Ah, Bitcoin (BTC), that whimsical creature of the digital realm, has responded to the latest US CPI (Consumer Price Index) data, revealing that inflation has decided to play coy and come in below expectations this July. How delightful! 🎉

Meanwhile, our dear President Trump’s tariffs continue to pinch like a pair of ill-fitting shoes, leaving the Federal Reserve (Fed) in quite the pickle. 🍔

Inflation, That Mischievous Rascal, Rose at an Annual Rate of 2.7% in July!

The US Bureau of Labor Statistics (BLS) has graced us with the CPI data on a fine Tuesday, revealing that inflation has risen at an annual rate of 2.7% in July. Oh, what a surprise! 🙄

U.S. CPI: +2.7% YEAR-OVER-YEAR (EST. +2.8%)

U.S. CORE CPI: +3.1% YEAR-OVER-YEAR (EST. +3.0%)– Tree News (@TreeNewsFeed) August 12, 2025

This reading mirrors June’s inflation data, which BeInCrypto reported at the same 2.7%. How original! 😏

Despite being a tad below the anticipated 2.8%, this CPI print suggests that inflation in the US is still throwing a grand party. It highlights earlier reports indicating that the high-inflation component of the US inflation basket has ballooned to 40% in July 2025, the highest this year. 🎈

Moreover, data reveals that a weighted share of CPI components is growing faster than a cat chasing a laser pointer at over 4%, suggesting persistent inflationary pressure, even after a dramatic drop from a peak of 60% in 2022. 🐱

All these figures suggest that tariff-induced price pressures are becoming as clear as a sunny day in July. ☀️

//beincrypto.com/wp-content/uploads/2025/08/image-200.png”/>

In a similar vein, Ethereum has also joined the party, rising to the $4,400 mark after a delightful surge of over 5% in the last 24 hours. 🎊

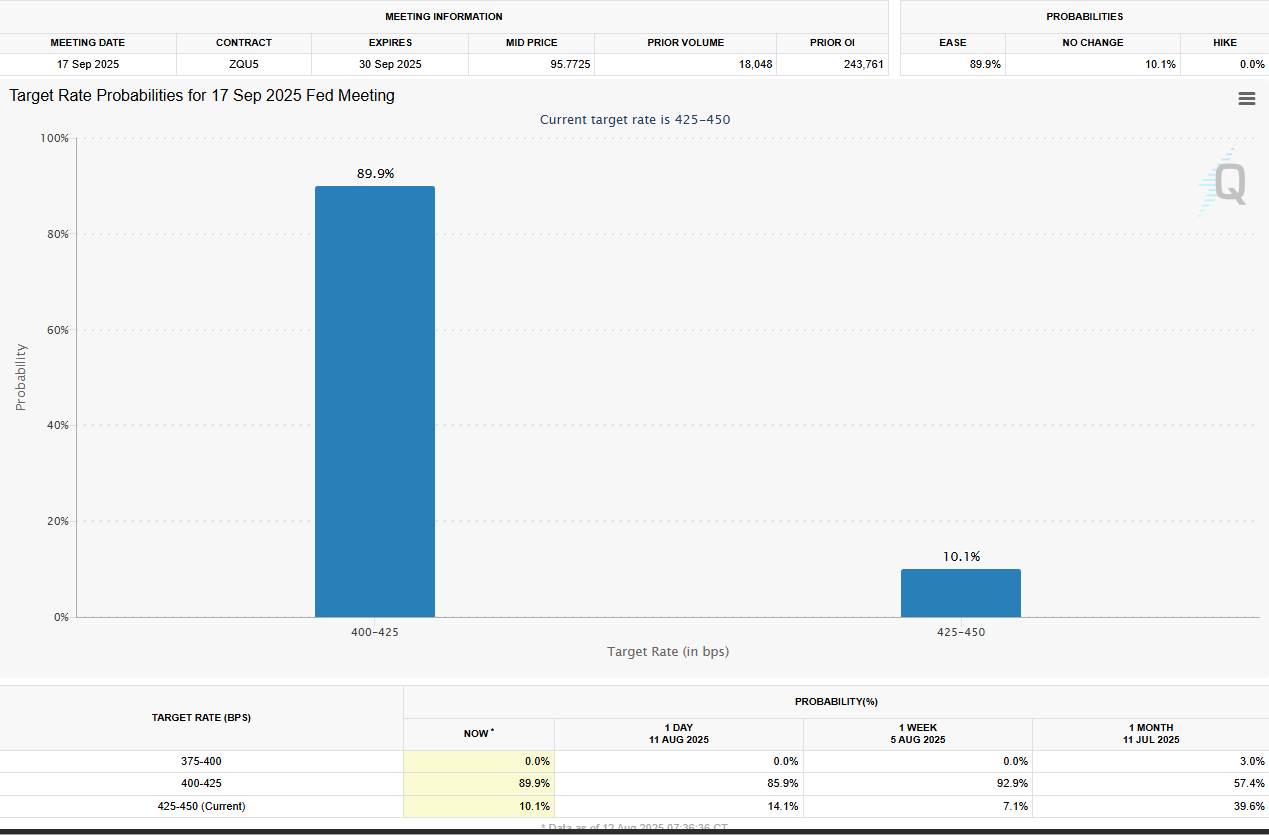

As the crypto market digests this CPI feast, all eyes are on the Federal Reserve (Fed). Interest bettors are placing their bets with a 90% chance that policymakers will cut rates by a quarter basis point (bp) in September. 🎰

Before the US CPI, the CME FedWatch Tool showed an 84.4% chance of interest rate cuts to 4.00 to 4.25%, against a mere 15.6% chance of holding steady at 4.25 to 4.50%. What a thrilling game of chance! 🎲

Indeed, today’s CPI report is a grand affair before next month’s Fed meeting. With inflation at 2.7%, the chances of a rate cut in September remain as high as a kite! 🪂

The Fed has maintained a cautious outlook, keeping interest rates steady as its elusive 2% inflation target dances just out of reach. 💃

However, despite the latest CPI print, which still places them further from the 2% target, their firm stance may waver amidst the fragility of the labor market. Oh, the drama! 🎭

The expectation of the Fed cutting rates in September follows dismal jobs data, which shows signs of a weakening labor market. Despite inflation rising in the US, policymakers may be forced to cut rates in pursuit of their dual mandate:

- Price stability (2% inflation target) and,

- Maximum employment. 🏢

Against this backdrop, analysts anticipated a muted reaction in the Bitcoin price after the CPI print. How predictable! 😏

“The Fed must cut rates in September due to bad job data, so higher CPI won’t really affect the Fed’s decision. Lower CPI will just give more confidence,” wrote the ever-astute analyst Bull Theory. 🧐

Analyst Miles Deutscher echoed this sentiment, proclaiming that overall, the Fed will indeed cut interest rates in September. What a revelation! 🥳

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-12 16:13