Ah, dear reader, here we stand, on the precipice of an epoch-defining shift. With the precision of a cold, calculating mathematician, Bitwise predicts that in mere moments—by 2026—billions will cascade into Bitcoin. Yes, you heard that correctly. Billions. And why? Because, of course, sovereign wealth funds, public corporations, state treasuries, and institutional vehicles like ETFs (which are somehow still the talk of the town) will find themselves enamored with the mysterious allure of this digital currency. It’s the kind of story only financial philosophers would dare dream up, isn’t it? 😏

Bitcoin’s Glorious Transformation: Not Just a Fool’s Gamble Anymore

And lo, BTC—that enigmatic and often misunderstood child of the blockchain—has evolved. No longer just the toy of speculative gamblers, Bitcoin now struts its stuff as a contender for the title of “Global Store of Value.” You see, Bitwise boldly claims that a grand, quiet revolution is underway. Wealth, that trusty old friend of gold, is slowly but surely taking its leave from the golden pastures and sauntering into the cold embrace of Bitcoin. No big deal, right? Just a minor shift in the entire global financial system… 😏

Spot Bitcoin ETFs: Breaking Records Like an Overzealous Bull

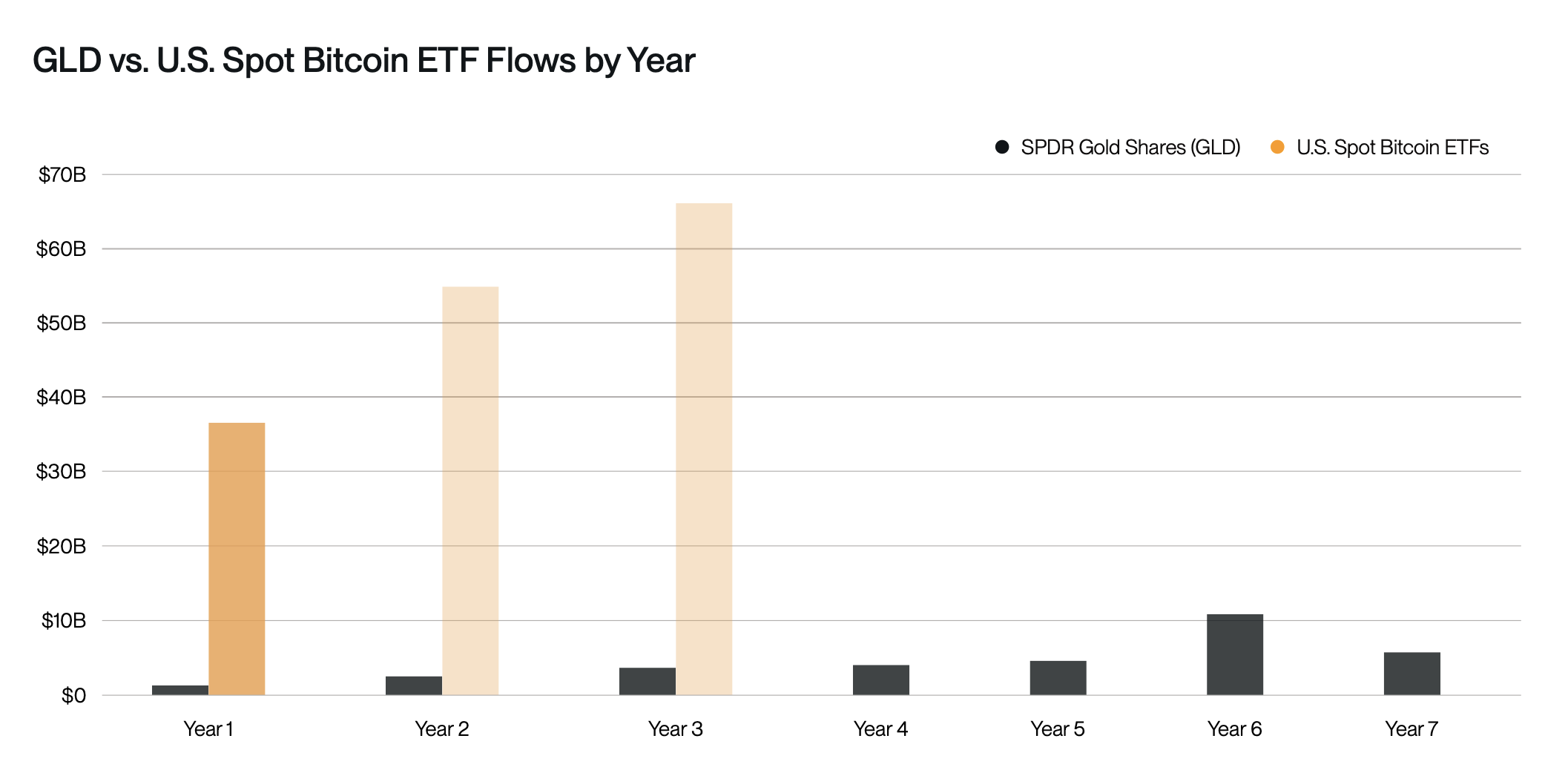

Let us turn to the magnificent spectacle of Spot Bitcoin ETFs, which have, in the most astonishing of turns, exceeded all expectations. In 2024 alone, these ETFs garnered over $36.2 billion in net inflows. A small fortune, one might say. And in case you missed it, this feat wasn’t merely impressive—it outpaced the early performance of SPDR Gold Shares (GLD)—the gold-standard (pun absolutely intended) of commodity ETFs—by a factor of twenty. Who would have thought? Even the most optimistic would have been left slack-jawed in disbelief. 💸

Fast forward a mere twelve months, and behold—the U.S. Bitcoin ETFs have amassed $125 billion in assets. A whirlwind of money swirling through the marketplace, signifying a growing hunger among both the retail masses and those corporate behemoths. And it doesn’t stop there. By 2027, Bitwise predicts that inflows could reach a staggering $100 billion per year. A small sum, surely? 🤷♂️

But, wait—there’s a catch, as always. About $35 billion sat in limbo in 2024, sidelined due to the usual suspects—compliance restrictions at the giants like Morgan Stanley and Goldman Sachs. But fear not! These institutions, having seen the resilience of Bitcoin ETFs, are loosening their grip. A wise move, some might say. One can only wonder what waits ahead. 😏

Bitcoin’s New Admirers: Governments and Institutions Get Onboard

But hold your applause, for the drama has only just begun. According to Bitwise, Bitcoin’s appeal is now spreading like wildfire, far beyond Wall Street’s ivory tower. Public companies are sitting on over 1.1 million BTC, worth a jaw-dropping $125 billion. Sovereign governments, too, have been getting in on the action, collectively holding over 500,000 BTC. The U.S., China, and the U.K. are leading the charge. Oh, what an unexpected plot twist, right? Governments, those bastions of traditional finance, dabbling in the digital currency of the future. Who would have guessed? 😜

In Bitwise’s conservative scenario, just 5% of gold reserves held by governments and 0.5% of assets from major wealth platforms would be enough to funnel a cool $420 billion into Bitcoin between 2025 and 2026. A modest prediction, surely. However, in a bolder vision—a grand bull case, if you will—if 10% of gold holdings and 1% of managed portfolios were to find their way into BTC, we might witness an influx surpassing $426 billion. A sum so vast, it could absorb over 4 million BTC—about 15% of the total supply. Ah, the beauty of speculation! 😏

This predicted tidal wave of capital will not only further solidify institutional trust in Bitcoin but also pave the way for a broader transformation in the financial landscape. The future of digital assets may be less speculative and more… inevitable. Perhaps we should all dust off our old crypto wallets, just in case. 😏

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

2025-05-26 00:11