As a seasoned researcher with over a decade of experience in the dynamic world of cryptocurrencies, I’ve seen my fair share of market fluctuations and trends. The current surge in Bitcoin’s price, reaching an all-time high above $82,000, is indeed a sight to behold. It’s like watching a rocket take off, but instead of space, it’s the digital frontier we’re exploring.

Since Donald Trump won the U.S. presidency, the cost of the leading cryptocurrency, Bitcoin (BTC), has been on a prolonged surge, reaching unprecedented heights over $82,000 and establishing a brand-new record high.

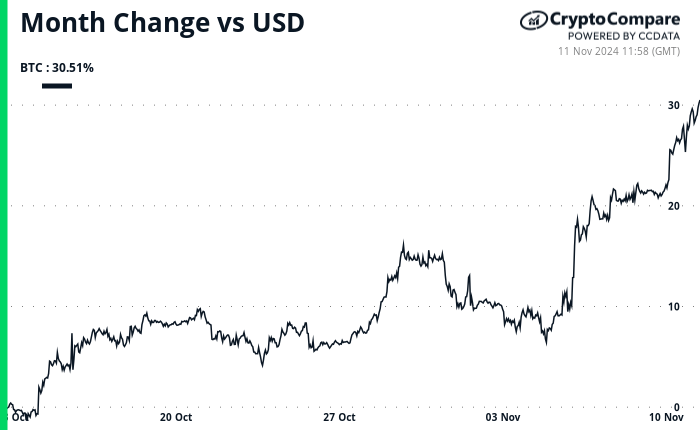

As per information from CryptoCompare, the current value of the cryptocurrency is $81,170, having experienced a minor dip from its record-high of $82,442.01 reached just hours ago. The ongoing optimism among investors continues to influence their wagers on this digital currency.

Over the last seven days, Bitcoin (BTC) has increased approximately 19.4%, while Ethereum (ETH), the second most valuable cryptocurrency, has climbed around 29.3%. Compared to other notable cryptos like Binance Coin (BNB), Ripple (XRP), The Open Network (TON), and Suisei (SUI), BTC and ETH have shown better performance. However, they lag behind certain altcoins in terms of growth rate.

The latest market statistics indicate that Solana’s SOL has experienced a significant increase of approximately 32%, bringing its current market capitalization to $102 billion. On the other hand, Dogecoin (DOGE), fueled by meme popularity, has climbed by around 86% and is now valued at about $0.293 per token.

According to two major cryptocurrency exchanges, Binance and Coinbase, there was a massive $9.3 billion influx of stablecoins into the Ethereum network following the U.S. elections. This pattern, where significant stablecoin inflows are followed by upward market trends, has previously indicated bullish market rallies in historical analysis.

As a researcher, I’m noticing an interesting trend: The influx of stablecoins coincides with a period where Bitcoin spot exchange-traded funds (ETFs) have witnessed unprecedented daily inflows totaling $1.38 billion. This surge in investments comes as the price of Bitcoin continues to reach new peaks.

As an analyst, I anticipated that a Trump victory would potentially bolster Bitcoin’s value due to his evident affinity towards the cryptocurrency industry. This could have led to a more favorable regulatory environment, as his administration might have worked to clarify regulatory uncertainties and appoint pro-crypto officials to key positions, thereby fostering a more supportive stance towards digital currencies.

Following U.S. presidential elections, Bitcoin’s value has historically surged. For instance, it rose by 87%, 44%, and an impressive 145% within the subsequent 90 days following the elections in 2012, 2016, and 2020 respectively.

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- DODO PREDICTION. DODO cryptocurrency

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Everything We Know About DOCTOR WHO Season 2

2024-11-11 15:07