In the labyrinthine corridors of the digital bazaar, where fortunes rise and fall with the capricious whims of the market, the so-called “smart money” has once again flexed its muscles. Glassnode, that modern-day oracle of on-chain wisdom, has unveiled the machinations of Bitcoin‘s leviathans during the recent market reversal. Ah, the irony of it all-these titans of finance, with their algorithms and spreadsheets, dancing to a tune only they can hear. 🎻

The Whales Shift Their Tails: A Net Short Bias Emerges

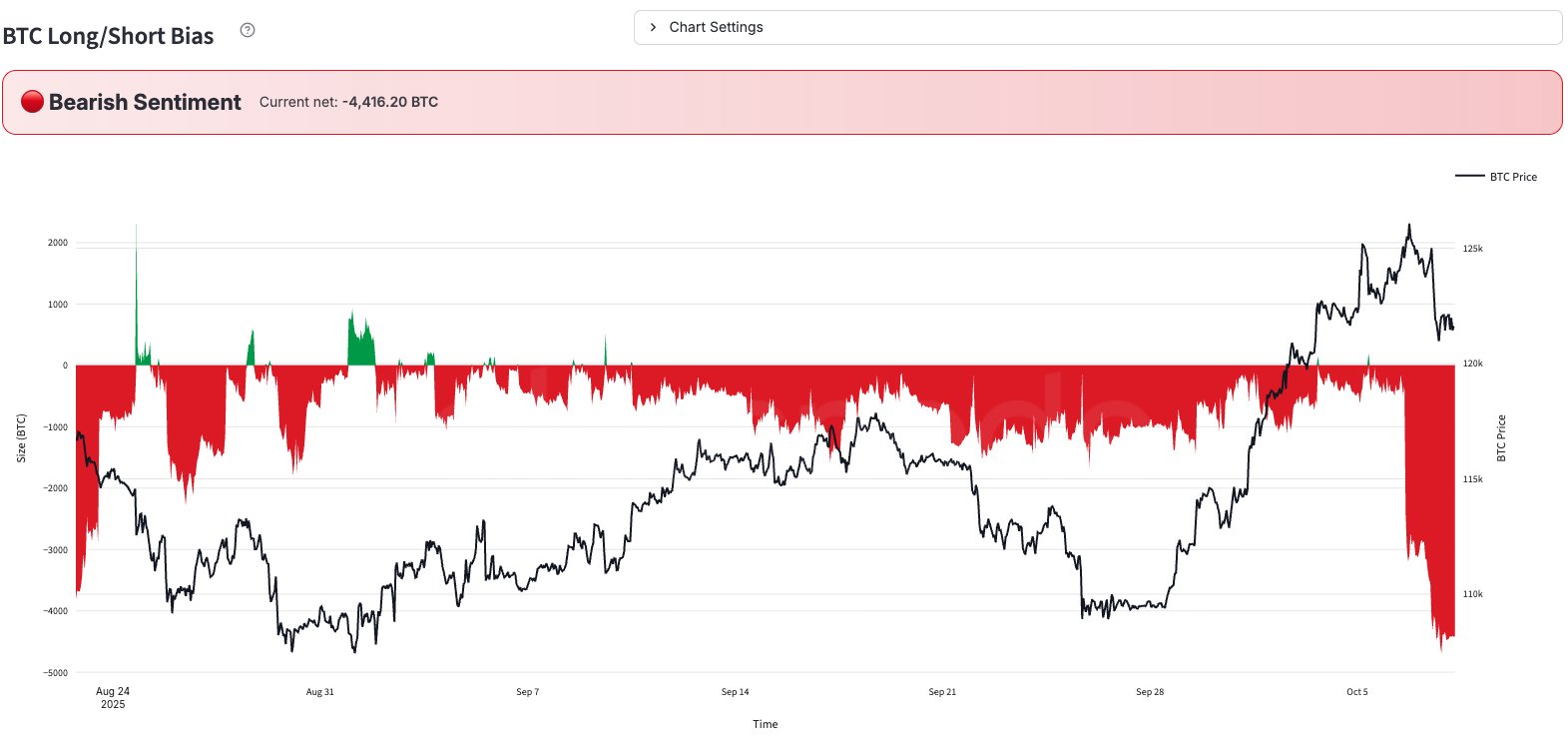

In a missive dispatched via the bird app, X, Glassnode has regaled us with tales of how these financial behemoths navigated the latest pullback in Bitcoin’s price. Behold, the chart below, a testament to their supposed foresight, tracking the BTC Long/Short Bias-a metric as convoluted as the minds of those who devised it.

From this graph, one discerns that the Long/Short Bias has languished in the shadows of negativity for weeks, suggesting our whales have been betting against the tide. Yet, when Bitcoin briefly kissed the heavens above $125,000, the indicator flickered with a fleeting positivity, a momentary lapse into bullish delirium. But ah, the fickleness of fate! When the second ATH was breached, these same whales turned tail, plunging the bias into the abyss of negativity. “Profit-taking on longs alongside new short positioning,” Glassnode intones, as if reading from the Book of Market Revelations. 🦈

And so, the whales, those harbingers of doom, anticipated the pullback, their movements as calculated as a chess grandmaster’s. The bias plummeted further when Tuesday’s crash sent prices tumbling below $121,000. Now, it sits at a dour -4,416.20 BTC, a testament to the preponderance of bearish bets. What next? Only the shadows know, and perhaps the whales, those enigmatic masters of the universe. 🌊

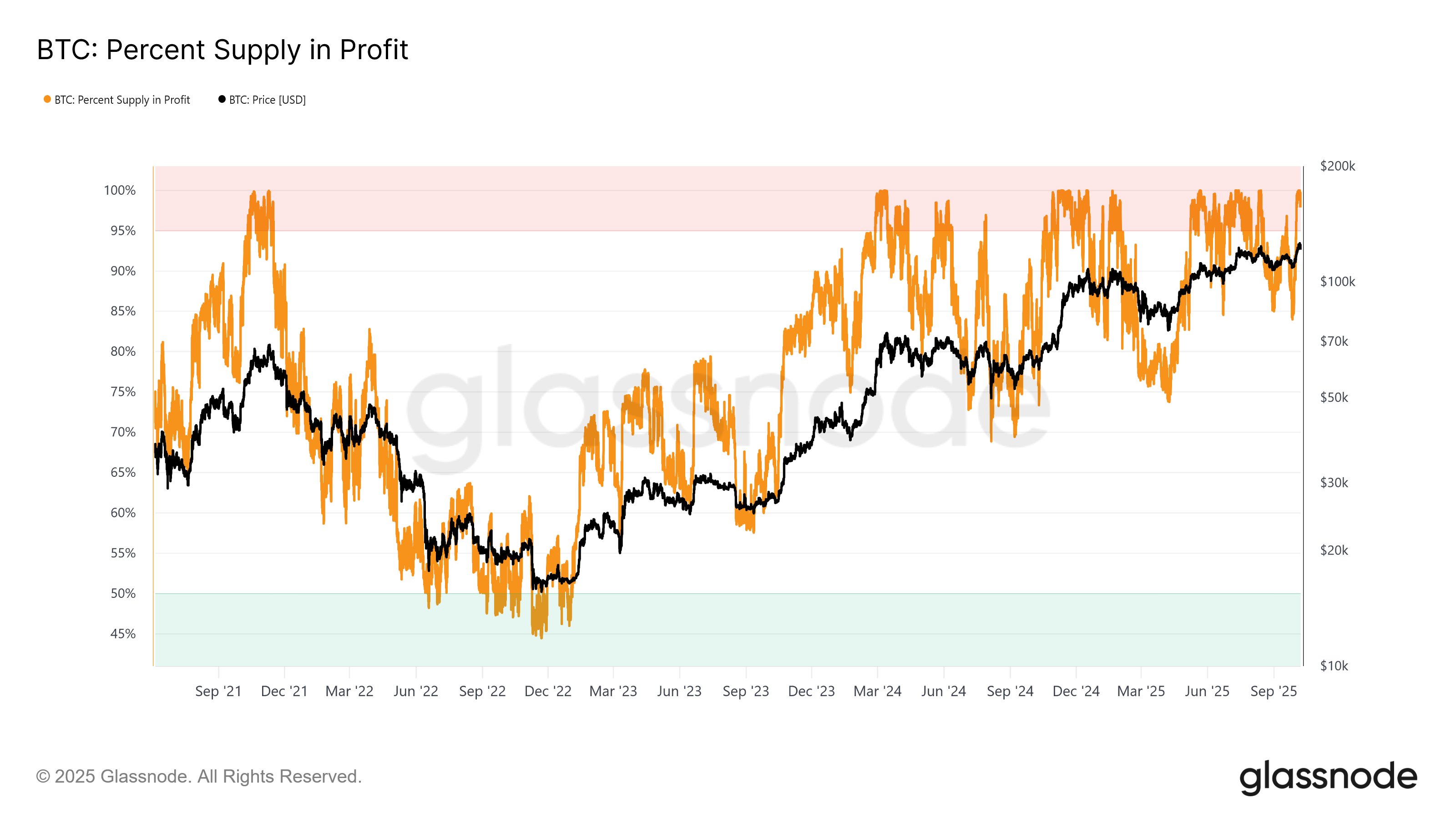

In other tidings, the recent Bitcoin surge has propelled the Percent Supply in Profit into the stratosphere, as Glassnode has duly noted in another X post. Behold, the chart that speaks of euphoria and greed:

As Bitcoin breached $117,000, the Percent Supply in Profit soared above 95%, a threshold historically associated with overheated markets. Naturally, it reached 100% as BTC scaled new heights, for who is not in the green when the coin ascends to uncharted territories? Yet, Glassnode warns, such exuberance is “a hallmark of Euphoria phases,” where profit-taking accelerates and risk looms large. Ah, the folly of man, ever chasing the mirage of endless gains. 🤑

BTC Price: A Modest Recovery

Bitcoin, that resilient phoenix, has clawed its way back to the $123,000 mark in the past day. Behold, the chart that chronicles its journey:

And so, the saga continues, a tale of whales and wails, of greed and fear, of algorithms and intuition. In this digital colosseum, who shall emerge victorious? Only time, that implacable judge, will tell. ⏳

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

2025-10-09 10:55