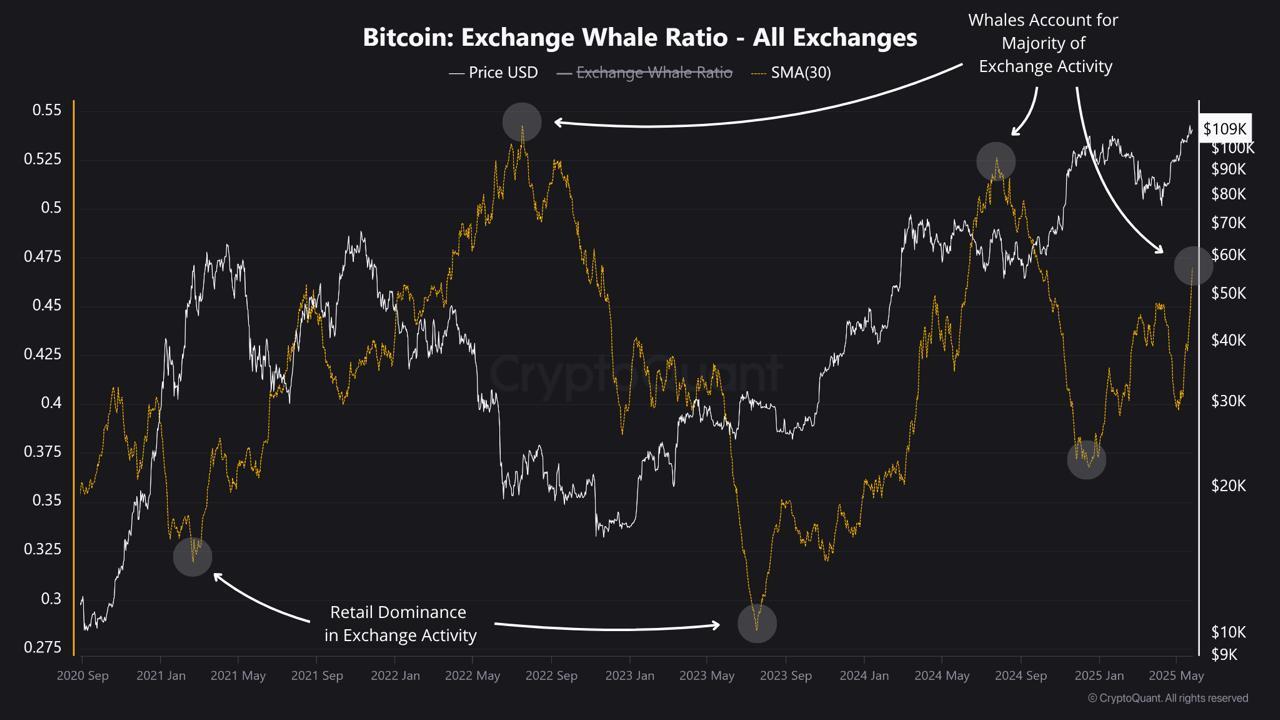

Ah, the Bitcoin whales! Those magnificent creatures of the crypto ocean are once again making waves in exchange activity. The Exchange Whale Ratio’s 30-day moving average has surged to a staggering 0.47—its highest level in seven months! This means that nearly half of all BTC inflows to exchanges are now coming from the largest transactions. Talk about a whale of a tale! 🐳

Historically, when these behemoths start splashing around, it often precedes major market tops. It’s like watching a group of elephants in a china shop—large holders tend to move their funds in preparation to sell, and with retail participation fading faster than a magician’s rabbit, we might be heading into a distribution phase. Buckle up, folks; a short-term correction could be on the horizon! 🎢

Is a Deeper Bitcoin Crash Coming?

Bitcoin recently soared past $111,000, setting new all-time highs. But just as quickly, profit-taking from our friendly neighborhood whales and the looming specter of another macroeconomic downturn have sent BTC plummeting over 6%. It’s currently trading at a mere $104,000. Oh, the drama! 🎭

Data from CryptoQuant shows a sharp rise in the Exchange Whale Ratio, which is a fancy way of saying, “Hey, maybe you should be cautious!”

When this ratio exceeds 0.5—indicating that whales account for the majority of exchange inflows—price tops often follow. It’s like a game of musical chairs, and you don’t want to be the last one standing when the music stops! 🎶

The Exchange Whale Ratio measures how much of all Bitcoin flowing onto exchanges comes from the ten largest transactions. A 30-day moving average at 0.47 means nearly half of every BTC deposit is a “whale” transaction. That’s a lot of fishy business! 🐟

This pattern has played out during previous market cycles, like mid-2022 and late 2024, when elevated whale activity coincided with significant corrections. It’s almost as if these whales have a sixth sense for market tops. 🧙♂️

In contrast, periods when the whale ratio dips below 0.35 have often marked phases of accumulation or early bull market momentum, dominated by retail participants. Remember mid-2023? The ratio hit a low point, and Bitcoin began to climb steadily afterward. It’s like watching a phoenix rise from the ashes—if the ashes were made of digital currency! 🔥

“There is a growing dominance of large holders in recent exchange activity. This sharp increase mirrors the surge seen in the Exchange Whale Ratio during Bitcoin’s price rally in late 2023 and early 2024,” CryptoQuant analyst JA Maartunn told BeInCrypto. Sounds like a party, doesn’t it? 🎉

The current spike in the 30-day moving average of the ratio further reinforces the notion that whales are once again becoming more active in exchange activity. If history repeats itself, significant whale selling could trigger a pullback or increased volatility. It’s like waiting for the other shoe to drop—except the shoe is made of Bitcoin! 👟

While Bitcoin price remains strong for now, this shift in behavioral dynamics suggests the market may be transitioning from accumulation to distribution, increasing the probability of a near-term top or correction. So, keep your eyes peeled and your wallets ready! 🧐

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- Everything We Know About DOCTOR WHO Season 2

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- All 6 ‘Final Destination’ Movies in Order

2025-05-30 23:51