Bitcoin Shrugs Off Slump as Trump Calls Powell a ‘Numbskull’

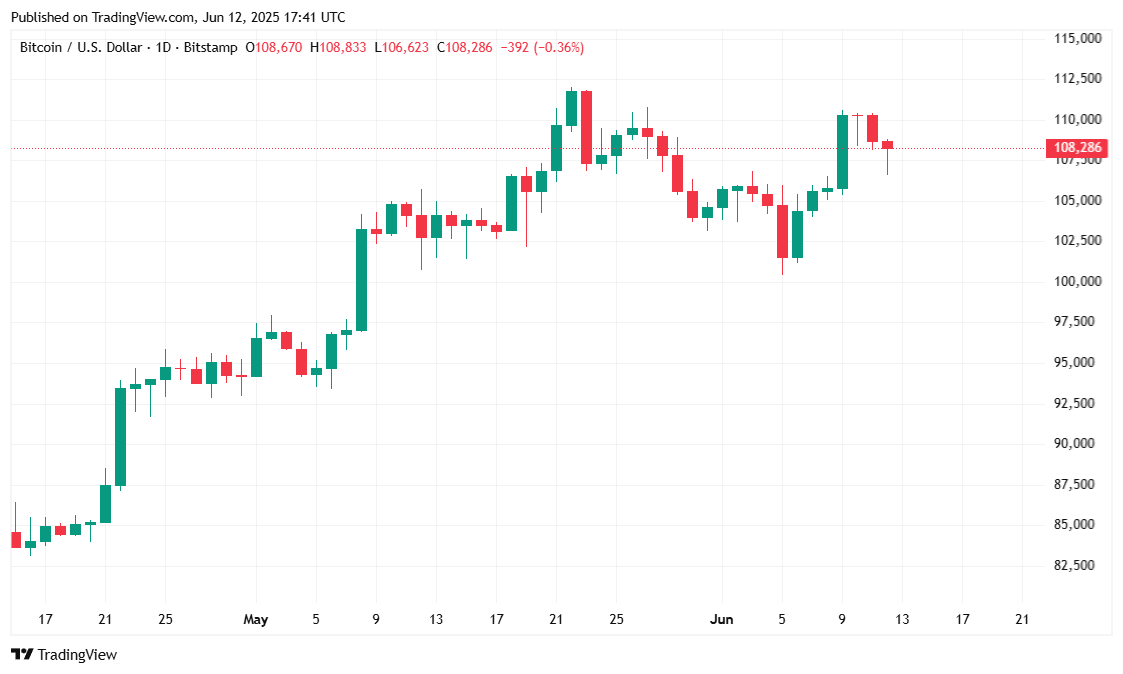

Oh, darling, another day, another inflation report that no one really gets excited about. The Producer Price Index (PPI) for May came in lower than hoped, leading our favorite president to unleash his verbal fireworks on Jerome Powell — because why not? 😏 Bitcoin decided to drop by approximately 1% — nothing too dramatic, just a little summertime dip.

Trump Roasts Jerome Powell As Bitcoin Drops

The President, in a masterclass of diplomacy, exclaimed, “We’re going to spend $600 billion a year because of one numbskull.” Truly inspirational, isn’t it? That’s what he said Thursday, usually while sipping on a Diet Coke and probably thinking about his next tweetstorm. Meanwhile, Powell remains unbothered, sitting in his chair, probably fixing his tie, while Bitcoin’s price wobbled at around $108K. Markets? Just doing their little rollercoaster thing, thank you very much. 🎢

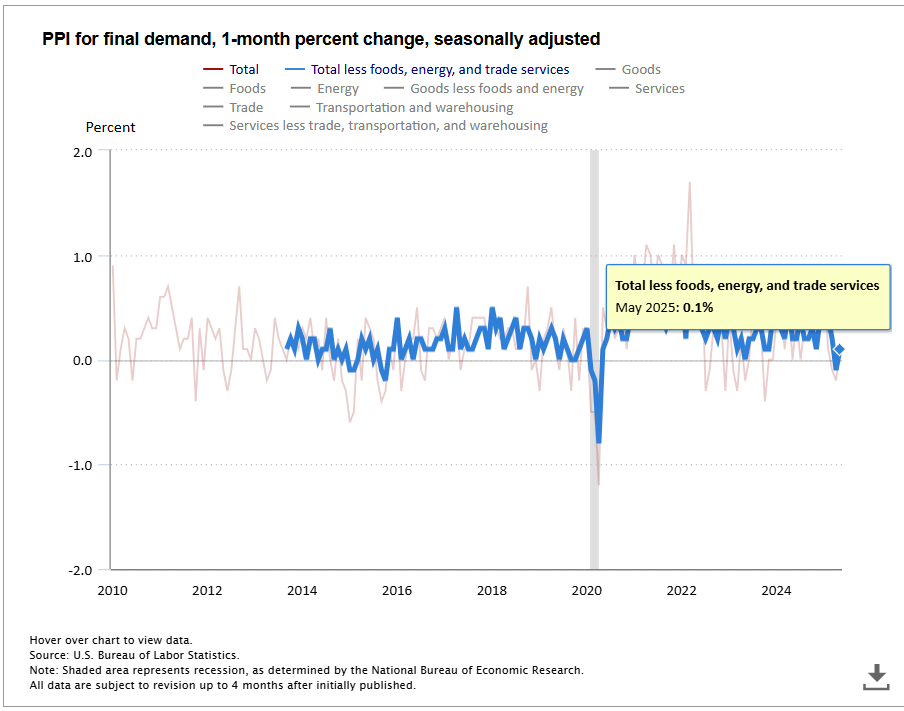

The PPI measures inflation at the wholesale level and is basically the economic equivalent of a bad Tinder date—promising in the beginning but usually disappointing in the end. The US Bureau of Labor Statistics published that wholesale inflation nudged up by 0.1% in May, less than the 0.3% economists had buzzed about. Nice try, inflation data, but Bitcoin was like, “Eh, I’m just here for the snacks.”

Despite the good news, Bitcoin didn’t get its weekend boost and languished at roughly $108K. Trump, ever the showman, used the numbers as another reason to call Powell a “numbskull” — because clearly, that’s the best way to fix the economy. He’s been hinting he might fire Powell, which many say would be as constitutional as a unicorn sighting. The Fed’s next party is on June 17 and 18, where they’ll decide whether to keep rates the same or cause chaos just for fun. 🎉

“We’ve got inflation under control,” Trump declared at the White House, at the same time signing a bill that terminates California’s electric vehicle (EV) mandate — because, why not add a little more fuel to the fire? 🚗🔥

Market Overview — Buckle Up

Bitcoin dipped 1.09% over 24 hours to a cool $108,272. Still, with a weekly rise of 4.66%, it’s basically the Beyoncé of crypto — still shining despite the drama. 24-hour trading volume? A modest climb of 4.35% to $53.46 billion. Market cap? Slightly smaller, sitting at $2.15 trillion after being whapped for a bit — but it’s still plenty large enough to buy a small island or, you know, a lot of avocados.

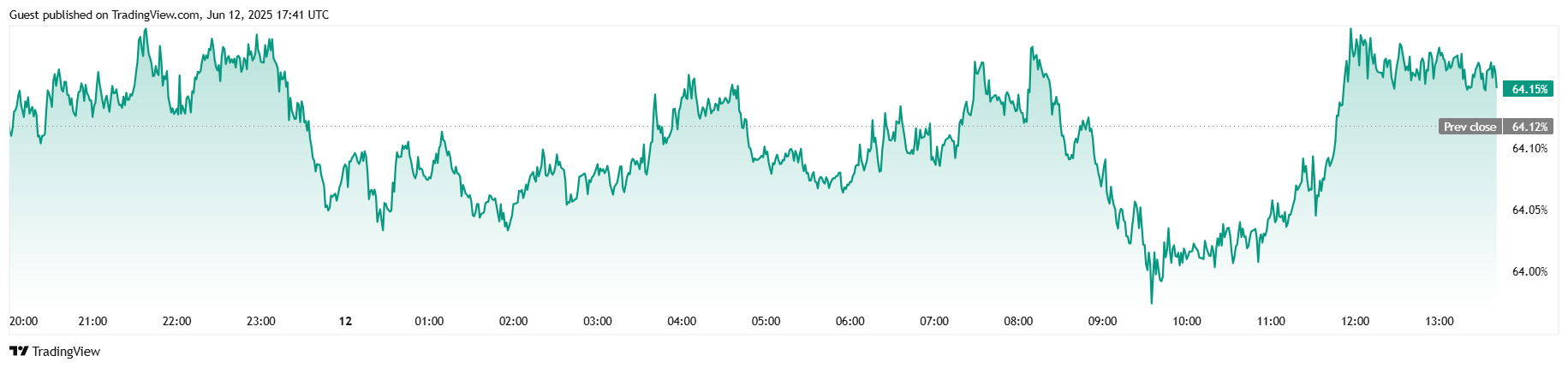

Trading volume? Slightly peppier, jumping 4.35% to $53.46 billion. Bitcoin’s market share of all the crypto chaos now stands at 64.16%, up just a smidge — like a cat sneaking onto the sofa when you’re not looking. The altcoins? Still hiding under the bed.

Futures traders? A tad more cautious now — open interest fell 2.51% to $73.81 billion — probably because they finally watched the movie and realized it wasn’t a comedy. Liquidations? Mostly shorts. Nearly $3 million got wiped out betting against Bitcoin, proving once again that in crypto, you either win big or go home with a bruised ego.

Read More

2025-06-12 21:59