bitcoin-usd/”>BITCOIN WHALES ARE BUYING UP WHILE SMALLER INVESTORS PANIC! IS THE MARKET BOTTOM NEAR? 🤑🚀

- Those sneaky Bitcoin whales are buying up while smaller investors are running around like headless chickens, panicking and selling their coins!

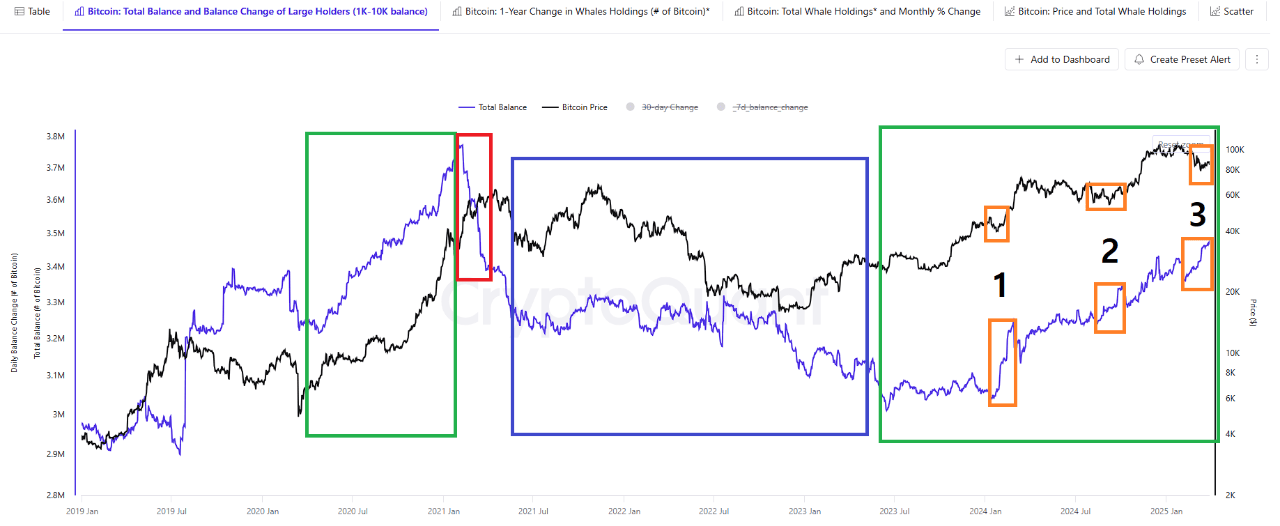

- And, oh dear reader, the data is hinting at a potential bottom, just like in the good old 2020 bull cycle!

A Bitcoin [BTC] bottom, you see, is like a big ol’ pot of gold at the end of a rainbow. It forms when several key conditions align, like a critical accumulation zone where sell-side liquidity is absorbed by strong hands. And, oh boy, this phase often signals a supply squeeze, setting the stage for a powerful rally as demand begins to outpace available supply! 🚀

And, at the time of writing, on-chain data from CryptoQuant seemed to reveal a familiar pattern – Bitcoin whales are aggressively accumulating while smaller investors are, well, selling their souls to the market gods! 🤣

But, does this mean the bottom is in, you ask? Well, we’ll have to wait and see, won’t we? 🤔

$407 billion in sell-off risk – The STH dilemma

Three weeks ago, Bitcoin sent the market into a tailspin as it retraced to its pre-election low of $77k. But, despite the broader sentiment swinging between extremes of fear, BTC’s ability to hold above $80k speaks volumes about its underlying strength. It’s like a big ol’ rock that just won’t budge! 🌎

And, what’s more, there has been a sharp spike in the total balance of Bitcoin whales holding 1k–10k BTC (marked in orange). This accumulation has been a key factor in preventing a deeper market correction, suggesting that whale activity is absorbing sell-side pressure and providing the support needed to stabilize prices. It’s like a big ol’ safety net, folks! 🌟

This accumulation has been a key factor in preventing a deeper market correction, suggesting that whale activity is absorbing sell-side pressure and providing the support needed to stabilize prices. It’s like a big ol’ safety net, folks! 🌟

As noted by AMBCrypto’s recent analysis, the SOPR (Spent Output Profit Ratio) remains below 1. This is a sign that short-term holders (STHs) with positions older than 155 days have been realizing losses. It’s like a big ol’ bucket of ice water, folks! 😳

Put simply, with Bitcoin down 23% from its all-time high of $109k, a significant pool of buyers’ acquisition value remains well above the press time market value of $83k. It’s like a big ol’ mountain to climb, folks! 🏔️

AMBCrypto also found that $95,138 is the average acquisition price for these STHs, where roughly 4.28 million BTC were traded. This equates to approximately $407 billion in potential sell-off risk from these holders. It’s like a big ol’ ticking time bomb, folks! ⏰

Should STHs capitulate, we could see a surge in sell pressure. Even so, the question remains – Will whales continue to absorb this pressure and confirm $80k as a strong bottom? It’s like a big ol’ game of chicken, folks! 🐓

$80k at stake – Will Bitcoin whales confirm the bottom?

Notably, the pattern of Bitcoin whales accumulating while smaller investors panic-sell mirrors previous cycle bottoms, particularly the 2020 cycle. It’s like a big ol’ déjà vu, folks! 🕰️

During that phase, BTC broke above $10k for the first time by mid-Q3, kicking off what came to be known as the “breakout cycle.” It’s like a big ol’ rocket ship, folks! 🚀

In a striking parallel, CryptoQuant data also showed no signs of Bitcoin whales exiting during the 2020 bull run. This implied that these whales may still be absorbing sell-side pressure. This could lay the groundwork for a major shift in the current cycle. It’s like a big ol’ puzzle piece, folks! 🧩

Right now, there is no significant distribution from these whales. In fact, instead of going dormant, they are actively accumulating. Hence, the chances of a collapse below $77k–$80k due to macroeconomic uncertainty or weak hands exiting are low. It’s like a big ol’ safety net, folks! 🌟

Moreover, U.S. buy orders remain robust while Bitcoin exchange reserves continue to plunge. It’s like a big ol’ double whammy, folks! 🤯

If these dynamics align in the coming days, Bitcoin could be on the cusp of confirming a market bottom. It’s like a big ol’ dream come true, folks! 😴

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Everything We Know About DOCTOR WHO Season 2

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Honkai: Star Rail – Hyacine build and ascension guide

- All 6 ‘Final Destination’ Movies in Order

2025-04-02 10:19