As a seasoned crypto investor with a few scars on my trading battlefield, I find myself standing at a crossroads amidst Bitcoin’s current market dynamics. The recent profit-taking wave, fueled by “extreme greed,” signals to me that we might be witnessing the beginning of a possible price reversal.

The price of Bitcoin (BTC) has dropped from its highest point of $93,495, currently standing at $92,428, as the pace of profit-taking increases.

The collective feeling or attitude among investors, characterized by excessive optimism, may indicate an impending change in prices since traders are more likely to take profits at this point.

Bitcoin’s Rally Prompts Its Long-Term Holders To Sell

As a researcher, I’ve observed an increase in the distribution of Bitcoin (BTC) by its long-term investors, those who have maintained their ownership for over 155 days – a group we refer to as Long-Term Holders (LTHs). This significant surge in coin dissemination, according to BeInCrypto’s analysis, could provide insights into potential market trends.

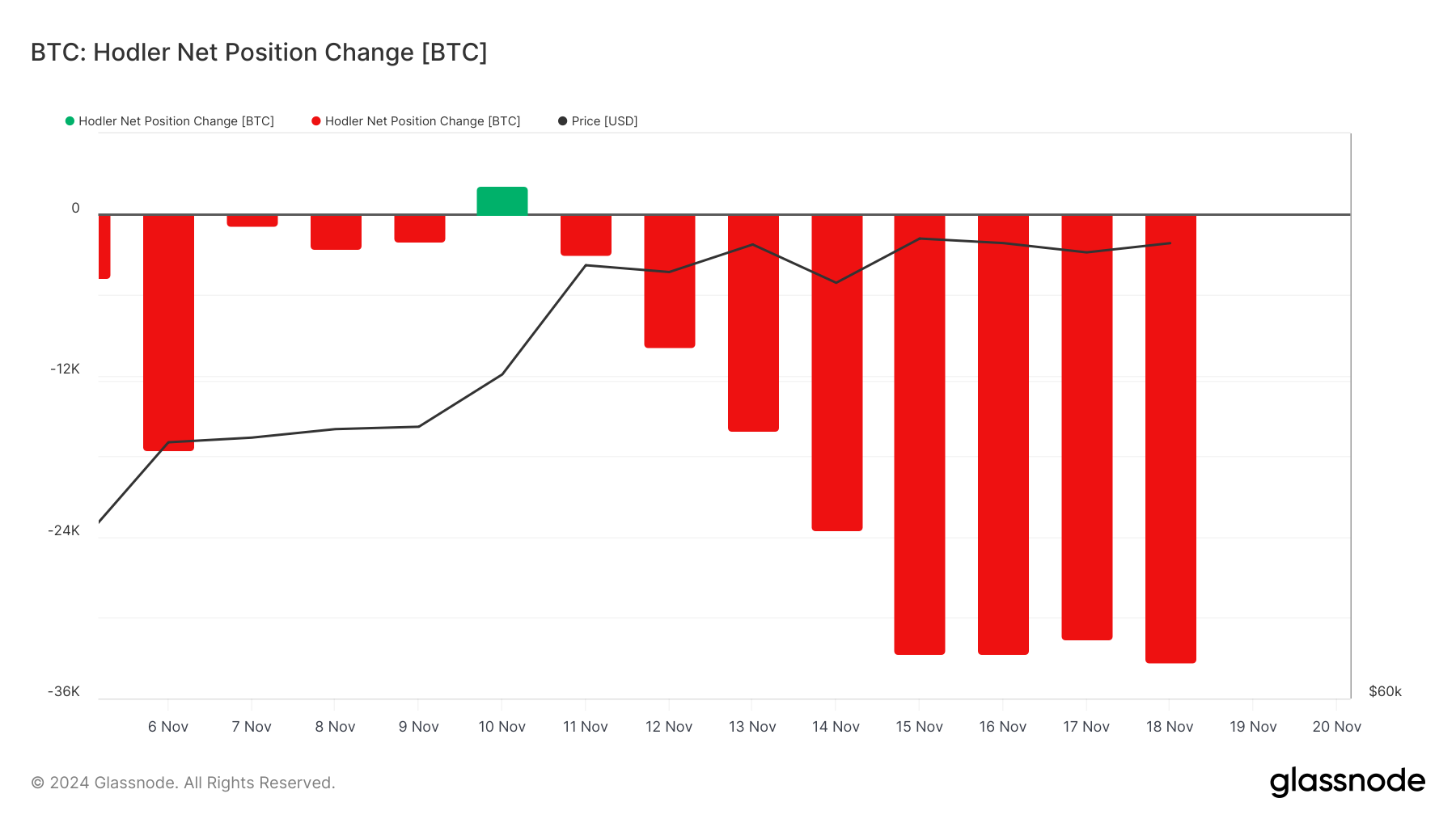

According to Glassnode’s data, the change in position for long-term Bitcoin holders (Hodlers) reached a five-month low on Tuesday. This metric is an indicator of the overall buying and selling activity among these long-term investors. Essentially, this suggests that they sold approximately $3 billion worth of Bitcoin on that day, marking their largest one-day sell-off since June 26.

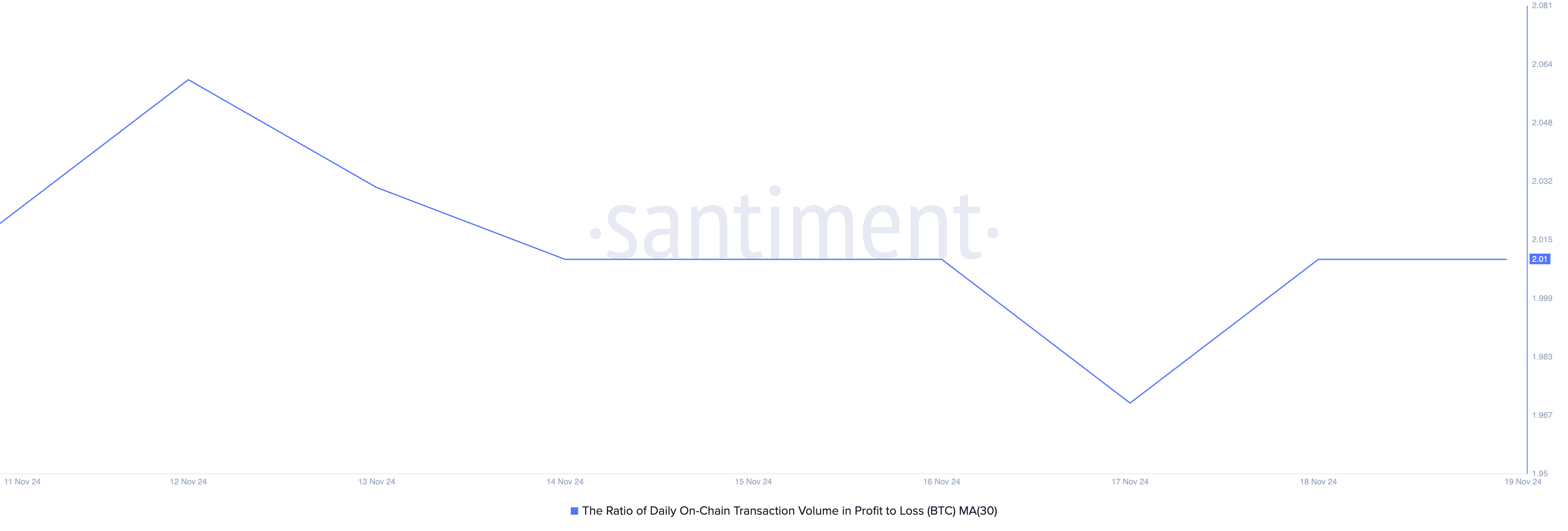

It’s worth mentioning that Bitcoin transactions have been quite lucrative recently. As we speak, the number of profitable transactions compared to losses (based on a 30-day moving average) stands at approximately 2.01. This implies that for every Bitcoin transaction resulting in a loss, there are about 2.01 transactions yielding a profit.

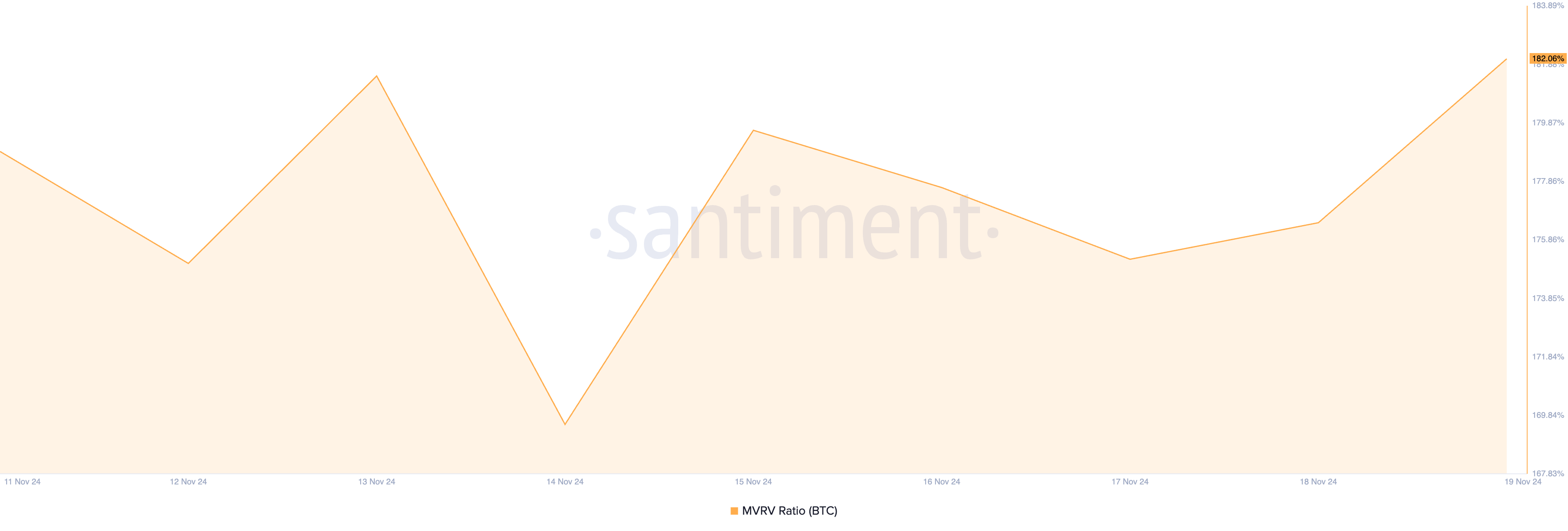

Additionally, the Market Value to Realized Value (MVRV) ratio of Bitcoin indicates it might be excessively priced, potentially leading to increased selling by its holders. Based on Santiment’s analysis, the present MVRV ratio stands at 182.06%.

182.06% higher than its actual worth, Bitcoin’s MVRV (Market Value to Realized Value) ratio indicates that its current market value exceeds its real value substantially. This implies that if every holder were to sell, they would on average make a profit of 182.06%.

BTC Price Prediction: All Lies With the Coin’s Long-Term Holders

Currently, Bitcoin is trading for about $92,428, just shy of its peak cycle price of $93,495. If long-term holders continue to sell in pursuit of profits, the price could drop even lower from this high, potentially reaching support levels below $90,000. Based on data from Bitcoin’s Fibonacci Retracement tool, a significant level of support is anticipated at approximately $83,983.

Should trading action comes to a halt and there’s an increase in demand for the coin, it could surpass its previous record high of $93,495 and potentially push even higher.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2024-11-20 02:14