Starting from January this year, Bitcoin‘s price hasn’t returned to its record peak of $108,230. As a result, the potential earnings for short-term Bitcoin holders have decreased, which is adding extra weight and causing the price to drop further.

As demand leans further, BTC’s price could see new declines. Here is why.

Bitcoin Short-Term Holders Count Their Losses

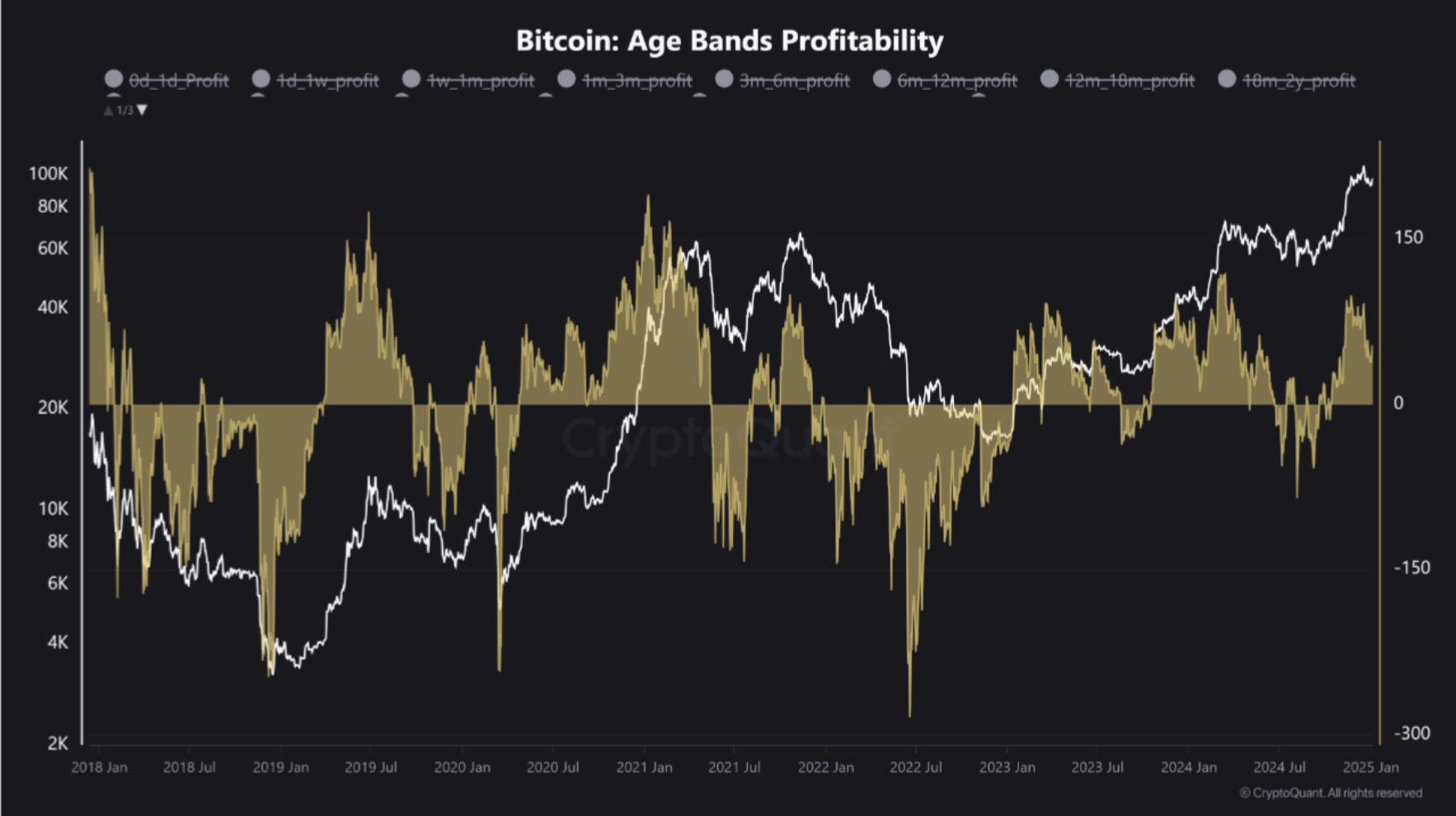

According to a recent analysis by an anonymous expert known as Crazzyblockk, it has been observed that individuals who have owned Bitcoin for fewer than 155 days may be experiencing a decrease in the profitability of their investments.

After Bitcoin reached a peak of $108,000 and failed to regain that significant price mark, the profitability gap for short-term investors has noticeably decreased.

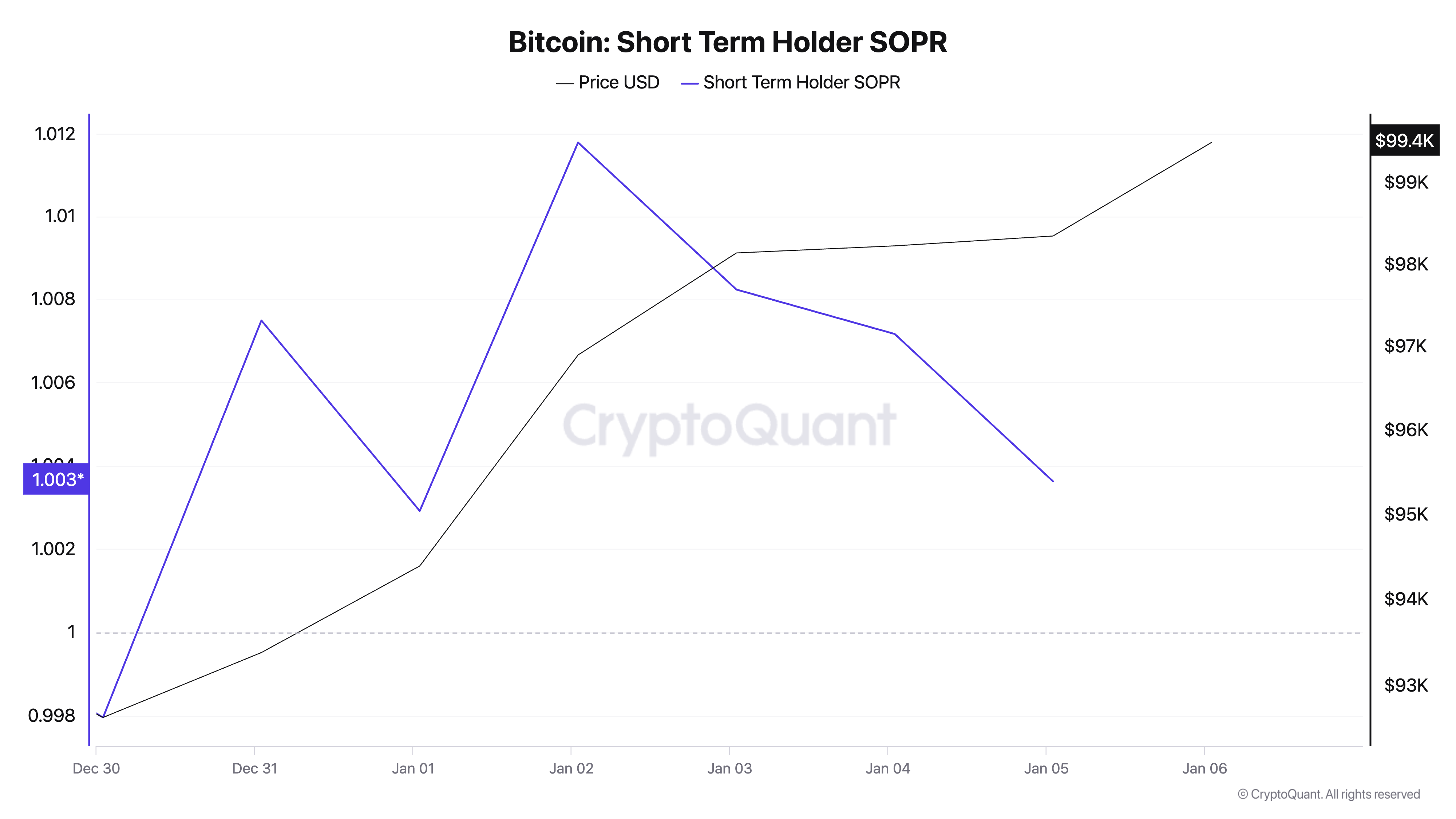

Based on BeInCrypto’s analysis, the Spent Output Profit Ratio for their STHs aligns with the analyst’s viewpoint. This ratio, as per CryptoQuant, has been gradually decreasing since January 2.

The Short-Term Holder Spent Output Profit Ratio (STH-SOPR) measures the profitability of individuals holding a specific cryptocurrency for a short period, typically under 155 days. Essentially, it helps determine whether short-term investors are currently making or losing money on their investments in that particular asset.

As the value of Bitcoin drops, more and more short-term investors find themselves selling it at a loss instead of making a profit. This trend indicates decreasing trust in the market from recent buyers, which could signal a decrease in the overall demand for the dominant cryptocurrency.

On how this may impact BTC’s price, Crazzyblockk said:

A decrease in profits for short-term investors frequently indicates a strong warning of dwindling market demand and pessimistic feelings over both the short and long terms. Given the present circumstances, this implies a higher chance of price adjustments due to decreased demand and weakened performance.

BTC Price Prediction: Is a Decline to $91,000 Imminent?

Right now, Bitcoin is being bought and sold for around $100,943. However, if there’s a significant increase in selling activity from short-term investors who are experiencing losses, the price might fall to approximately $91,488.

Should the public’s feelings change and Bitcoin sees an increase in fresh interest, it could potentially drive the price above $100,000 and move closer to its previous record high of $108,230.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 30 Best Couple/Wife Swap Movies You Need to See

- Persona 5: The Phantom X Navigator Tier List

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2025-01-06 22:21