As a seasoned researcher with years of experience navigating the cryptocurrency markets, I must say that the current state of Bitcoin is a fascinating study. While it may seem disheartening to see it struggling to reclaim $100,000 as a support floor, I’ve learned over the years that the market rarely moves in a straight line.

The bullish sentiment among investors is undeniable, fueled by Bitcoin’s growing institutional support and its symbolic milestone of turning 16 years old. The reduced selling pressure and surge in accumulation indicate a confidence in an eventual rally that I find encouraging.

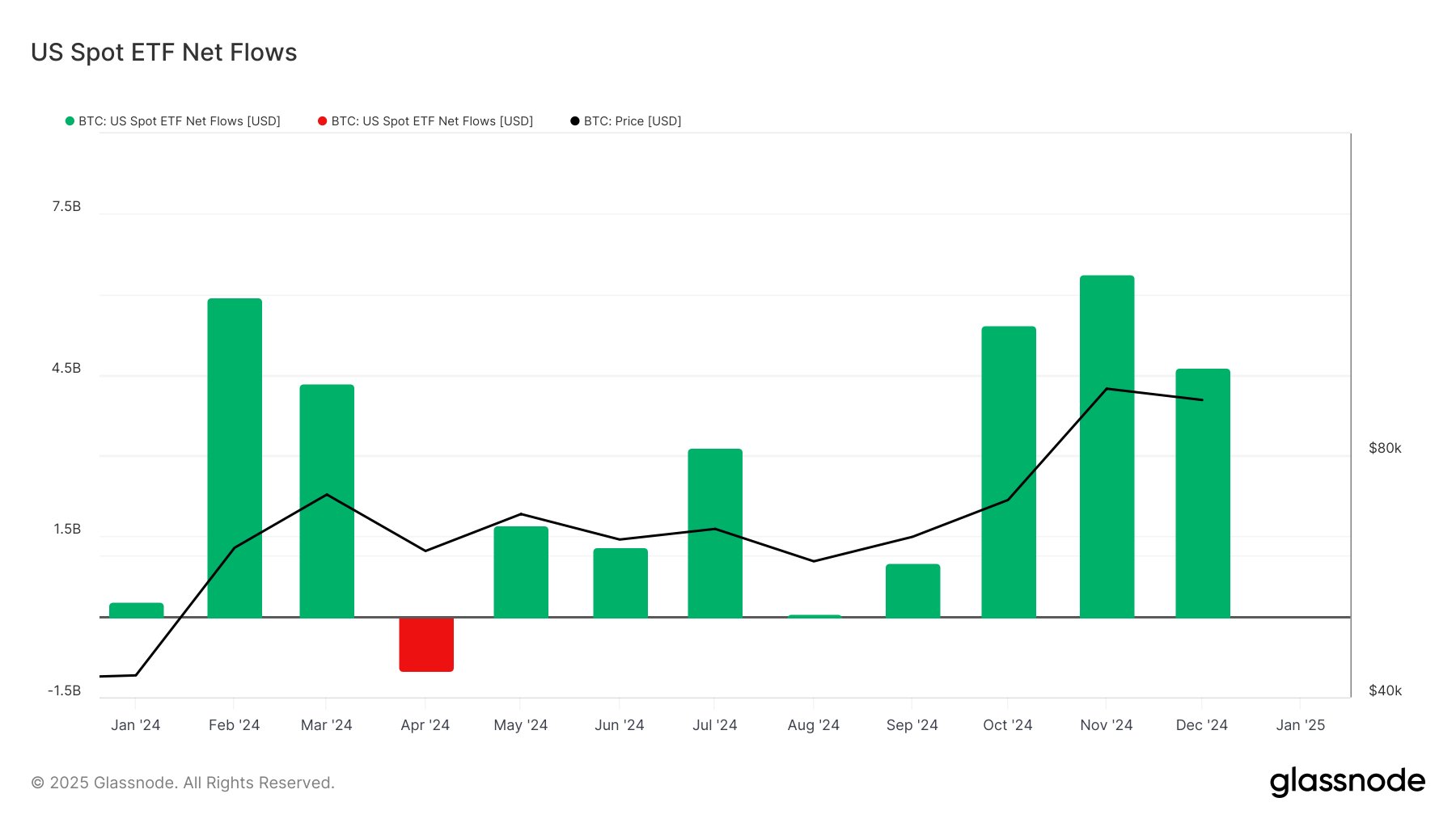

The increased institutional interest is particularly noteworthy, with net flows into spot BTC ETFs totaling $4.63 billion in December – a significant leap from the 2024 monthly average. This trend underscores the increasing appetite for Bitcoin among institutional investors and could potentially drive its price higher.

However, as we all know too well in this field, nothing is certain. If Bitcoin loses the $95,668 support level, it might face a downward spiral. But then again, that’s what they said about gravity – and look at us now, floating around!

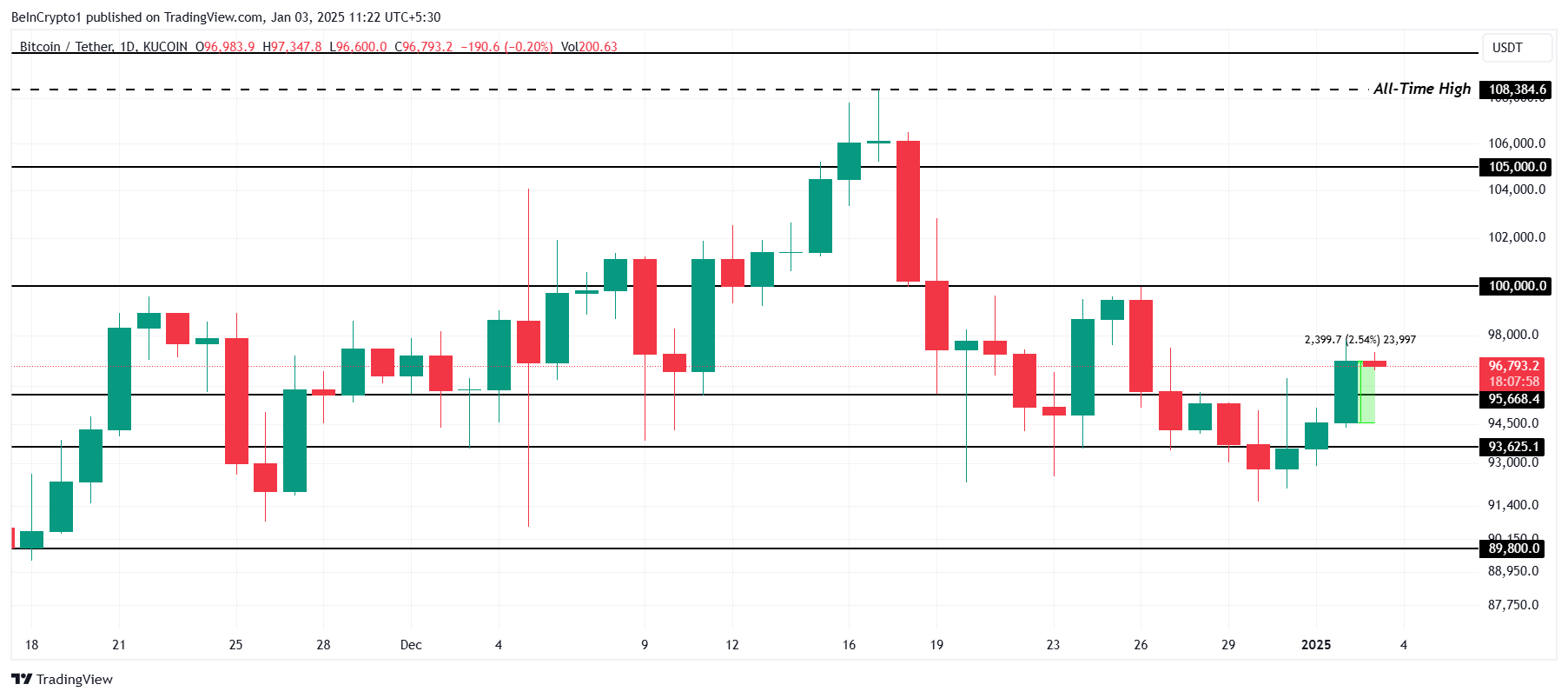

Bitcoin’s efforts to hold the $100,000 level as a foundation have been challenging, demonstrating a decline in recent price movement’s thrust.

Despite the recent challenges, investors continue to express optimism, as they are encouraged by the increasing institutional backing of Bitcoin and its significant milestone of celebrating 16 years in existence.

Bitcoin Investors Are Bullish

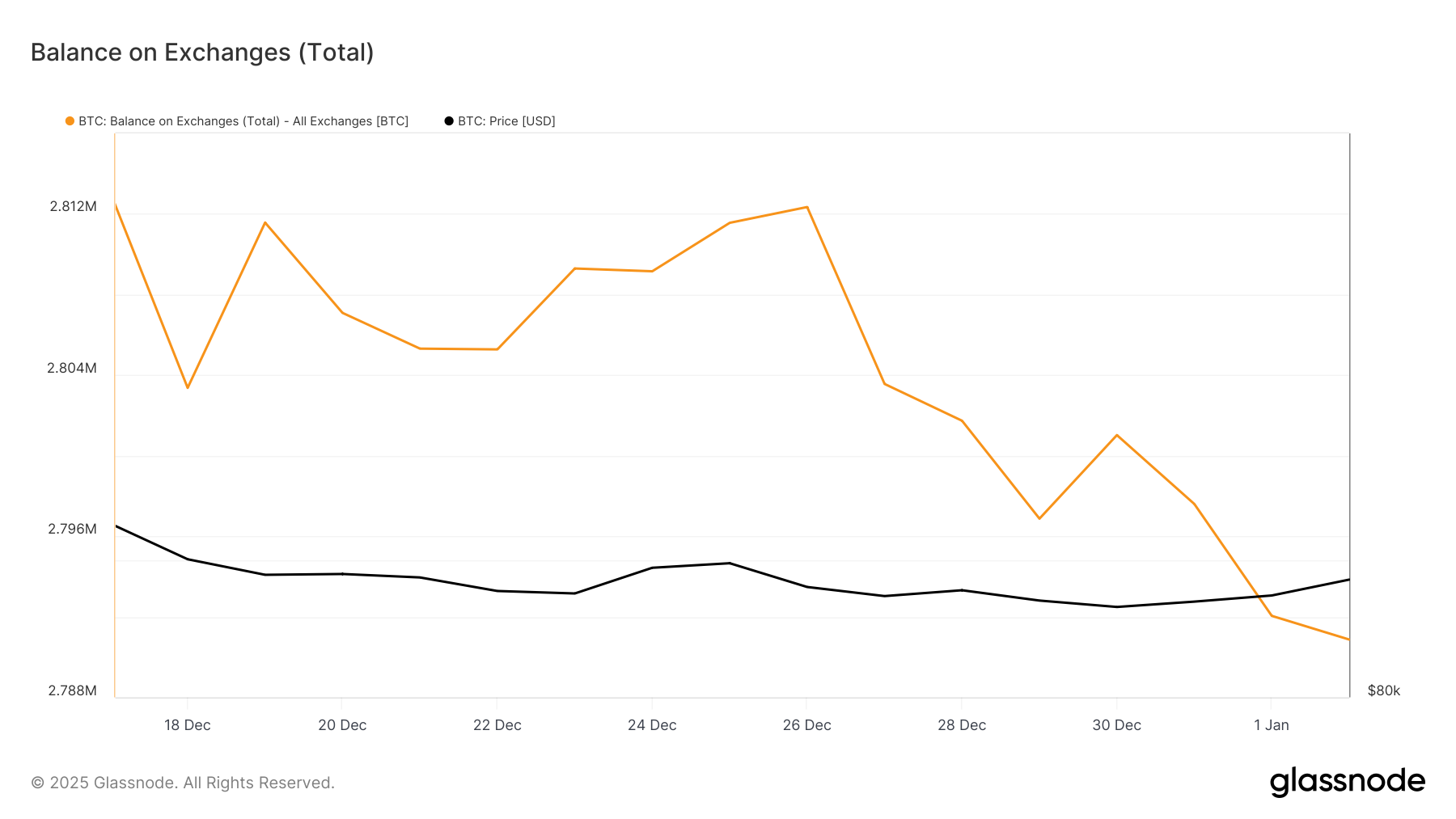

In the last 2 days, approximately 11,000 Bitcoins have left exchanges, suggesting a decrease in selling pressure. Since January began, the accumulation of Bitcoin has skyrocketed to $1 billion, indicating that investors are actively buying BTC, even during periods of price instability. This pattern underscores the faith that Bitcoin holders have in an upcoming market surge.

Institutional investment in Bitcoin has soared to unprecedented levels, as inflows into Bitcoin Exchange-Traded Funds (ETFs) amounted to a staggering $4.63 billion in December alone. This figure far exceeds the average monthly investment of $2.77 billion predicted for 2024, underscoring the growing demand among institutional investors for Bitcoin.

Although the majority of inflows happened in the early part of December, the negative market trends during the second half didn’t substantially curb activity. The ongoing institutional backing suggests a strategic perspective that might aid Bitcoin in rebounding and potentially pushing its value upwards.

BTC Price Prediction: Finding A Breach

Right now, Bitcoin is being bought at approximately $96,793, maintaining its position above the important support level of $95,668. For Bitcoin to reclaim the $100,000 mark, it needs to avoid dropping below this crucial line. The current market indicators hint towards a potential rise in price.

Positive signs from investors and increased institutional investment suggest a fall might not occur soon. If Bitcoin manages to establish $100,000 as a support level, it could potentially lead to a surge towards $105,000, signifying an important advance in its recovery process.

If Bitcoin fails to maintain its support at $95,668, it might slide down to $93,625, causing unease among investors. Dropping below this point could challenge the bullish perspective, possibly driving Bitcoin towards $89,800. Maintaining critical levels is crucial for preserving market confidence and optimism.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- 30 Best Couple/Wife Swap Movies You Need to See

- Persona 5: The Phantom X Navigator Tier List

2025-01-03 11:10