Approach indicates a bullish pattern akin to Bitcoin’s recent surge. As the price touches the resistance level, a possible correction towards robust support may initiate a leap towards new record-breaking heights.

Michael Saylor’s company (MSTR) is currently moving in a positive market trend similar to Bitcoin (BTC). Given its history of purchasing large amounts of Bitcoin, MSTR has shown a strong connection to Bitcoin’s price fluctuations, and this link might propel the stock towards fresh record highs. As MSTR approaches a significant resistance point, the situation seems to indicate either an immediate breakthrough or a bullish adjustment that paves the way for further growth.

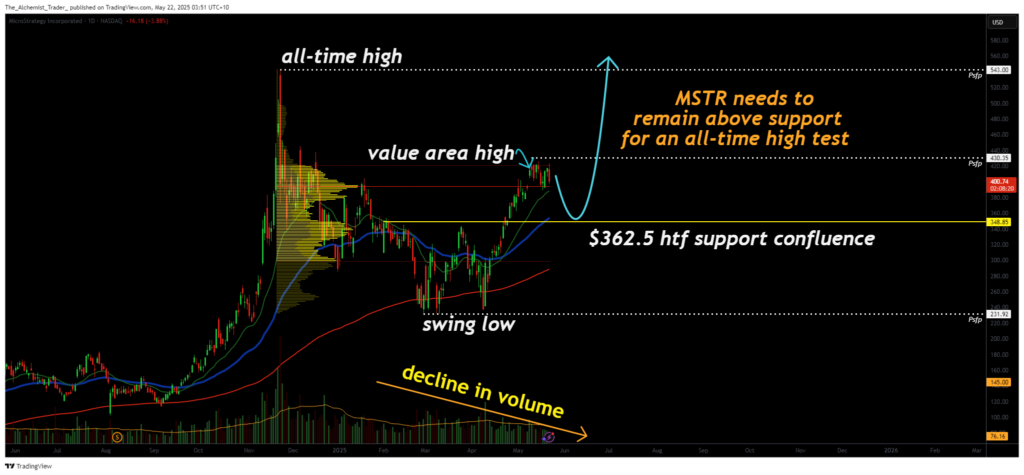

Key technical points

- Major Support Zone: $362.50 — confluence of value area low, 21 EMA, and 200 MA

- Market Structure: Higher highs and higher lows since the recent swing low

- Volume Behavior: Declining volume suggests imminent influx following consolidation

- Potential Target: Expansion into ATH price discovery if resistance breaks or holds post-correction

The ongoing behavior in MSTR’s price movement indicates a persistent bullish pattern. After setting a strong support level, the stock has repeatedly created higher peaks and troughs, which is typically indicative of an ongoing trend. Presently, it’s encountering a substantial resistance area. If this barrier persists, there might be a brief reversal or correction in the near term.

The possible price drop might return it to the $362.50 region, which is a significant support area due to its technical convergence. This spot is where the value area’s lowest point, the 21-day exponential moving average, and the 200-day moving average intersect. A correction into this zone would likely create a higher low, offering a solid foundation for the subsequent rise.

Significantly, if MicroStrategy (MSTR) surges past its current peak without a subsequent dip, it would indicate robust bullish energy. This could imply persistent buying interest and raise the chances of price movement entering exploration phase and the creation of new record highs, much like Bitcoin’s recent surge. Historically, MSTR’s price trends have frequently followed Bitcoin’s, and this technical correlation strengthens the bullish forecast.

What to expect in the coming price action

Should Mastercard (MSTR) maintain its position above the $362.50 support level or surge past the current resistance, the likelihood of reaching new record highs becomes considerably higher. Keep an eye on potential periods of retracement or clear breakouts, as both situations indicate a continued upward trend for traders to capitalize on.

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-05-21 21:36