Well, well, well! Bitcoin is strutting its stuff at a dazzling $106,724, showing off its resilience like a contestant on a game show! With a market cap of $2.117 trillion and a trading volume that could fill a swimming pool with cash—$37.43 billion, to be exact—this digital diva is dancing between $104,386 and $108,035 like it’s auditioning for “Dancing with the Stars!” 💃🕺

Bitcoin

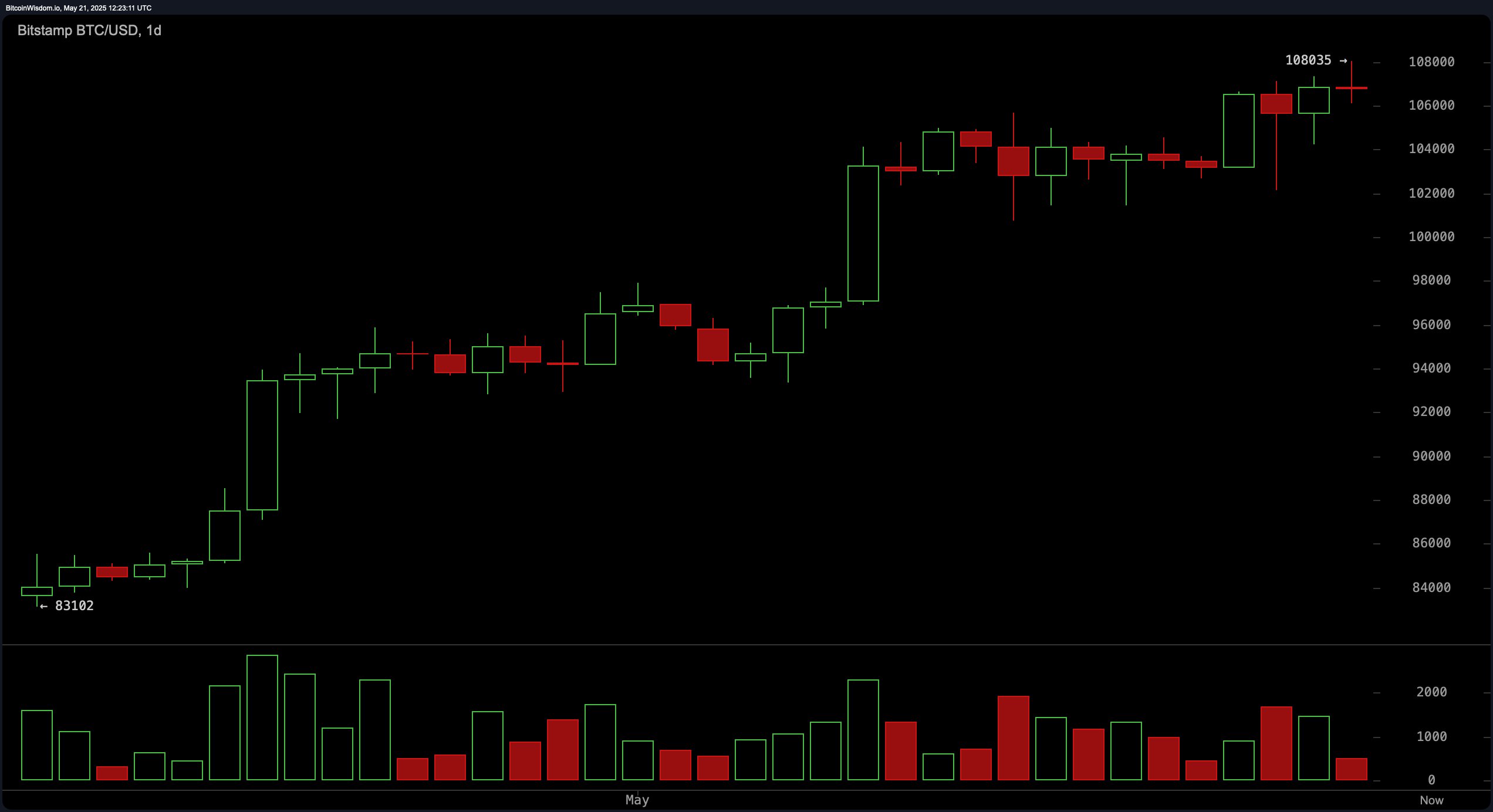

In the daily timeframe, bitcoin is holding onto its bullish structure tighter than a kid with a candy bar! It’s bounced from around $83,100 to a recent high of $108,035. Price action is like a suspenseful movie, with tight consolidation just below resistance at $108,500, hinting at some sneaky accumulation. The relative strength index (RSI) is at 71, and the Stochastic is at 91—overbought, anyone? Caution is the name of the game for our momentum traders! 🎩

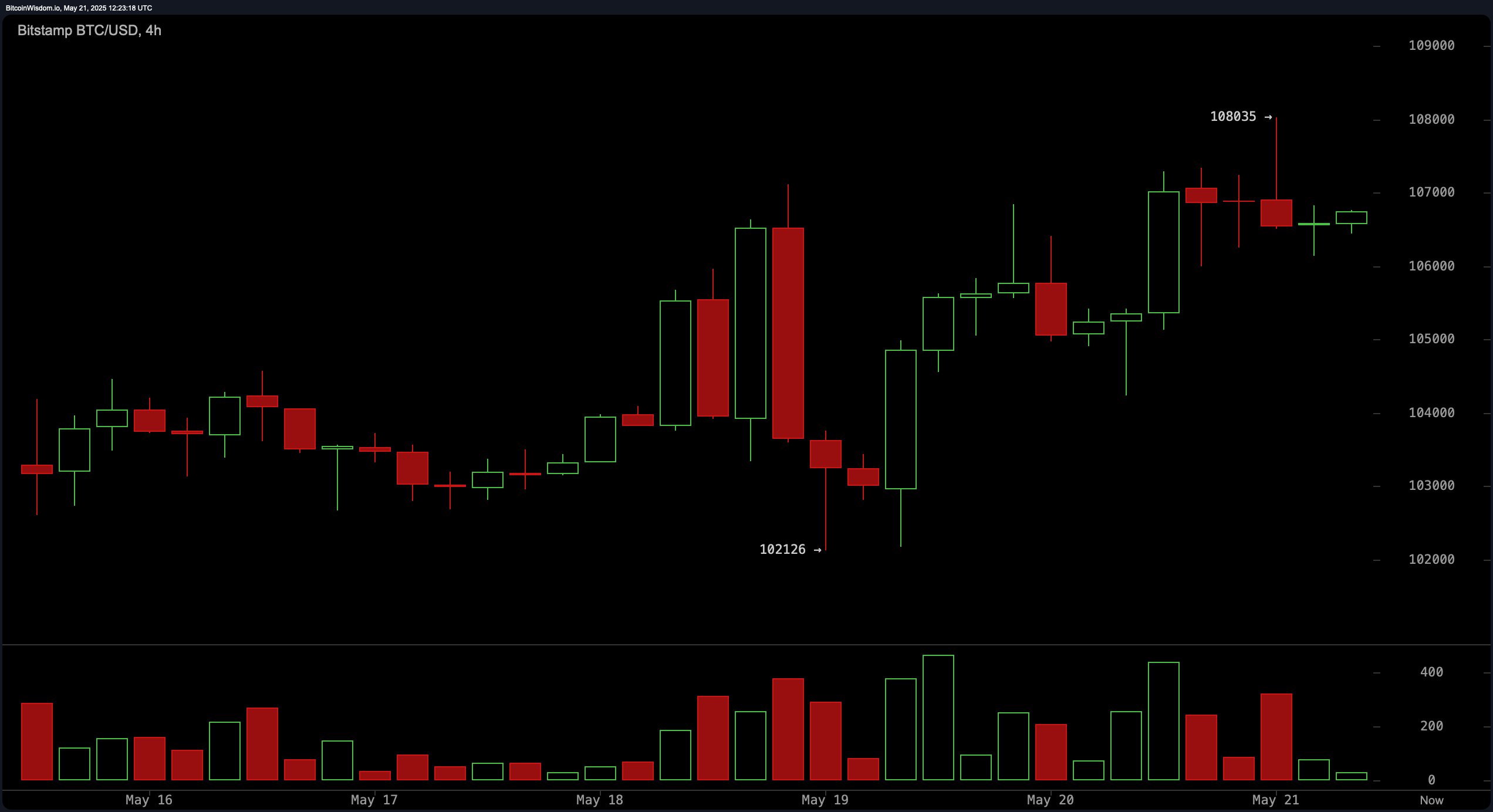

The 4-hour chart is like a soap opera, full of drama! We saw a dip to $102,126, followed by a rapid rebound to $108,035. Currently, bitcoin is forming a consolidation base between $106,500 and $107,000, where buying interest is popping up like popcorn in a microwave! 🍿 Momentum oscillators are giving mixed signals: the momentum indicator is waving a “buy” flag at 2,622, while the MACD is throwing a “sell” tantrum at 3,725. Talk about a family feud!

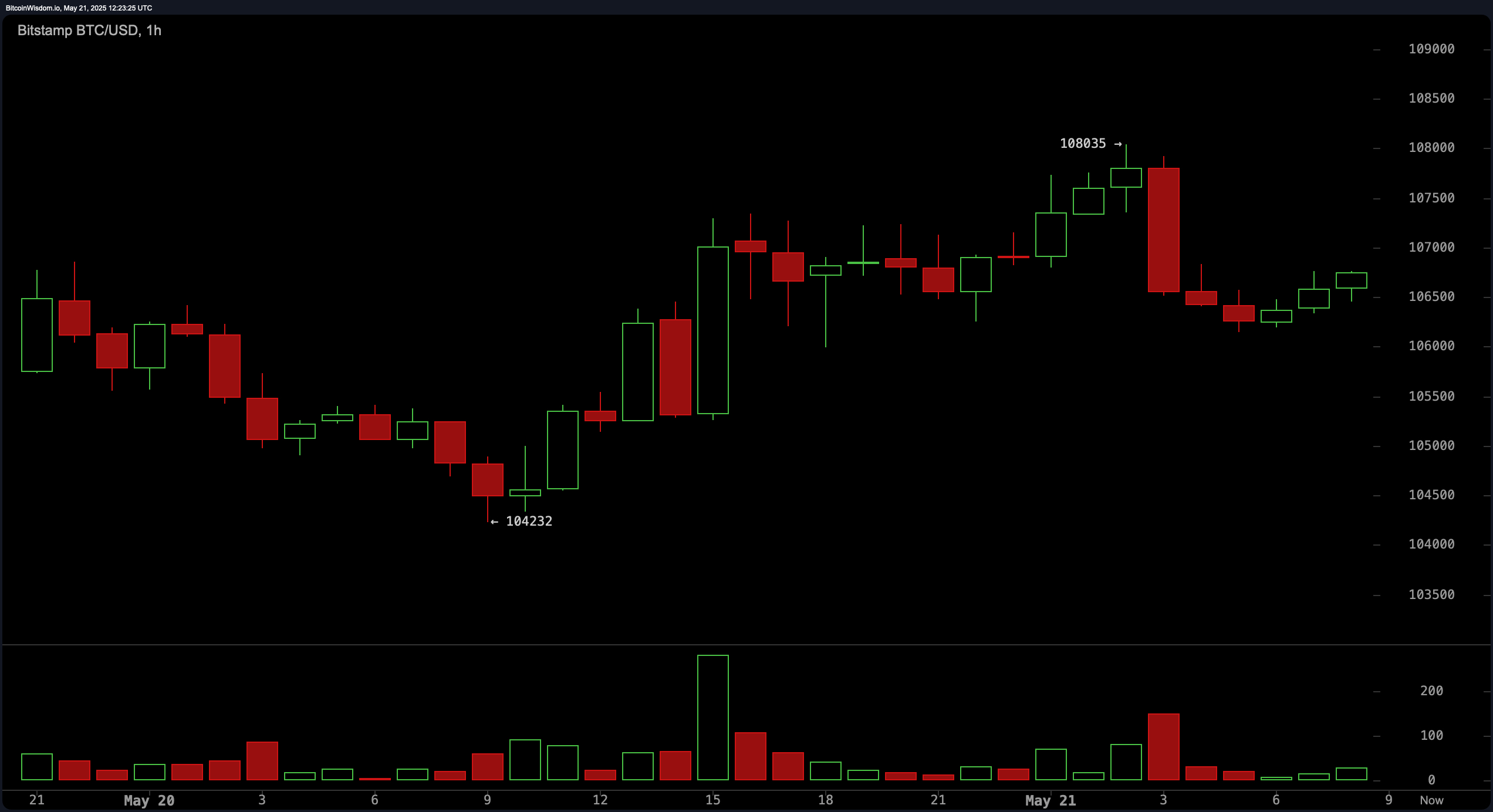

On the 1-hour chart, we see a dramatic rejection at $108,035, followed by a pullback to about $106,300, where a minor recovery is trying to make a comeback like a washed-up rock star! The intraday support range is between $106,300 and $106,500, with resistance hanging out from $107,500 to $108,000. Oscillators are playing it cool, remaining neutral to bearish, which is like saying, “I’m not mad, just disappointed!” 😒

The combination of technical indicators and price structure across timeframes confirms that bitcoin is in a macro bullish phase, but it’s facing short-term resistance like a stubborn door! Most moving averages—from 10-period to 200-period—are waving their flags for continued accumulation, cheering on the broader trend. However, oscillators like the RSI and Stochastic are flashing red lights, warning of an overheated market. It’s like a rollercoaster ride that might need a little brake! 🎢

//markets.bitcoin.com/crypto/bitcoin”>bitcoin keeps its upward momentum, supported by friendly moving averages, near-term price action is like a game of chess—careful trade management is key! Traders should keep an eye out for a decisive move above $108,500 or a confirmed support retest around $104,000 for reliable entries. Oscillator divergences and tight consolidation suggest increased volatility, so don’t forget your stop-loss strategies! With institutional and retail interest keeping the volume high, bitcoin is technically strong but not without its short-term risk signals. 🎯

Bull Verdict:

Bitcoin is struttin’ its stuff across all major timeframes, supported by a unanimous buy signal from the 10-period to the 200-period moving averages. If buyers can break through the $108,500 resistance with some serious volume, the uptrend is likely to accelerate, paving the way for new all-time highs! 🚀

Bear Verdict:

Despite the uptrend, overbought signals from the RSI and Stochastic are waving caution flags! If bitcoin can’t hold above $105,500 and breaks below the $104,000 support zone, we might be looking at a deeper retracement, invalidating the bullish structure faster than you can say “Oh no!” 😱

Read More

2025-05-21 15:59