As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market fluctuations and trends. The recent surge in Bitcoin whale selling activity is a development that warrants close attention. While Bitcoin’s return to $100,000 was an exciting milestone, it seems we might have to pause our celebrations for now.

Large-scale Bitcoin (BTC) investors, often referred to as ‘whales,’ are once again active, offloading their cryptocurrency in substantial quantities. This increased selling activity occurs as Bitcoin approaches the $100,000 mark, leading some to question its capacity to hold this crucial level of resistance.

If this event transpires, it might postpone the approaching predictions that Bitcoin’s value will reach or even exceed $125,000.

Bitcoin Big Wigs Have Refrained from HODLing

According to IntoTheBlock, the movement of large amounts of Bitcoin (over 1% of the total supply) has displayed significant fluctuations over the past week. A week ago, this netflow amounted to approximately 28,570 Bitcoins when the price was around $97,885.

On the other hand, things have changed recently. Presently, the netflow stands at -3,960 BTC, which equates to a significant sale of about $400 million by large investors (whales), given Bitcoin’s current price of around $100,954.

This implies that major Bitcoin owners might be increasing their rate of selling, which could potentially lead to a decrease in Bitcoin’s price over the next few days if this trend continues.

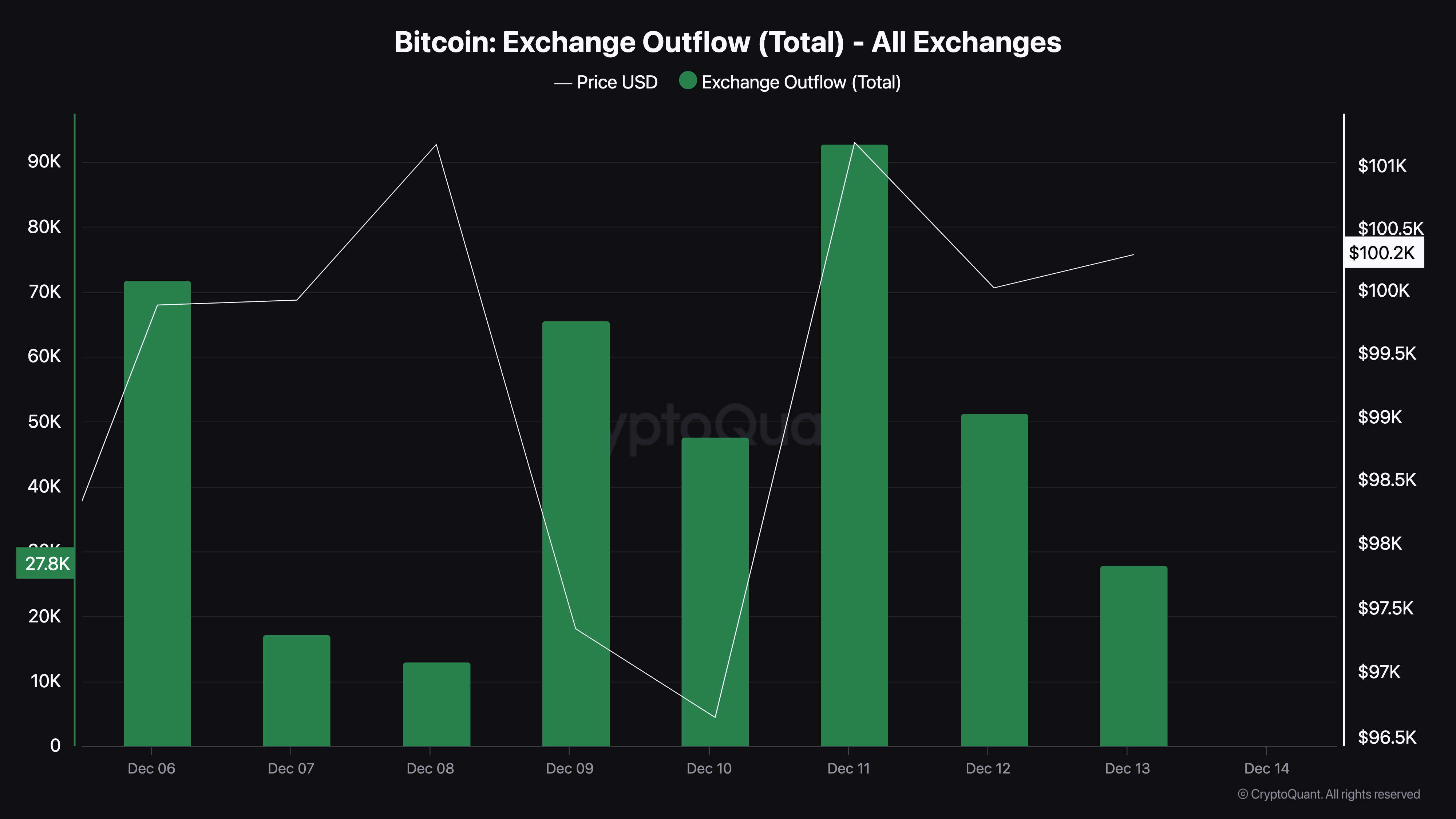

According to our theory, an increase in the total amount of Bitcoins being transferred from exchanges to personal wallets provides supporting evidence. The term “exchange outflow” refers to the coins moving from centralized trading platforms into self-managed wallets. When this metric goes up, it suggests that many holders are not intending to sell their Bitcoin.

Conversely, a drop in outflows might suggest a decrease in HODLing activity, potentially leading to a downward pressure on Bitcoin’s price. As per CryptoQuant, the Bitcoin exchange outflow has diminished from its peak on December 11th. If this trend persists, there’s a possibility that Bitcoin’s price could dip below $100,000 once more.

BTC Price Prediction: Is $91,000 Looming

According to the daily Bitcoin-to-U.S. Dollar (BTC/USD) chart analysis, the Momentum Oscillator Convergence and Divergence (MACD) has moved into the negative zone. The MACD is used to determine market momentum, with higher values suggesting a bullish trend, while lower values imply a bearish one.

Consequently, this decrease suggests that the surge in Bitcoin’s price up to $100,000 may not be sustainable. It’s more likely that BTC will reach a price range close to $91,918. If the market becomes excessively bearish and the selling pressure from large Bitcoin holders increases significantly, it could potentially drop down to around $80,437.

If purchasing intensity grows, it’s possible that the Bitcoin price could surpass its current resistance at $101,173. Under such conditions, the digital currency might head towards a potential high of $108,000.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- ANDOR Recasts a Major STAR WARS Character for Season 2

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Is a Season 2 of ‘Agatha All Along’ on the Horizon? Everything We Know So Far

- Where To Watch Kingdom Of The Planet Of The Apes Online? Streaming Details Explored

2024-12-13 22:40