As a crypto investor, I’ve found myself keeping a keen eye on the signals coming from the new administration. They’ve dropped hints of potentially highly favorable policies towards digital assets, which makes me optimistic about the future of my investments in this space.

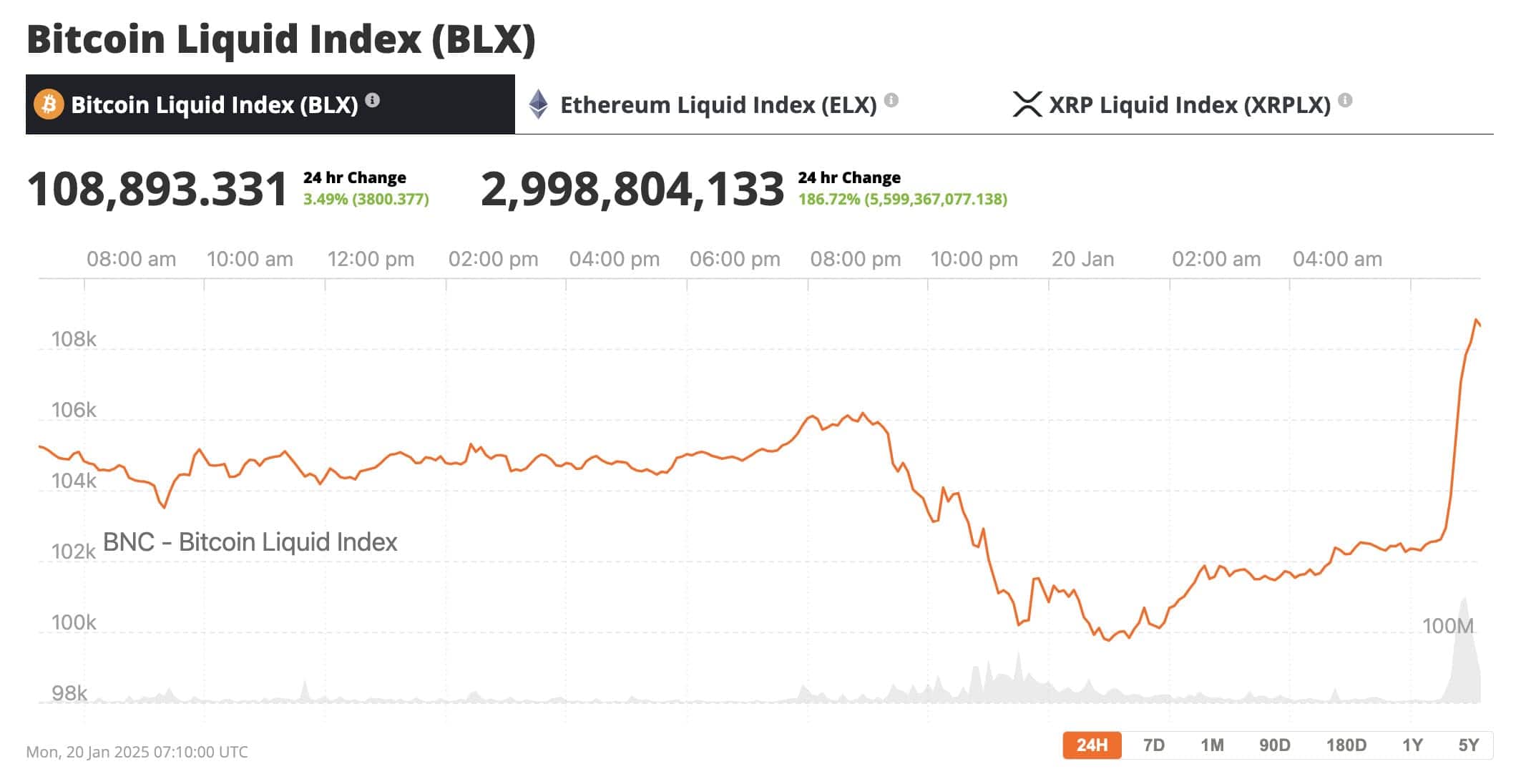

By Monday morning, Bitcoin reached approximately $108,807, marking a fresh record high for its price before Trump’s significant day. The beginning of the week was rocky as it dipped below $90,000 due to apprehension about Federal Reserve policies; however, rumors of a potential interest rate cut swiftly countered the downward trend. In the past, low interest rates have proven attractive for Bitcoin, leading traders to re-invest once more.

As an analyst, I found myself sharing the excitement of investors when President Trump resumed office, as the cryptocurrency community hoped for pro-crypto initiatives in the coming days. Furthermore, the surge in substantial investments into Bitcoin-centric exchange-traded funds (ETFs) significantly contributed to its upward trend. By midweek, over $1.3 billion had flowed into Bitcoin ETFs, marking a turnaround from the outflows experienced earlier in the month.

Trump’s Policy Signals and Federal Reserve Moves

Economic analysts attribute the recent surge to a mix of anticipation towards future policies and overall market movements. The possibility of the Federal Reserve lowering interest rates seems to have boosted investor trust in risky assets such as cryptocurrencies. Given Bitcoin’s limited supply and its track record of strong performance during low-rate periods, traders perceive an opportunity for additional growth.

Investors are paying close attention to the speculation that President Trump’s administration might enact regulations beneficial for the digital asset industry. His open endorsement of cryptocurrencies has kept long-term investors hopeful about Bitcoin’s continued expansion. As his inauguration draws closer, the market is showing this optimism through high trading activity and increased institutional interest.

Institutional Shifts and Expert Insights

It seems like institutional investors are moving towards diversifying their portfolios by adding more Bitcoin. For instance, Michael Saylor, CEO of MicroStrategy, hints that the company might keep buying Bitcoin for the 11th week in a row. Moreover, he encourages France to hop on board the Bitcoin bandwagon, indicating a strong dedication to this digital currency.

With more than 100,000 Bitcoins amassed, MicroStrategy’s persistent investment suggests that the leadership firmly believes Bitcoin to be a dependable form of wealth preservation.

As an analyst, I’ve noticed a shift in investment strategies among several wealthy investors. Rather than holding onto established tech stocks like Nvidia, they are increasingly directing their capital towards Exchange Traded Funds (ETFs) that focus on Bitcoin, such as the iShares Bitcoin Trust (IBIT). For instance, Millennium Management’s Israel Englander has decreased his Nvidia holdings by 12.5%, while simultaneously increasing his IBIT shares by approximately 12.6 million. This pattern suggests a growing interest in Bitcoin and digital assets among the investment community.

Capula Management’s Yan Huo decreased their holdings in Nvidia by approximately 27.7% while simultaneously increasing their ownership of IBIT shares by about 1.1 million. Analysts are indicating a broader trend, implying that some prominent investors believe the leading cryptocurrency may outperform Nvidia in the long term.

Cathie Wood of Ark Invest predicts that Bitcoin’s value could soar to an astonishing $3.8 million by 2030, based on its scarcity and increasing institutional backing. While this prediction is still considered speculative, it underscores a continued bullish sentiment within the cryptocurrency sector. Wood believes that Bitcoin’s limited supply and impressive historical returns could fuel broader market acceptance.

Significantly, market observers are closely monitoring Trump’s forthcoming actions, Federal Reserve decisions, and developments in the digital currency industry. Whether Bitcoin will persistently rise or not is uncertain, but a combination of favorable policy indicators, financial inflows, and renewed investor enthusiasm suggests that the leading cryptocurrency may sustain its upward trend for an extended period.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2025-01-20 11:52