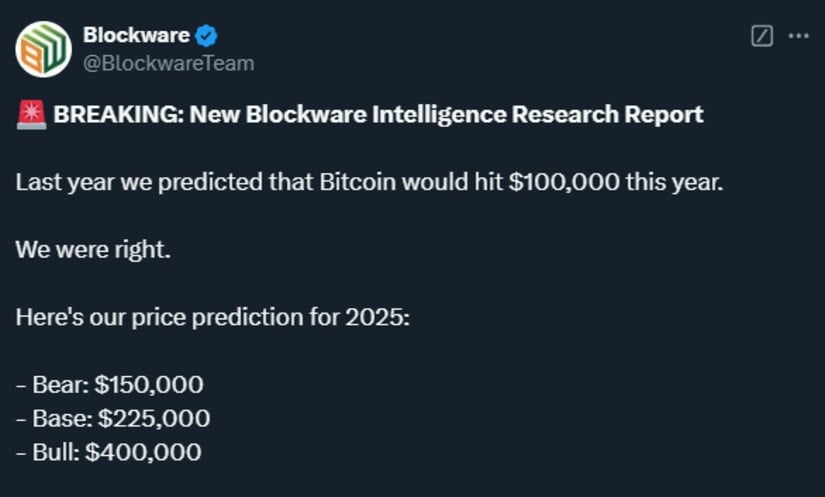

As a seasoned researcher who has witnessed the meteoric rise and fall of various financial markets throughout my career, I find myself intrigued by Blockware’s forecast for Bitcoin‘s price trajectory in 2025. The three potential scenarios presented – Bear, Base, and Bull cases – provide an interesting perspective on how a complex interplay of factors could shape the future of this revolutionary digital currency.

Having closely followed the cryptocurrency market since its inception, I am well aware that it is no stranger to volatility. The potential for Bitcoin to reach prices as high as $400,000 seems almost unbelievable, but then again, so did the idea of a digital currency replacing physical money at one point.

The role of the Strategic Bitcoin Reserve (SBR) initiative and corporate adoption in determining Bitcoin’s 2025 price is particularly fascinating to me. While I am not as optimistic as Jack Mallers regarding an early executive order designating Bitcoin as a U.S. reserve asset, I do believe that the government’s stance on cryptocurrency could have a significant impact on its future value.

The skepticism expressed by experts like Alex Thorn regarding the likelihood of the U.S. government purchasing additional Bitcoin is not unfounded. However, I remain hopeful that corporate adoption will continue to play a crucial role in driving Bitcoin’s growth. The recent rejection of a resolution to add Bitcoin to Microsoft’s balance sheets serves as a reminder that resistance still exists among large corporations, but I am confident that the tide will eventually turn.

Lastly, I find the Federal Reserve’s monetary policies to be a wild card in this game of predictions. A dovish stance could certainly boost investment in Bitcoin, while a hawkish approach might dampen its growth prospects. The next two years are indeed going to be crucial in deciding the fate of Bitcoin in global finance.

In conclusion, I find it amusing to ponder the thought that a currency created in the shadows of the internet could one day reach prices rivaling those of some of the world’s most valuable companies. Only time will tell if the predictions hold true or if we are all left marveling at the sheer audacity of such forecasts. After all, as Mark Twain once said, “Predictions are difficult, especially about the future.

Our analysis indicates a strong possibility of Bitcoin’s worth potentially increasing substantially. However, the actual results may vary based on influencing factors like the Federal Reserve’s monetary decisions and the position taken by the U.S. administration regarding cryptocurrencies.

Bitcoin Price Scenarios: Bear, Base, and Bull Cases

Blockware outlines three potential scenarios for Bitcoin’s price trajectory in 2025:

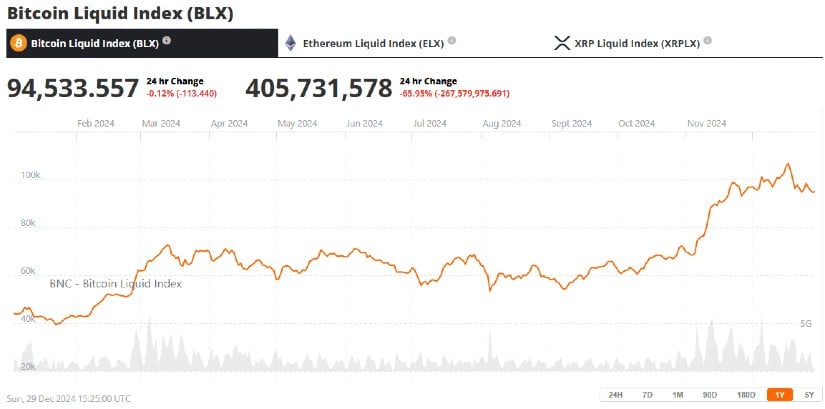

- Bear Case: Bitcoin could rise modestly to $150,000, representing a 58% increase from its current price of about $95,000. Such a scenario could be achieved if the Federal Reserve kept interest rates higher for longer and long-term holders started aggressively selling their Bitcoin. Additionally, failure by the Donald Trump administration to act on the Strategic Bitcoin Reserve plan could see the expected bull run falter.

- Base Case: The more optimistic estimate puts Bitcoin at $225,000. This outcome assumes the Federal Reserve reduces interest rates as expected, the U.S. government establishes Bitcoin as a reserve asset through the SBR initiative, and corporate adoption of Bitcoin continues steadily.

- Bull Case: The most ambitious forecast is to reach $400,000, which is conditioned on a slew of positive developments. This means the Federal Reserve would have to turn ultra-dovish, speed up corporate adoption, including adding Bitcoin on their respective balance sheets by at least one of the tech giants, and the U.S. government expands its reserves to give Bitcoin an even greater seal as a reserve asset.

Strategic Bitcoin Reserve and Corporate Adoption

1. According to the Trump administration’s SBR plan, it serves as the key foundation for these predictions. Jack Mallers, head of Strike, predicts that an executive order might be issued soon during Trump’s term to classify Bitcoin as a U.S. reserve asset.

or

2. The central component in these forecasts is the SBR scheme proposed by the Trump administration. Jack Mallers, CEO of Strike, speculates that an executive order designating Bitcoin as a U.S. reserve asset could be issued early during Trump’s term in office.

While some experts might be optimistic about the potential impact of a Bitcoin reserve policy, Alex Thorn, from Galaxy Digital, suggests that the U.S. government is unlikely to buy more Bitcoin. Instead, they might make use of their current holdings for strategic purposes rather than acquiring new ones.

As a crypto investor, I firmly believe that the level of corporate involvement in Bitcoin adoption plays a crucial role in determining its price by 2025. According to Blockware’s analysis, if we witness an increased pace of adoption, especially among prominent corporations like Microsoft and Tesla, it could potentially drive Bitcoin’s value closer to the upper limit of the projected forecast.

Lately, some new events have raised questions about this. It seems that Microsoft’s shareholders have recently turned down a proposal to include Bitcoin in their financial records, which might suggest opposition from big companies regarding this digital currency.

Macroeconomic Influences

As a researcher examining the relationship between traditional finance and cryptocurrencies, I anticipate that the Federal Reserve’s monetary policies could significantly influence Bitcoin’s future course. A more accommodative stance, characterized by low interest rates, may encourage increased investment in Bitcoin, as it presents an attractive alternative for yield-seeking investors. Conversely, a more aggressive policy stance, or a hawkish approach, could potentially curb Bitcoin’s growth potential due to the perceived higher risk associated with such monetary tightening.

Blockware’s predictions outline the possible ups and downs in Bitcoin’s future trajectory, ranging from $150,000 to an optimistic $400,000 over the next two years. These critical years will determine Bitcoin’s role within global finance, as the interplay between governmental policies, corporate environments, and economic situations will shape its destiny in 2025.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-30 15:23