What’s the scoop:

- Bitcoin is clinging to life at a shiny 25.2% rise this year-just behind gold’s dazzling 29%, because apparently they’re both running a close race for the “most glittery” award.

- Since the dawn of Bitcoin’s chaotic existence in 2011, its imaginary wealth has exploded over 308,000 times more than gold-forget inflation, Bitcoin’s the real space-time warp.

- In the marathon of gains since 2011, Bitcoin has sprinted ahead of stocks, real estate, and probably most of your favorite investments, leaving them in a cloud of virtual dust.

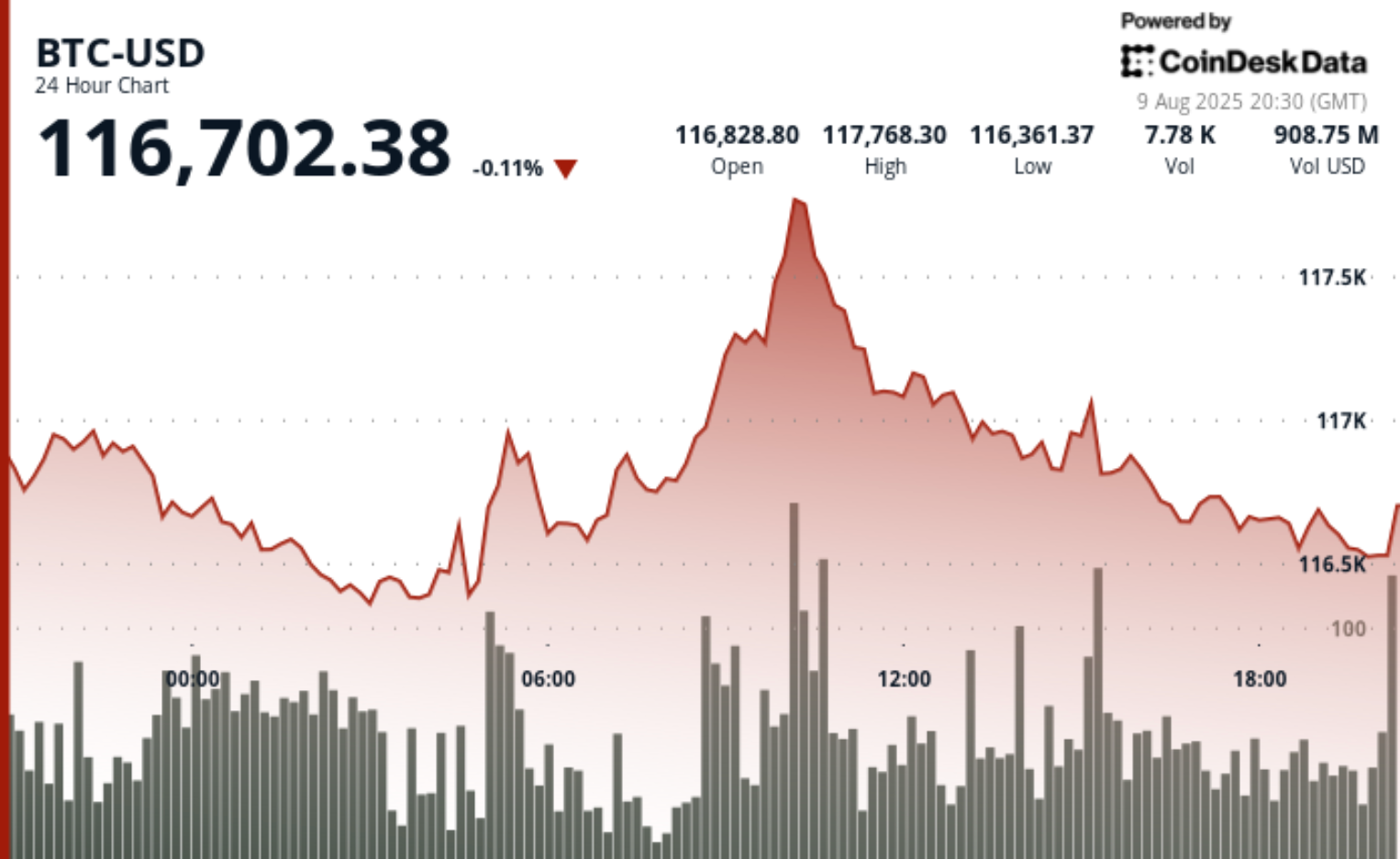

Bitcoin’s tiny 0.11% dip in the last 24 hours barely registers when you consider it’s still at a whopping $116,702-yeah, that’s more than most people’s yearly salary-according to CoinDesk Data. It’s up 25% this year, second only to gold’s 29%.Charlie Bilello on X confirms that mere mortals shouldn’t get too cocky; it’s still a red-hot year for the digital gold rush.

2025 So far, in glorious detail

As of August 8, Bitcoin’s 25% YTD gain just lags behind that shining piece of metal, gold’s 29.3%. Meanwhile, the other usual suspects-emerging market stocks (VWO) at 15.6%, Nasdaq’s QQQ at 12.7%, and trusty old S&P 500 at 9.4%-are just moseying along, while tiny mid caps (MDY) and small caps (IWM) are doing… well, practically nothing – a mere 0.2% and 0.8% respectively. First time in recorded history that gold and Bitcoin occupy the top two spots – finally, the universe recognizes their undeniable awesomeness.

The long game: 2011-2025

Zoom out, and Bitcoin’s mind-boggling 38,897,420% total return since 2011 makes gold’s modest 126% look like a warm-up act. Big tech like Nasdaq’s 1101% or U.S. large caps’ 559% seem downright pedestrian next to Bitcoin’s unrelenting meteoric rise, dwarfing everything in its digital wake. Yes, it’s more than 300,000 times gold’s return-talk about playing a different sport.

Annualized magic: a new landscape

On a yearly basis, Bitcoin delivers a staggering 141.7% average gain since 2011-meaning it’s earned more in one year than gold has in its entire life. Gold’s slow and steady 5.7%, while respectable, seems quaint compared to Bitcoin’s laser focus on exponential growth, making traditional hedges seem like mere antiques in comparison.

Peter Brandt’s timeless wisdom

Some sages, like luminary trader Peter Brandt, say gold is a “great store of value”-which is true, if you prefer nostalgia or a shiny paperweight. But he hints Bitcoin might just be king of the castle someday: “The ultimate store of value will prove to be bitcoin,” he Tweeted, flashing a long-term chart of the dollar’s… um, losing battle. Who needs paper when you have code, right? 😉

Technical hints and whispers

- CoinDesk’s analysis shows Bitcoin shuffling within a $1,534.42 range-a tad volatile, but mostly just a typical Tuesday in crypto world.

- Prices danced from about $116,440 to $117,886, with big-volume moves during Asian hours because of course.

- Support and resistance lines are set, like a pretentious art piece-you know where the buyers and sellers are lurking.

- And amid the final hour’s quiet chaos, Bitcoin stubbornly dodged a downward spiral, touching support at $116,547-just another day in the wild west of digital currencies.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- USD PHP PREDICTION

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-10 01:22