Once again, the world’s economic stage trembles, and Bitcoin, that digital enfant terrible, pirouettes into the limelight—delighting in the chaos of traditional finance like a cat in a room full of rocking chairs. 🕺💸

It seems macroeconomic melodrama has returned with a vengeance in 2024 and 2025, after taking a rather uninspired sabbatical in 2023. Bitcoin, ever the opportunist, is now basking in the glow of global uncertainty.

Bitcoin Sips Champagne as China Cuts Rates and America’s Credit Gets a Haircut

This Tuesday, the People’s Bank of China (PBOC) decided to spice things up by trimming its 1-year Loan Prime Rate from 3.10% to 3.00%, and the 5-year from 3.60% to 3.50%. One can only imagine the sighs of relief (or was it boredom?) echoing through Beijing’s financial corridors.

With this move, China attempts to resuscitate its weary economy and prop up a property sector that’s wobblier than a debutante at her first ball—all while trading barbs with the US. The result? Liquidity flows like cheap champagne at a nouveau riche soirée.

“The PBOC cut… to support the economy amid slowing growth and US trade pressures. Essentially, this injects additional momentum into risk assets by providing cheaper liquidity and fostering a risk-on sentiment,” quipped Axel Adler Jr., who presumably keeps his monocle polished for such occasions.

China’s largesse may spill over into global markets, including crypto, much like an overzealous toast at a wedding. Bitcoin, ever sensitive to liquidity, perks up at the faintest whiff of monetary easing.

Meanwhile, across the Pacific, America finds itself in a spot of bother. Moody’s has demoted the US sovereign credit rating from AAA to AA1—because apparently, running up debts like a Regency rake eventually catches up with you.

This is only the third such snub in US history, following Fitch’s 2023 downgrade and S&P’s in 2011. Nick Drendel, data integrity analyst and part-time Cassandra, notes that previous downgrades have sent markets on rollercoaster rides worthy of Coney Island.

“[The Fitch downgrade in 2023] led to a 74 trading day (-10.6%) correction for the Nasdaq before closing above the close from before the downgrade,” Drendel observed, possibly while clutching pearls.

The downgrade is a polite way of saying: “Your fiscal house is on fire, but do carry on.”

Moody’s Downgrade: A Love Letter to Bitcoin’s Safe-Haven Fantasy

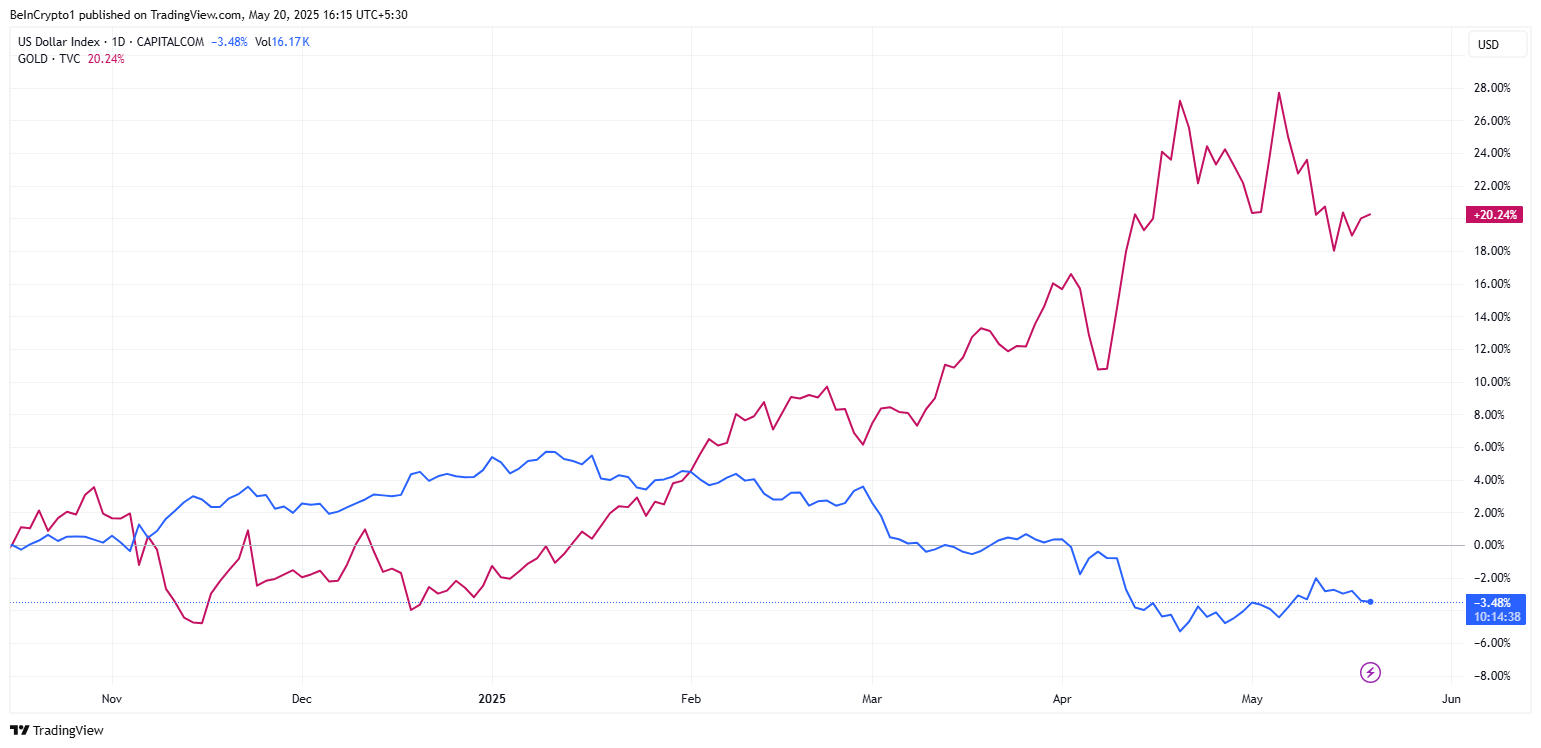

Adler notes that markets wasted no time in their flight to safety—the US Dollar Index (DXY) slipped to 100.85, gold glimmered with a 0.4% rise, and Bitcoin dusted off its “digital gold” moniker for another round on the dance floor.

Bitcoin, that darling of decentralization, found itself courted anew by those seeking refuge from fiat follies.

“…despite the prevailing ‘risk-off’ sentiment… Bitcoin may find itself in a relatively stronger position in the current environment due to its “digital gold” narrative and the supportive effect of a weaker dollar,” Adler mused, perhaps while sipping something expensive.

Ray Dalio, Bridgewater’s oracle-in-chief, dismissed credit ratings as mere window dressing—failing to account for governments’ penchant for printing money faster than Wilde could pen a witticism.

“…they only rate the risk of the government not paying its debt. They don’t include the greater risk that countries in debt will print money to pay their debts, thus causing holders of the bonds to suffer losses from the decreased value of the money they’re getting (rather than from the decreased quantity of money they’re getting),” Dalio warned, with all the subtlety of a Victorian matron at a scandalous soirée.

Dalio concludes that US government debt is riskier than rating agencies dare admit—a sentiment echoed by economist Peter Schiff, who insists inflation risk should be front and center when rating sovereign debt, especially when much of it is held by foreign investors who can’t even vote on their own misfortune.

“…when a nation owes a lot of debt to foreigners, who can’t vote, the odds of a default on foreign-owned debt should be factored in,” he noted dryly.

With China pumping liquidity and America flirting with fiscal disaster, Bitcoin finds itself with a tailwind strong enough to ruffle even the most starched collars. Historically, BTC has thrived when inflation fears rise and fiat currencies lose their luster—like an actor who shines brightest when everyone else forgets their lines.

The market remains as volatile as Wilde’s love life, but if central banks keep loosening their belts and the dollar continues its downward waltz, Bitcoin’s allure as an incorruptible asset may become irresistible—even to those who once scoffed at its charms.

As of this writing (and what delicious timing!), BeInCrypto reports BTC trading at $105,156—a modest 2.11% leap in just 24 hours. One can almost hear Bitcoin whisper: “To lose one fiat currency may be regarded as a misfortune; to lose both looks like carelessness.” 😉

Read More

2025-05-20 15:39