder Mark Thielen stated that a positive inflation figure might spark renewed optimism, potentially leading to a market surge lasting until President-elect Trump’s inauguration on January 20th.

Nevertheless, the excitement sparked by this rally might not last long, according to Thielen. He also mentioned that the market could pull back before the FOMC meeting on January 29. His prediction is that Bitcoin’s value will be between $96,000 and $98,000 by the end of January.

In the last quarter of 2024, Bitcoin reached unprecedented peaks. This surge followed the Federal Reserve’s decision to reduce interest rates by 0.25%. This reduction, made in September, was particularly favorable for the cryptocurrency market as well.

Bitcoin Dominance Persists in 2025

As a crypto investor, when contemplating Bitcoin’s price trend in 2025, it’s crucial to take into account its dominance in the market. Based on the 10x report, from January 2024 to mid-November, Bitcoin’s market share increased significantly, rising from 50% to 60%. This surge put substantial pressure on alternative cryptocurrencies.

With Bitcoin’s influence growing, numerous alternative cryptocurrencies faced challenges in gaining momentum, which made it hard for investors to reap significant profits beyond Bitcoin.

As a researcher, I noticed an intriguing fluctuation in Bitcoin’s dominance during a three-week stretch, where it dipped to approximately 53%. This minor decline fueled anticipation for an ‘altcoin season’. However, this dip proved temporary as Bitcoin’s dominance swiftly bounced back, reaching almost 58%, and stabilizing around the 55% mark by late 2024. This prolonged position near the 55% level suggests that Bitcoin continues to hold a strong grip on the market.

For investors, it underscores the significance of keeping a close eye on Bitcoin’s influence in the market. Currently, Bitcoin’s dominance stands approximately at 57%, with its value being quoted at $99,225.

Or simply:

It’s essential for investors to watch Bitcoin’s impact on the market closely. At present, it has around a 57% share and is valued at $99,225.

10xResearch’s Bitcoin predictions indicate a possible peak of $150,000 and a potential drop to $80,000 by the year 2025, as suggested by James Butterfill, the head of research at CoinShares last week.

Just as Bitwise Asset Management foresees, they predict Bitcoin might touch $200,000 by the year-end.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2025-01-06 13:16