The crypto market, like a nervous novice golfer, keeps hitting the rough. According to the latest CoinShares report, digital asset investment products have been giving investors the cold shoulder for five consecutive weeks.

The bears are having an absolute picnic, with Bitcoin (BTC) taking center stage in the “Oh, dear!” department. Its price remains lower than a butler’s mood during laundry day, far below the $90,000 threshold some dreamers were crooning about.

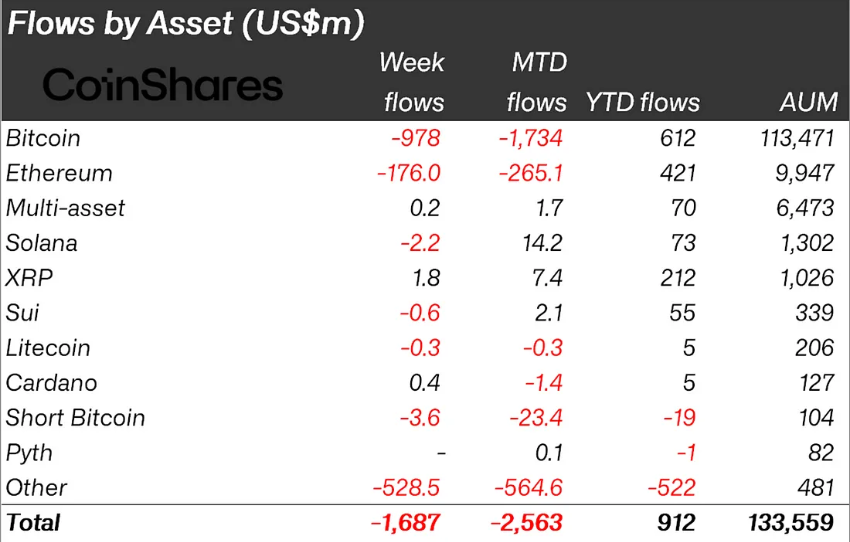

Crypto Outflows Surge to Nearly $1.7 Billion

Now, hold onto your monocles! The report reveals that crypto outflows have reached a staggering $1.687 billion, propelling cumulative losses during this gloomy streak to $6.4 billion. That’s not a streak, old chap, that’s a marathon of misery! To add icing to the cake, this marks the 17th consecutive day of outflows—a record only rivaled by what happens when Aunt Agatha visits.

Despite the market resembling a deflated soufflé, year-to-date (YTD) inflows are surprisingly positive, tallying $912 million. But alas, clouds gather as the latest round of withdrawals brings about a heartbreaking $48 billion decline in total assets under management (AuM) across digital asset investment products. It’s enough to make a strong man weep—or at least consider a stiff gin and tonic.

Most of the misery, unsurprisingly, centers around the United States, which single-handedly accounts for $1.16 billion in outflows. That’s a solid 93% of this financial exodus—a “leading performance,” if one ever needed an example 😅. Germany, meanwhile, clearly didn’t get the memo, with modest inflows of $8 million showcasing a certain contrarian charm.

Bitcoin, the supposed king of crypto, has taken hit after hit like an actor in a poorly-written melodrama. Another $978 million vanished from its coffers this week, pushing its five-week total losses to $5.4 billion. Oh, the humanity! Short-Bitcoin positions also limped away with $3.6 million in outflows, suggesting bearish bettors aren’t keen to double down on misfortune just yet.

While most digital assets have been spending quality time in the doghouse, XRP has waltzed in with a glimmer of positivity. The asset attracted $1.8 million in new inflows, likely fueled by bubbling optimism surrounding Ripple’s courtroom bickering with the US SEC. Rumor has it, XRP may yet be crowned a commodity instead of a security. If you believe in miracles, here’s your moment! 🙃

However, don’t start popping champagne quite yet. Binance, that behemoth of exchanges, suffered what we can only describe as a financial trimming so severe it’s practically bald. A seed investor decided to pull out, leaving Binance with a mere $15 million in AuM—ouch, old bean, ouch!

This market sell-off has been as consistent as Jeeves’s tea-making talents, following weeks of mounting bad vibes. Last week saw outflows hit $876 million, with U.S. investors continuing their starring roles in financial theater’s latest tragedy. The week before, crypto outflows were already approaching $3 billion, as uncertainty brewed like an over-steeped Earl Grey.

Even with the crypto ship looking more like the Titanic, tiny sparks of hope remain. XRP’s defiant inflows and Germany’s modest gains suggest some investors still possess the guts—or perhaps sheer foolhardiness—to keep dancing in the rain. Bravo, brave souls! 🎩

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Oblivion Remastered: How to get and cure Vampirism

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Does Oblivion Remastered have mod support?

- DODO PREDICTION. DODO cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- Franklin Templeton’s 2025 Crypto Predictions: BTC Reserves, Crypto ETFs, and More

2025-03-17 17:36