As the dollar’s throne wobbles, Arch whispers that Bitcoin may be the heir apparent in a world weary of monarchs.

Ah, the world! That grand stage where nations pirouette and currencies waltz, only to stumble over their own feet. World leaders, those august figures, now squint at the financial system as if it were a faded portrait, wondering if the frame still holds. Ray Dalio, that sage of markets, declares the post-war order as defunct as a forgotten ballad. And Arch, ever the observant courtier, suggests Bitcoin holders may not be mere dreamers but shrewd players in this new masquerade.

Global Power Shift Brings Bitcoin Back Into Focus, Arch Report Says

In Munich, Secretary Marco Rubio, with a voice as firm as a general’s boot, proclaimed the U.S. seeks allies not shackled by guilt but proud of their heritage. Meanwhile, Dalio, with his usual candor, pronounced the post-1945 world order as extinct as the dodo. Arch, ever the interpreter of whispers, sees in these words the rustling of a new era.

We do not want allies shackled by guilt and shame.

We want allies who are proud of their culture and heritage and are willing to help us defend it.

– Secretary Marco Rubio (@SecRubio)

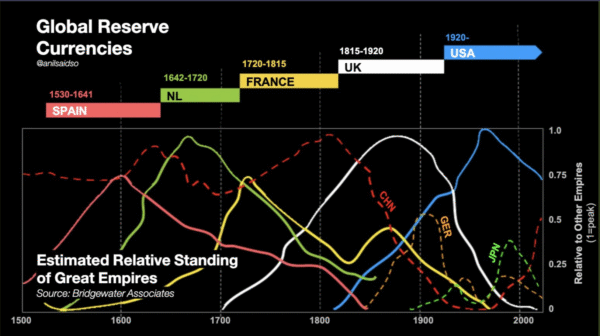

Monetary systems, Arch reminds us, are but fleeting guests at history’s banquet. Gold standards, Bretton Woods, the petrodollar-each had its moment before yielding to the next. Chaos, it seems, is the midwife of order, though only in hindsight does it curtsy gracefully.

Today, deficits loom like storm clouds over major economies, and central banks, after years of low rates and bond-buying sprees, find their arsenals depleted. Policy tools, once the reliable musketeers, now falter, their effects waning, their side effects multiplying. Currencies, once mere mediums of exchange, have become pawns in a global chess match.

Amid this tumult, Arch turns its gaze to Bitcoin, not as a speculative fad but as a design marvel. Untethered to any nation, unbound by central banks, its supply fixed by code rather than decree-what once seemed ideological now appears pragmatic, even elegant.

Arch posits that the new monetary phase favors assets with traits as rare as a witty nobleman:

- Portability across borders, no banks required.

- Fixed supply, immune to policy whims.

- Direct settlement, no intermediaries to muddle the affair.

- Political neutrality, a Swiss watch in a world of ticking time bombs.

Gold Faces Digital Limits as Bitcoin Gains Long-Term Appeal

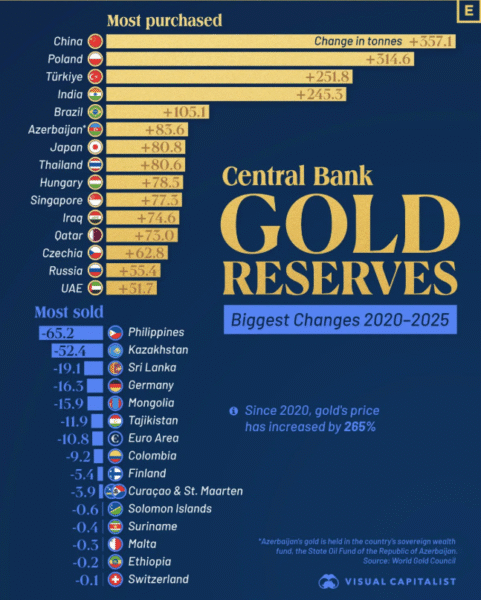

Gold, that eternal siren, still beckons in times of uncertainty. Central banks, particularly those of China and Poland, have been hoarding it like misers. Yet, in a digital age, gold’s luster dims. Moving it is costly, verifying it tedious, and sending it across continents? A snail’s pace compared to Bitcoin’s lightning speed.

Image Source: X/Mining

Bitcoin, in contrast, traverses the globe in minutes, its scarcity enforced by code rather than promise. Holders, those modern-day alchemists, store value without a custodian’s gaze. For long-term investors, the question is no longer about price but about sanctuary-where can value hide from the grasping hands of politics?

Arch Says Monetary System Faces Long-Term Strain Despite Crypto Volatility

Bitcoin, volatile as a tempest, swings with the whims of regulation and sentiment. Geopolitical shifts only add fuel to its fiery nature. Yet, Arch distinguishes between the tempest and the tide. While Bitcoin’s price may dance, the monetary system itself faces a slower, more relentless erosion.

The U.S. dollar, once the undisputed monarch, now finds its crown tilted. Alliances, once seen as enduring marriages, are treated as fleeting affairs. Financial systems, once neutral grounds, are now weapons in a global duel. The result? A world divided into competing economic blocs, each with its own ambitions.

Image Source: X/Arch

Arch, ever cautious, notes that a changing world order does not crown Bitcoin as victor. Other technologies, regulations, and market cycles will play their parts. Yet, in a multipolar world, an asset free from any single master may be the most fitting heir. Whether it ascends or falls remains to be seen, but one thing is certain-the old order is fading, and the new one is yet to be written.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- All weapons in Wuchang Fallen Feathers

- Where to Change Hair Color in Where Winds Meet

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Movie Black-Haired Beauties, Ranked

- Best Video Games Based On Tabletop Games

2026-02-17 20:29