Alas, poor Bitcoin! Once thought to ascend to the heavens, it has plummeted sharply this week, from a dizzying $95,700 to the dismal depths below $80,000. As if cast by some malevolent sorcery, the crypto monarch’s recovery is now but a rumor, whilst the infamous whales, those plump albatrosses of the digital sea, have seized upon this misfortune to sell their glittering hoard of BTC.

This raucous sale exacerbates the plight of beleaguered investors, who are left clutching their cryptographic pearls in despair.

The Great Cash-Out of Bitcoin Holders

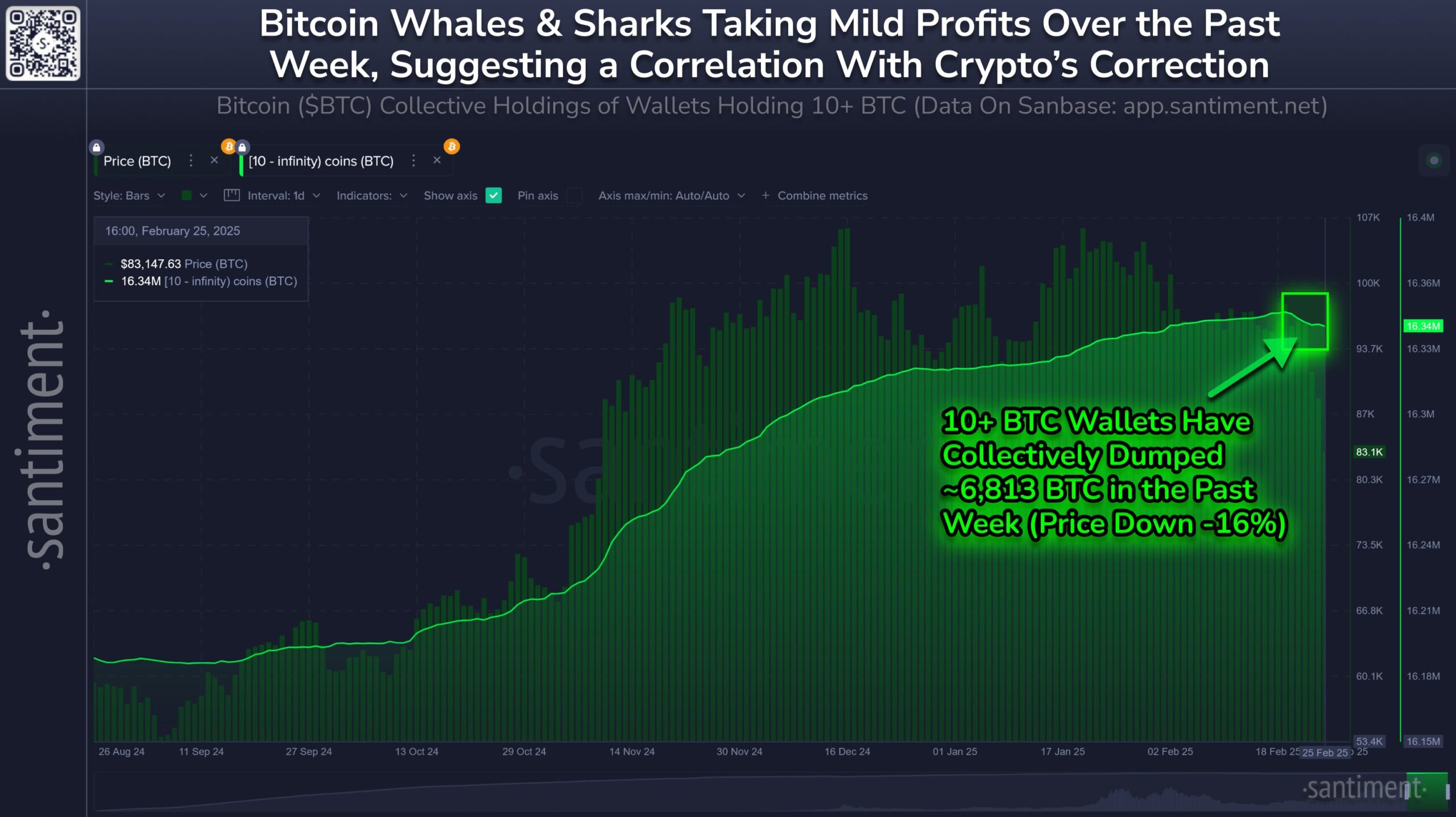

Behold the whales and their sharkish cohorts—a cadre of wallets boasting ten or more BTC—who have furiously dumped a staggering 6,813 coins into the abyss, worth a staggering $540 million since last week. Such seismic activity has not been witnessed since the scorching July sun, and it surely serves as a portent of doom, signaling further declines might await like lurking wolves in the shadows.

Yet, amidst this tumult, let us not shun the notion that these gargantuan holders might one day decide to gloat over their hoard again, possibly suggesting a recalcitrant reversal of fortunes. Historically, these market titans wield an influence that shakes the very foundations of our digital universe; thus, we shall not overlook their machinations as they may eye those lower levels once the storm passes.

The mood remains gloomier than a dreary Petersburg winter, yet we must ponder whether these whales might shift their strategies. If they don their hopeful visages and begin to accumulate BTC again, could it not whisper of confidence in Bitcoin’s enduring potential? 🤔

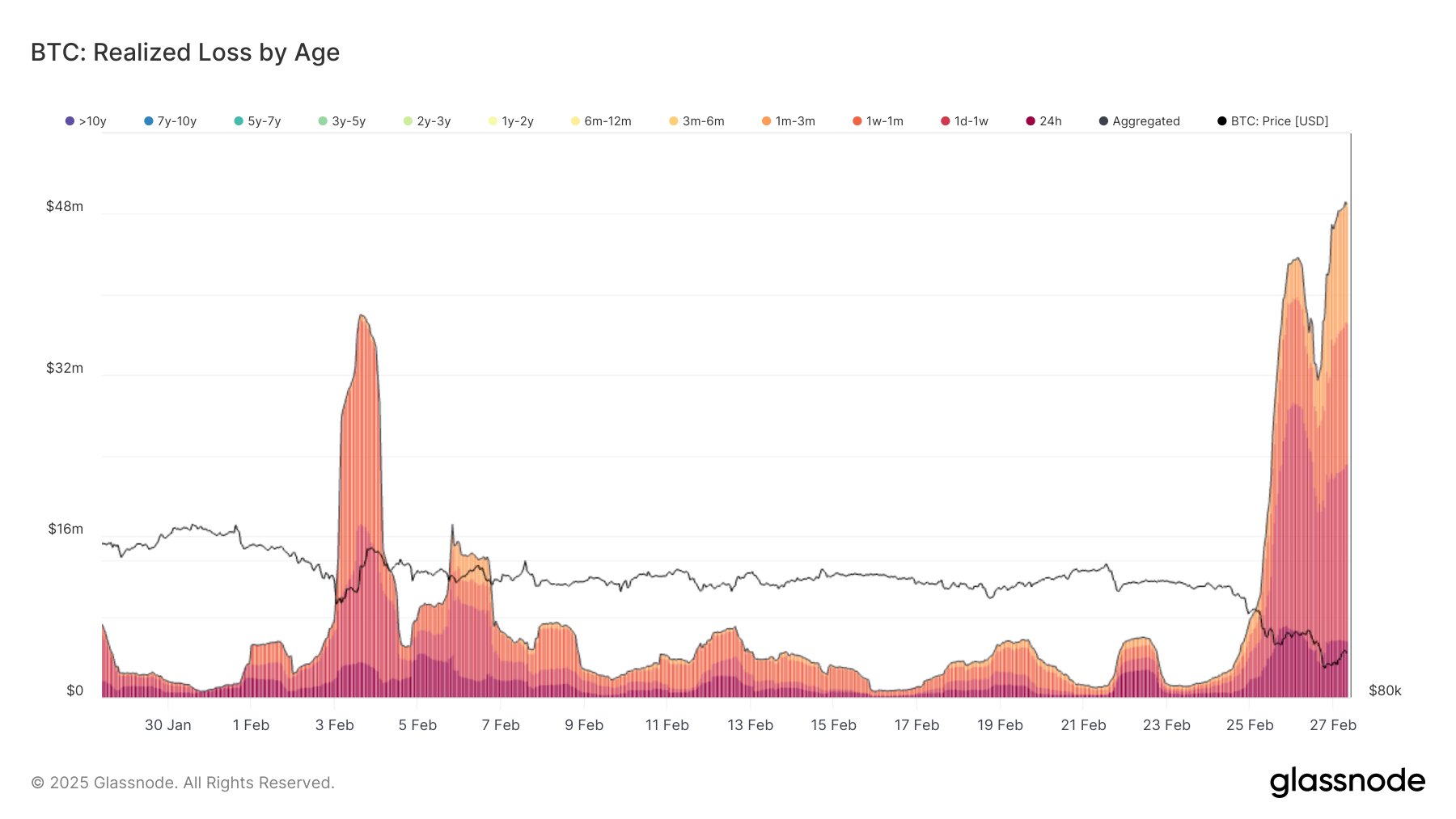

Looking to the wider seas of the market, Bitcoin’s recent dive has been accompanied by a veritable deluge of realized losses. From February 25 to 27, an astronomical $2.16 billion vanished, mainly from those neophyte investors like woolly lambs thrown into the slaughter.

Of such losses, a staggering $927 million—42.85% of the tender footed cohort—vanished in just one day! This marked the largest single-day disaster since the summer of 2024. Such dramatic losses from the fresh-faced entrants is a dreadful omen, as it may scare away any noble souls willing to brave the waters of this volatile market.

Indeed, these losses paint a grim tableau of the hardships faced by these modern-day Icaruses. With the soaring losses, one might fear for the very confidence that nourishes investor spirits. As long as this grim trend lingers, it hovers over Bitcoin’s potential recovery like a ravenous specter. Such developments could plunge us deeper into the abyss of bearish sentiment!

BTC Price: A Toiling Wretch

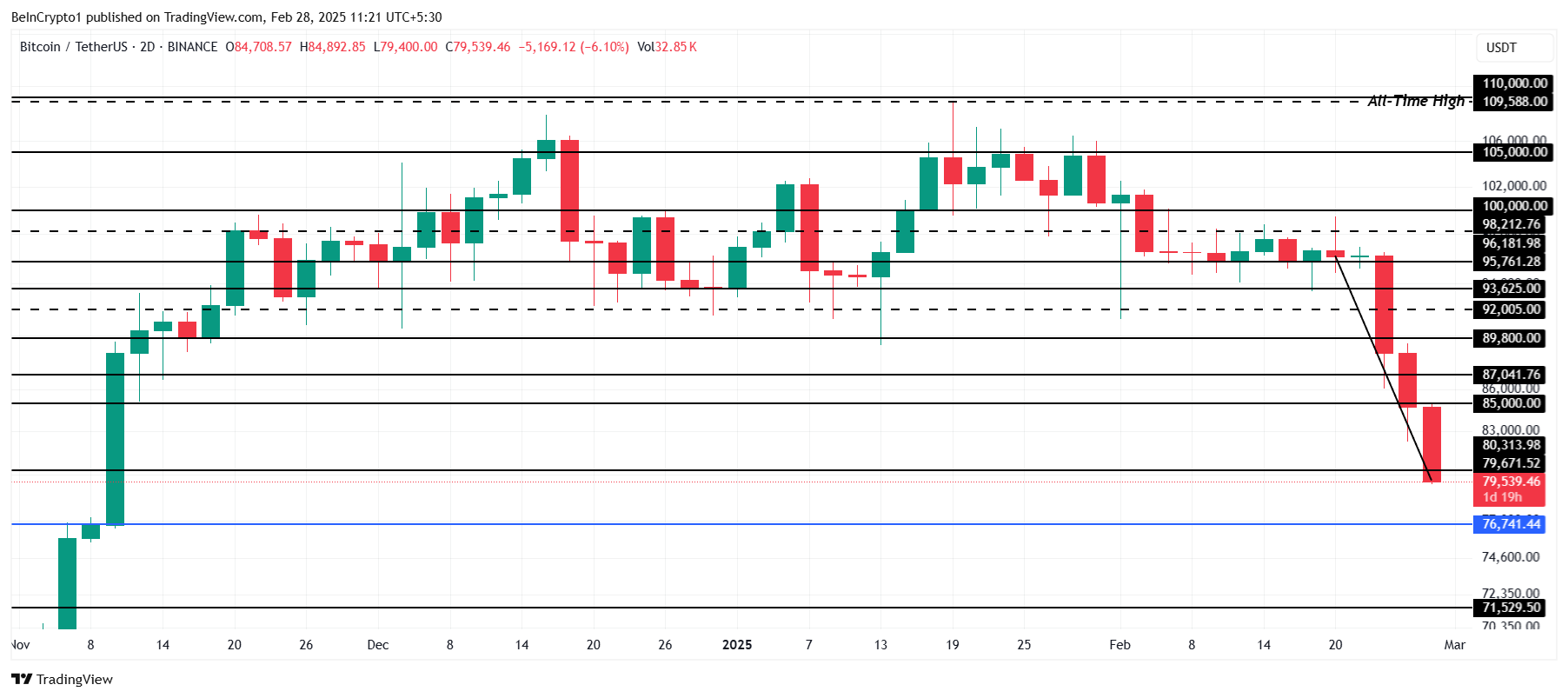

Lo and behold! Bitcoin currently languishes at the pitiful sum of $79,539, having lost the once-supportive mantle of $80,313. With the currents shifting unfavorably, BTC appears set to test the foreboding next support level of $76,741—a key bounce point from times gone by, offering fleeting hope for a price rebound!

But if the tide of selling pressure continues to rise, and the confidence of investors wanes like the moon on a chilly night, our poor Bitcoin may plunge below $76,741, creeping ever closer to the shadowy support of $71,529. A descent to this depth would further extend the vast chasms of loss and deepen our bearish outlook for the cryptocurrency realm.

To vanquish the bearish specter and spark the flames of potential recovery, Bitcoin must reclaim its grand support of $80,313 and gallop back towards the gleaming $85,000. If such a miraculous feat comes to pass, we might just witness the dawn of a new, splendid reversal amidst the chaos.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-28 10:05