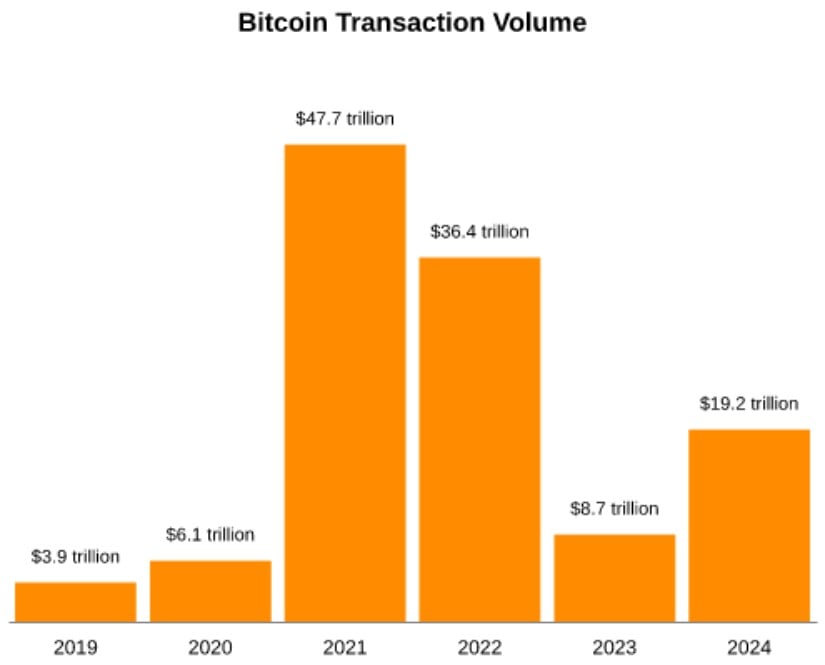

1. The amount processed exceeds twice the $8.7 trillion from 2023, effectively halting a two-year drop in transaction volume that started following the 2021 bull market high point.

OR

2. The figure surpasses double the $8.7 trillion transacted in 2023, marking an end to a two-year decrease in transaction volume since the peak of the 2021 bull market.

2021 witnessed a significant surge in Bitcoin transactions that peaked around $47 trillion. However, a downturn ensued in both 2022 and 2023. Pierre Rochard, research vice president at Riot Platforms, highlighted the importance of the recovery observed in 2024.

As a researcher, I can confidently assert that the Bitcoin network concluded over $19 trillion in BTC transactions throughout the year 2024. This significant volume of transactions serves as undeniable evidence that Bitcoin functions not only as a store of value but also as a medium of exchange.

Bitcoin’s Hashrate Hits Unprecedented 1,000 EH/s

A significant event occurred on January 3, 2024, as Bitcoin’s total computational power, or hashrate, reached a record-breaking 1,000 exahashes per second (EH/s). This remarkable achievement underscored the network’s growing security and efficiency. Nevertheless, the hashrate eventually leveled off at approximately 775 EH/s, according to CryptoQuant’s reports.

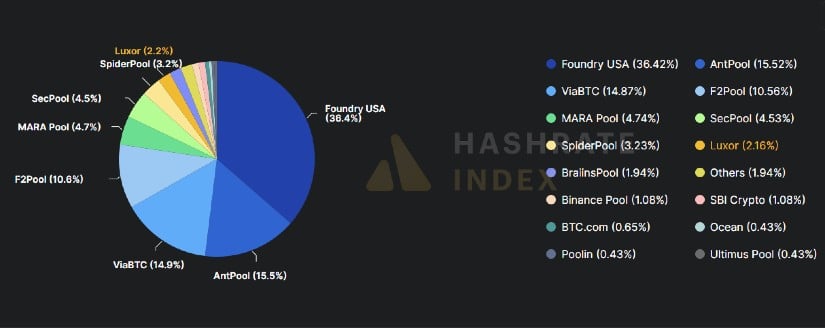

2024 witnessed a worldwide rearrangement in Bitcoin mining, as U.S.-based mining collectives gained prominence. Specifically, Foundry USA and MARA Pool accounted for approximately 38.5% of all mined blocks last year, which significantly boosted the over 40% share held by American operations. However, Chinese mining pools continued to dominate the global hash rate.

Bitcoin mining often happens anonymously across various locations, thanks to its decentralized structure and the use of VPNs. This makes it tricky to determine exactly where most miners are based. However, the rising overall mining capacity shows that the Bitcoin network is robust and expanding.

In January 2024, Bitcoin turned 16 years old, recalling the day – January 3, 2009 – when the Genesis Block was mined, launching 50 Bitcoins into existence. This significant event was orchestrated by the mysterious creator of Bitcoin, Satoshi Nakamoto. Over time, a total of 877,665 blocks have been mined since then, creating the robust foundation for Bitcoin’s unchangeable record book.

In 2024, the mining complexity of the network hit an unprecedented peak of 109.78 trillion hashes, marking a significant increase. This surge highlights the growing strength and security of Bitcoin, making it increasingly unlikely for unauthorized changes to its blockchain. As per Bitinfocharts, this rise also reinforces Bitcoin’s fortress-like nature, reflecting Satoshi Nakamoto’s original vision.

Bitcoin’s Core Strength in 2024

In 2024, two significant events played a crucial role in Bitcoin’s substantial growth: the launch of a Bitcoin-based exchange-traded fund (ETF) in the U.S., and the much-anticipated halving event in April. The ETF served as an easy entry point for institutional investors into the market, while the halving, which cut mining rewards in half, heightened the sense of scarcity.

During the year, the decreased Bitcoin reward amounts contributed to the digital currency hitting a record peak price of approximately $108,000. This significant price achievement underscores the expanding use of Bitcoin as both a financial investment and a means for transactions.

Regardless of the ongoing discussions about mining pool influence, Bitcoin’s fundamental strength lies in its decentralized structure. These mining pools, based primarily in certain countries, draw upon miners from all around the globe to operate, thus maintaining a wide distribution of power. The network’s reliance on this decentralization is crucial for its security and ability to withstand potential risks.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2025-01-06 13:32